Publication 1494 Rev Internal Revenue Service 2021

What is the Publication 1494 form?

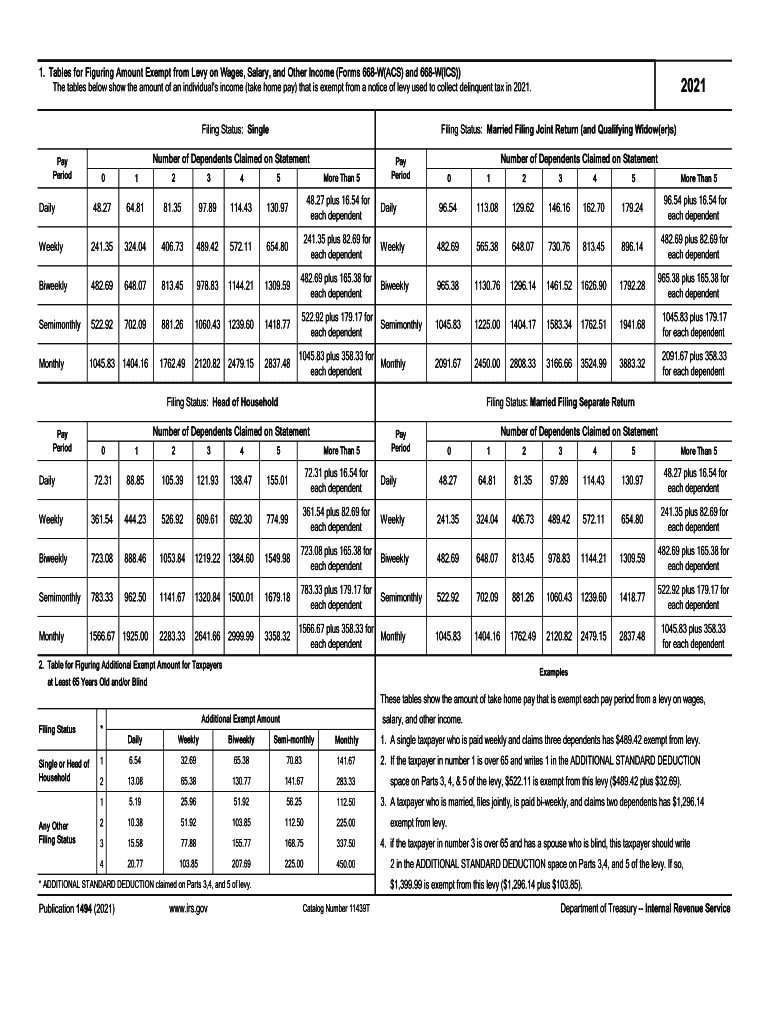

The Publication 1494 form, issued by the Internal Revenue Service (IRS), is a vital document used primarily for reporting tax information related to certain transactions. This form is particularly relevant for taxpayers who need to disclose specific financial details to comply with U.S. tax regulations. Understanding its purpose is essential for ensuring accurate reporting and adherence to tax laws.

Steps to complete the Publication 1494 form

Completing the Publication 1494 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents and information required for the form. Next, carefully fill out each section, ensuring that all details are correct and complete. Pay special attention to the instructions provided by the IRS for each field. After completing the form, review it thoroughly for any errors before submission.

Legal use of the Publication 1494 form

The legal use of the Publication 1494 form is governed by IRS regulations, which stipulate that the form must be filled out accurately to be considered valid. This form serves as an official record of the information provided, which can be referenced by the IRS for verification purposes. Failing to comply with the legal requirements associated with this form can result in penalties or further scrutiny from tax authorities.

How to obtain the Publication 1494 form

To obtain the Publication 1494 form, taxpayers can visit the official IRS website, where the form is available for download in PDF format. Additionally, individuals may request a physical copy by contacting the IRS directly. It is important to ensure that you are using the most current version of the form, as updates may occur annually.

Filing Deadlines / Important Dates

Filing deadlines for the Publication 1494 form vary based on the specific tax year and the nature of the transactions being reported. Generally, taxpayers should be aware of the annual tax filing deadline, which is typically April 15. It is advisable to check the IRS website for any updates or changes to filing dates to ensure timely submission.

Key elements of the Publication 1494 form

The key elements of the Publication 1494 form include detailed sections that require specific financial information, such as transaction amounts, dates, and the parties involved. Additionally, the form may include instructions for calculating any applicable taxes or penalties. Understanding these elements is crucial for accurate completion and compliance with IRS regulations.

Quick guide on how to complete publication 1494 rev 2021 internal revenue service

Complete Publication 1494 rev Internal Revenue Service effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Publication 1494 rev Internal Revenue Service on any platform using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Publication 1494 rev Internal Revenue Service with ease

- Obtain Publication 1494 rev Internal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive data using the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes moments and bears the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your liking. Modify and eSign Publication 1494 rev Internal Revenue Service and ensure excellent communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 1494 rev 2021 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the publication 1494 rev 2021 internal revenue service

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is the publication 1494 form?

The publication 1494 form is a document used for certain tax-related purposes. It helps outline the necessary information for businesses and individuals to comply with IRS requirements. Understanding how to fill out and submit the publication 1494 form correctly can streamline your tax processes.

-

How can I use airSlate SignNow to manage the publication 1494 form?

AirSlate SignNow allows you to easily upload, edit, and eSign your publication 1494 form. With our user-friendly interface, you can add necessary fields and automate the signing process to ensure compliance and efficiency. This helps you focus on your business while ensuring that all documentation is managed seamlessly.

-

Is there a cost associated with using airSlate SignNow for the publication 1494 form?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. You can use our platform to manage the publication 1494 form at a competitive price while benefiting from features such as unlimited signing, storage, and integrations. Check our website for specific pricing details.

-

What features does airSlate SignNow offer for the publication 1494 form?

AirSlate SignNow provides features like customizable templates, secure eSigning, and real-time tracking for the publication 1494 form. These tools enhance workflow efficiency and ensure that you can manage your documents securely and effectively. Additionally, our mobile app allows you to work on the go.

-

Are there integrations available for the publication 1494 form in airSlate SignNow?

Yes, airSlate SignNow integrates with numerous applications, making it easy to manage your publication 1494 form alongside other tools. Whether you use CRM systems, cloud storage, or other productivity software, our integrations facilitate a seamless workflow. This helps centralize your document management.

-

What benefits does airSlate SignNow provide for handling the publication 1494 form?

By using airSlate SignNow for the publication 1494 form, you gain signNow time savings and improved accuracy in document handling. Our solution streamlines the process, reduces paperwork, and ensures that your documents are legally binding. This enhances overall productivity and compliance for your business.

-

Can I track the status of the publication 1494 form in airSlate SignNow?

Absolutely! AirSlate SignNow offers real-time tracking for your publication 1494 form and other documents. You can monitor who has signed, who needs to sign, and see the entire history of actions taken on the document, ensuring transparency and accountability all along the way.

Get more for Publication 1494 rev Internal Revenue Service

Find out other Publication 1494 rev Internal Revenue Service

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple