DEPARTMENT of REVENUE MACHINERY for NEW and EXPANDED Form

Understanding the Department of Revenue Machinery for New and Expanded Industry

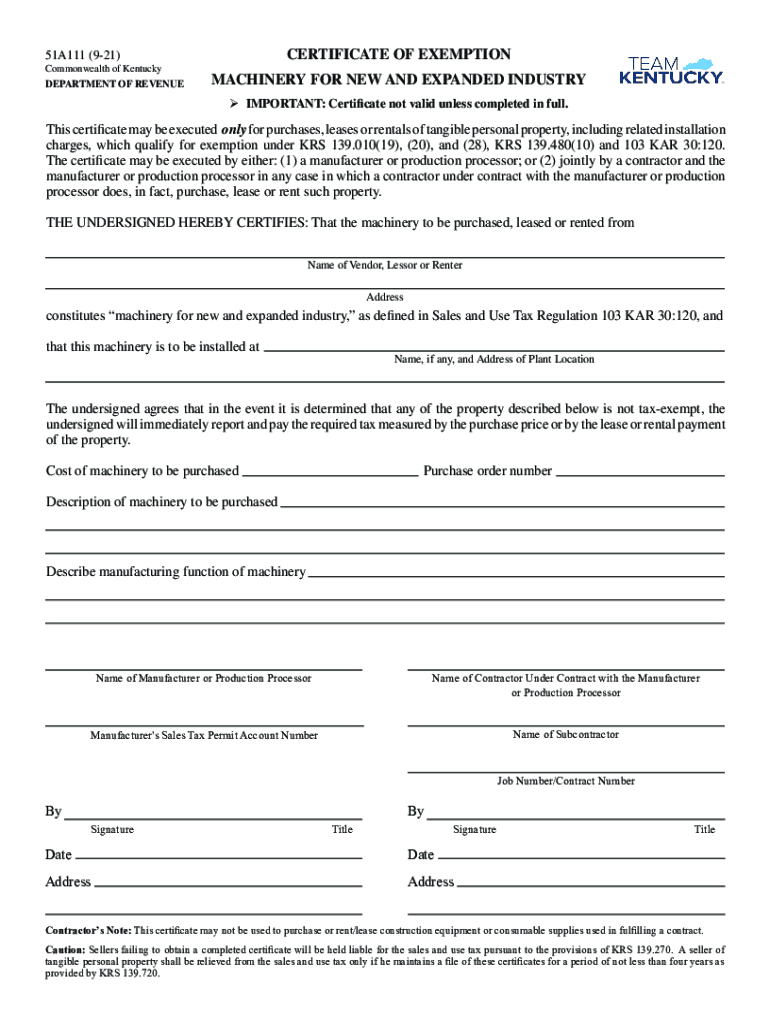

The Kentucky Form 51A111, known as the Department of Revenue Machinery for New and Expanded Industry, is essential for businesses seeking tax exemptions on qualifying machinery and equipment. This form facilitates the process of applying for exemptions, which can significantly reduce operational costs for new and expanding enterprises. The exemption is designed to encourage investment in Kentucky's economy by alleviating some financial burdens associated with purchasing new machinery.

Steps to Complete the Department of Revenue Machinery for New and Expanded Industry

Completing the Kentucky Form 51A111 involves several critical steps to ensure accuracy and compliance. Begin by gathering necessary information about your business and the machinery you intend to purchase. You will need to provide details such as:

- Your business name and address

- Description of the machinery or equipment

- Purchase price and date of acquisition

- Proof of eligibility for the exemption

Once you have compiled this information, fill out the form carefully, ensuring that all sections are completed. After filling out the form, review it for any errors before submission. This attention to detail can prevent delays in processing your application.

Eligibility Criteria for the Department of Revenue Machinery for New and Expanded Industry

To qualify for the Kentucky Form 51A111 exemption, businesses must meet specific eligibility criteria. Generally, the machinery or equipment must be used directly in the manufacturing process or in the production of goods for sale. Additionally, the business must be engaged in new or expanded operations within Kentucky. It is important to verify that your business aligns with these criteria to avoid complications during the application process.

Required Documents for Submission

When submitting the Kentucky Form 51A111, certain documents are essential to support your application. These typically include:

- A copy of the purchase invoice for the machinery

- Documentation proving the nature of your business operations

- Any previous exemption certificates, if applicable

Having these documents ready will streamline the submission process and help ensure that your application is processed without unnecessary delays.

Legal Use of the Department of Revenue Machinery for New and Expanded Industry

The legal framework surrounding the Kentucky Form 51A111 is designed to promote economic growth while ensuring compliance with state regulations. Businesses must use the exemption solely for the intended purpose, which is to support new and expanding industries. Misuse of the exemption can lead to penalties or revocation of the exemption status, underscoring the importance of adhering to the guidelines set forth by the Kentucky Department of Revenue.

Form Submission Methods for Kentucky Form 51A111

The Kentucky Form 51A111 can be submitted through various methods to accommodate different business needs. Options include:

- Online submission via the Kentucky Department of Revenue's official portal

- Mailing the completed form to the appropriate department address

- In-person submission at designated revenue offices

Choosing the right submission method can enhance the efficiency of your application process, allowing for quicker processing times and easier tracking of your submission status.

Quick guide on how to complete department of revenue machinery for new and expanded

Easily prepare DEPARTMENT OF REVENUE MACHINERY FOR NEW AND EXPANDED on any device

The management of documents online has gained traction among businesses and individuals. It offers an excellent environmentally-friendly alternative to traditional printed and signed forms, as you can obtain the necessary document and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle DEPARTMENT OF REVENUE MACHINERY FOR NEW AND EXPANDED on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign DEPARTMENT OF REVENUE MACHINERY FOR NEW AND EXPANDED effortlessly

- Find DEPARTMENT OF REVENUE MACHINERY FOR NEW AND EXPANDED and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or black out confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and eSign DEPARTMENT OF REVENUE MACHINERY FOR NEW AND EXPANDED to ensure effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the kentucky form 51a111 and why is it important?

The kentucky form 51a111 is a crucial document used in Kentucky to report your business's income and expenses. Accurate completion of this form ensures compliance with state regulations, avoids penalties, and can help in maximizing your tax deductions.

-

How can airSlate SignNow assist with the completion of the kentucky form 51a111?

airSlate SignNow streamlines the process of filling out the kentucky form 51a111 by allowing for easy document upload and eSigning. With our user-friendly interface, you can quickly manage your forms, ensuring you meet deadlines without stress.

-

Is there a cost associated with using airSlate SignNow for the kentucky form 51a111?

Yes, airSlate SignNow offers several pricing plans tailored to suit different business needs. Our solutions are designed to be cost-effective, ensuring that you can efficiently manage documents, including the kentucky form 51a111, without breaking the bank.

-

What features does airSlate SignNow provide for handling the kentucky form 51a111?

airSlate SignNow includes features like document templates, automated workflows, and secure cloud storage, specifically designed to facilitate the management of the kentucky form 51a111. These tools help streamline your document processes while ensuring security and compliance.

-

Can I integrate airSlate SignNow with other software for filing the kentucky form 51a111?

Yes, airSlate SignNow offers seamless integrations with various accounting and CRM software, making it easier to manage your finances and prepare the kentucky form 51a111. These integrations help centralize your workflow, ensuring efficiency and accuracy in your submissions.

-

What are the benefits of using airSlate SignNow for the kentucky form 51a111?

Using airSlate SignNow for the kentucky form 51a111 offers numerous benefits, including faster processing times, better organization of your files, and improved collaboration with clients or partners. Our platform enhances your productivity and makes it easier to keep track of essential documents.

-

Is it easy to eSign the kentucky form 51a111 with airSlate SignNow?

Absolutely! eSigning the kentucky form 51a111 with airSlate SignNow is straightforward. You can sign documents securely and quickly from anywhere, ensuring that your paperwork is completed on time and without hassle.

Get more for DEPARTMENT OF REVENUE MACHINERY FOR NEW AND EXPANDED

Find out other DEPARTMENT OF REVENUE MACHINERY FOR NEW AND EXPANDED

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online