Michigan Form MI 4797 Michigan Adjustments of Gains and

Understanding the Michigan Form MI 4797 for Adjustments of Gains

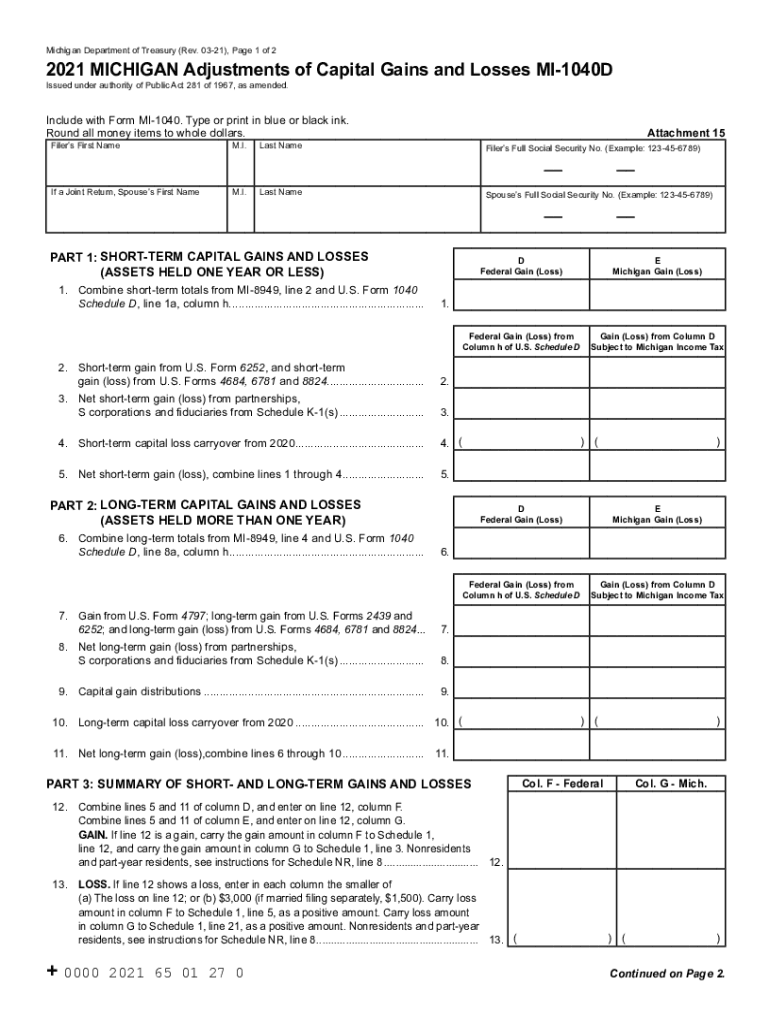

The Michigan Form MI 4797 is specifically designed for reporting adjustments related to gains from the sale of assets. This form is essential for taxpayers who need to report capital gains or losses incurred during the tax year. It is particularly relevant for individuals and businesses that have sold property or other significant assets. Understanding the purpose and requirements of this form can help ensure accurate reporting and compliance with state tax laws.

Steps to Complete the Michigan Form MI 4797

Completing the Michigan Form MI 4797 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the assets sold, including purchase and sale agreements. Next, calculate the total gains or losses by subtracting the original purchase price from the sale price. Once these figures are determined, fill out the form by entering the calculated amounts in the designated sections. Be sure to review the completed form for any errors before submission. Finally, submit the form according to the guidelines provided by the Michigan Department of Treasury.

Legal Use of the Michigan Form MI 4797

The Michigan Form MI 4797 must be used in accordance with state tax regulations to ensure that all reported gains and losses are legally recognized. This form is integral in determining the tax liability for individuals and businesses based on their capital transactions. Failure to use the form correctly can result in penalties or complications with tax filings. It is advisable to consult with a tax professional if there are uncertainties regarding the legal implications of using this form.

Filing Deadlines for the Michigan Form MI 4797

Timely filing of the Michigan Form MI 4797 is crucial to avoid penalties. The form is typically due on the same date as the federal income tax return, which is usually April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of any changes to filing deadlines, especially in light of any state-specific announcements or extensions.

Required Documents for the Michigan Form MI 4797

When preparing to complete the Michigan Form MI 4797, it is important to have all necessary documents on hand. Required documents typically include:

- Purchase and sale agreements for assets sold

- Documentation of any improvements made to the property

- Records of any associated costs, such as closing costs or commissions

- Previous tax returns that may impact current calculations

Having these documents readily available can streamline the process of completing the form and ensure accurate reporting.

Examples of Using the Michigan Form MI 4797

Practical examples can help clarify how to use the Michigan Form MI 4797 effectively. For instance, if an individual sells a rental property for $300,000 that was originally purchased for $200,000, they would report a gain of $100,000 on the form. In another scenario, if a business sells equipment for $50,000 that was bought for $70,000, they would report a loss of $20,000. These examples illustrate how to calculate and report gains or losses accurately on the form.

Quick guide on how to complete michigan form mi 4797 michigan adjustments of gains and

Effortlessly create Michigan Form MI 4797 Michigan Adjustments Of Gains And on any gadget

Digital document management has gained traction among enterprises and individuals alike. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents swiftly and efficiently. Manage Michigan Form MI 4797 Michigan Adjustments Of Gains And on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Michigan Form MI 4797 Michigan Adjustments Of Gains And effortlessly

- Locate Michigan Form MI 4797 Michigan Adjustments Of Gains And and click Get Form to begin.

- Make use of the tools we offer to submit your document.

- Emphasize pertinent sections of your documents or conceal confidential information using the instruments that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Michigan Form MI 4797 Michigan Adjustments Of Gains And and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Michigan MI 1040D form used for?

The Michigan MI 1040D form is a supplemental form used for additional deductions claimed on your Michigan income tax return. It helps taxpayers detail their eligible deductions beyond the standard file, optimizing potential refunds. Using airSlate SignNow, you can easily eSign and submit your MI 1040D form securely and quickly.

-

How can airSlate SignNow assist with the filing of the Michigan MI 1040D?

airSlate SignNow provides an intuitive platform to prepare, send, and eSign your Michigan MI 1040D form electronically. This eliminates the need for traditional pen-and-paper methods, saving you time and ensuring accuracy. Our features help streamline your tax filing process and improve organization, making it a breeze to manage documents.

-

Is there a cost associated with using airSlate SignNow for Michigan MI 1040D?

Yes, while airSlate SignNow offers a free trial, there are subscription plans available for ongoing usage, depending on your business needs. The pricing is competitive and designed to provide value, considering the time saved on document management like the Michigan MI 1040D form. Investing in our solution will enhance your document processes without breaking your budget.

-

What features does airSlate SignNow offer for the Michigan MI 1040D form?

airSlate SignNow offers features such as document templates, automatic reminders, and secure cloud storage for your Michigan MI 1040D form. These features ensure that you can manage, eSign, and track the status of your documents in real-time. The platform's user-friendly interface makes navigating through these features seamless and efficient.

-

Can I integrate airSlate SignNow with other tools for managing my Michigan MI 1040D?

Absolutely! airSlate SignNow integrates seamlessly with various productivity tools and platforms that can streamline your document management process, including accounting and tax software. This integration allows for easy transfer of data related to your Michigan MI 1040D form, enhancing productivity while ensuring accuracy in information handling.

-

What are the benefits of using airSlate SignNow for my Michigan MI 1040D form?

Using airSlate SignNow for your Michigan MI 1040D form signNowly reduces the complexity and time associated with tax filing. The ability to eSign documents from anywhere improves accessibility and collaboration with financial advisors. Additionally, our compliance and security measures ensure that your sensitive information remains protected during the filing process.

-

How secure is airSlate SignNow for submitting the Michigan MI 1040D?

airSlate SignNow prioritizes security and employs advanced encryption protocols to protect your documents, including the Michigan MI 1040D. Our compliance with industry standards guarantees that your sensitive financial information is safeguarded against unauthorized access. You can eSign and submit your forms with confidence, knowing that your data is secure.

Get more for Michigan Form MI 4797 Michigan Adjustments Of Gains And

- Quitclaim deed individual to a corporation mississippi form

- Warranty deed from husband and wife to two individuals mississippi form

- Petition to modify divorce decree by terminating child support child emancipated mississippi form

- Quitclaim deed individual to a trust mississippi form

- Heirship affidavit descent mississippi form

- Quitclaim deed from a trust to an individual mississippi form

- Mississippi trust form

- Contract for transfer of real property from bank to individual mississippi form

Find out other Michigan Form MI 4797 Michigan Adjustments Of Gains And

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors