Publication 1494 Tables for Figuring Amount Exempt from Levy on Wages, Salary, and Other Income Forms 668 WACS, 668 WcDO and 668 2022

What is Publication 1494?

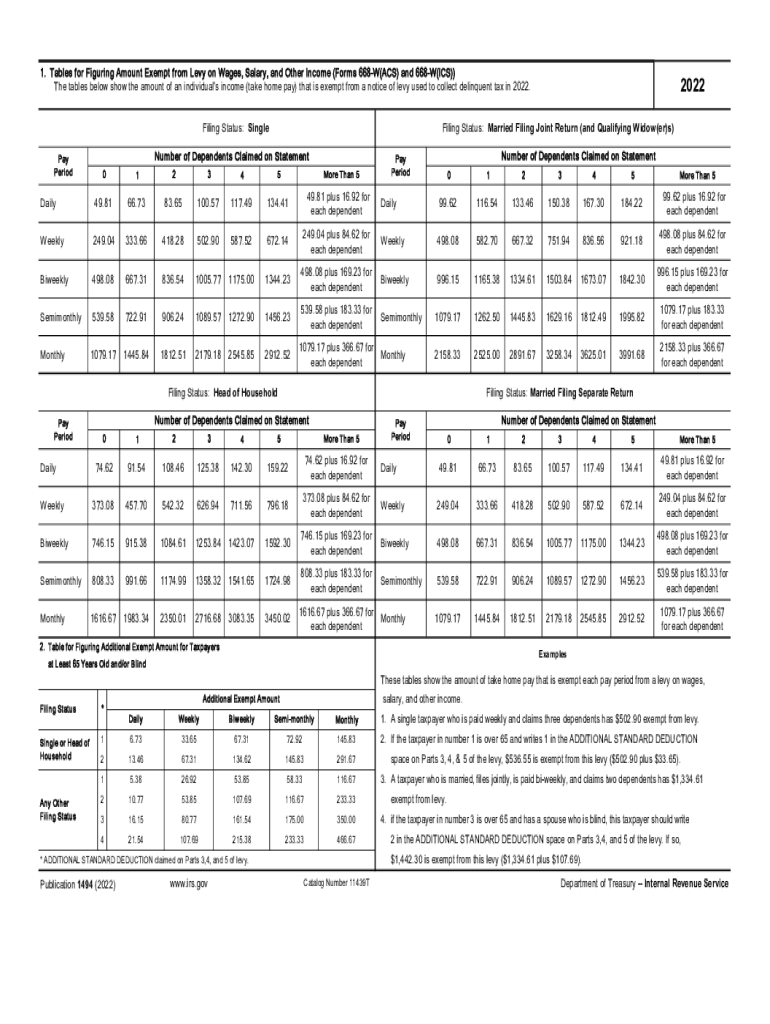

Publication 1494, titled "Tables for Figuring Amount Exempt From Levy on Wages, Salary, and Other Income," provides essential guidelines for individuals and businesses facing wage levies. This publication outlines how to determine the exempt amount from levies on various forms of income, including wages and salaries. It is particularly relevant for those who may be subject to IRS levies and need to understand their rights and obligations. The publication includes detailed tables that help taxpayers calculate the exempt amounts based on their specific circumstances.

How to Use Publication 1494

Using Publication 1494 effectively requires understanding the tables and guidelines it provides. Taxpayers should first identify their filing status and income level. Once this information is gathered, they can refer to the tables within the publication to determine the exempt amount from levies. It is advisable to carefully follow the instructions to ensure accurate calculations. This publication serves as a critical resource for both individuals and tax professionals when navigating the complexities of wage levies.

Steps to Complete Publication 1494

Completing the calculations in Publication 1494 involves several steps:

- Gather necessary financial information, including total income and filing status.

- Consult the tables within Publication 1494 to find the relevant exempt amount based on your income level.

- Apply the exempt amount to determine how much of your wages or salary can be protected from levies.

- Document the calculations for your records and any potential IRS inquiries.

These steps ensure that taxpayers can accurately assess their situation and comply with IRS requirements.

Legal Use of Publication 1494

Publication 1494 is a legally recognized document that provides guidance on the exempt amounts from levies. Understanding its legal implications is crucial for individuals facing wage garnishments. The publication ensures that taxpayers are aware of their rights and the legal limits on how much of their income can be levied. Utilizing this publication correctly can help prevent unlawful levies and protect essential income from being seized.

Examples of Using Publication 1494

To illustrate the application of Publication 1494, consider the following scenarios:

- A single taxpayer earning $3,000 per month can refer to the tables to determine the exempt amount based on their income and filing status.

- A married couple with combined income may use the publication to figure out the exempt amount that applies to both spouses' wages.

These examples highlight how different financial situations can impact the calculations provided in Publication 1494, underscoring its importance for various taxpayers.

IRS Guidelines for Publication 1494

The IRS provides specific guidelines regarding the use of Publication 1494. Taxpayers should ensure they are using the most current version of the publication, as updates may reflect changes in tax law or procedures. The IRS also emphasizes the importance of accurate reporting and compliance with the calculations outlined in the publication. Adhering to these guidelines helps maintain compliance and protects taxpayers from potential penalties.

Quick guide on how to complete publication 1494 2022 tables for figuring amount exempt from levy on wages salary and other income forms 668 wacs 668 wcdo and

Complete Publication 1494 Tables For Figuring Amount Exempt From Levy On Wages, Salary, And Other Income Forms 668 WACS, 668 WcDO And 668 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage Publication 1494 Tables For Figuring Amount Exempt From Levy On Wages, Salary, And Other Income Forms 668 WACS, 668 WcDO And 668 on any device with the airSlate SignNow Android or iOS applications and enhance any document-based operation today.

How to modify and eSign Publication 1494 Tables For Figuring Amount Exempt From Levy On Wages, Salary, And Other Income Forms 668 WACS, 668 WcDO And 668 with ease

- Obtain Publication 1494 Tables For Figuring Amount Exempt From Levy On Wages, Salary, And Other Income Forms 668 WACS, 668 WcDO And 668 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark essential sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and click the Done button to save your modifications.

- Select how you wish to distribute your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Publication 1494 Tables For Figuring Amount Exempt From Levy On Wages, Salary, And Other Income Forms 668 WACS, 668 WcDO And 668 and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 1494 2022 tables for figuring amount exempt from levy on wages salary and other income forms 668 wacs 668 wcdo and

Create this form in 5 minutes!

How to create an eSignature for the publication 1494 2022 tables for figuring amount exempt from levy on wages salary and other income forms 668 wacs 668 wcdo and

How to generate an e-signature for your PDF file online

How to generate an e-signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

The way to make an e-signature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The way to make an e-signature for a PDF document on Android devices

People also ask

-

What is airSlate SignNow, and how does it relate to 1494?

airSlate SignNow is an easy-to-use, cost-effective solution designed for businesses to send and eSign documents securely. The reference to 1494 may encompass specific features or pricing plans related to our offerings that can optimize your document workflow.

-

How much does airSlate SignNow cost, particularly regarding the 1494 plan?

Our pricing plans start at competitive rates, with the 1494 option being especially popular among small to medium-sized businesses. This plan provides essential features for document signing and management, ensuring you get maximum value for your investment.

-

What features are included in the 1494 pricing plan?

The 1494 pricing plan includes features such as unlimited eSigning, customizable templates, and comprehensive mobile access. These functionalities empower users to streamline their document workflows effectively.

-

How can businesses benefit from using airSlate SignNow 1494?

Businesses leveraging the 1494 plan can enhance their efficiency by reducing turnaround times for signed documents. Additionally, it facilitates compliance with electronic signature laws, making business processes faster and safer.

-

Is airSlate SignNow compatible with other software?

Yes, airSlate SignNow easily integrates with various applications, making it a versatile choice for businesses. Users taking advantage of the 1494 plan can seamlessly connect with CRM systems, cloud storage, and productivity tools.

-

Can I customize my document templates under the 1494 plan?

Definitely! With the 1494 plan, users can create and customize document templates tailored to their specific needs. This feature allows for a more personalized document experience, saving time and ensuring consistency across important communications.

-

What kind of support is available for users on the 1494 plan?

Subscribers to the 1494 plan have access to comprehensive customer support. This includes live chat assistance, knowledge base resources, and email support to ensure that users can get help whenever they need it.

Get more for Publication 1494 Tables For Figuring Amount Exempt From Levy On Wages, Salary, And Other Income Forms 668 WACS, 668 WcDO And 668

- Warranty deed from one individual to three individuals as tenants in common missouri form

- Missouri warranty deed 497313507 form

- Missouri company corporation form

- Mo deed beneficiary 497313509 form

- Legal last will and testament form for single person with no children missouri

- Legal last will and testament form for a single person with minor children missouri

- Legal last will and testament form for single person with adult and minor children missouri

- Legal last will and testament form for single person with adult children missouri

Find out other Publication 1494 Tables For Figuring Amount Exempt From Levy On Wages, Salary, And Other Income Forms 668 WACS, 668 WcDO And 668

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile