Revenue Form K 4 42A804 11 13 KENTUCKY

Understanding the Kentucky Form 62A044

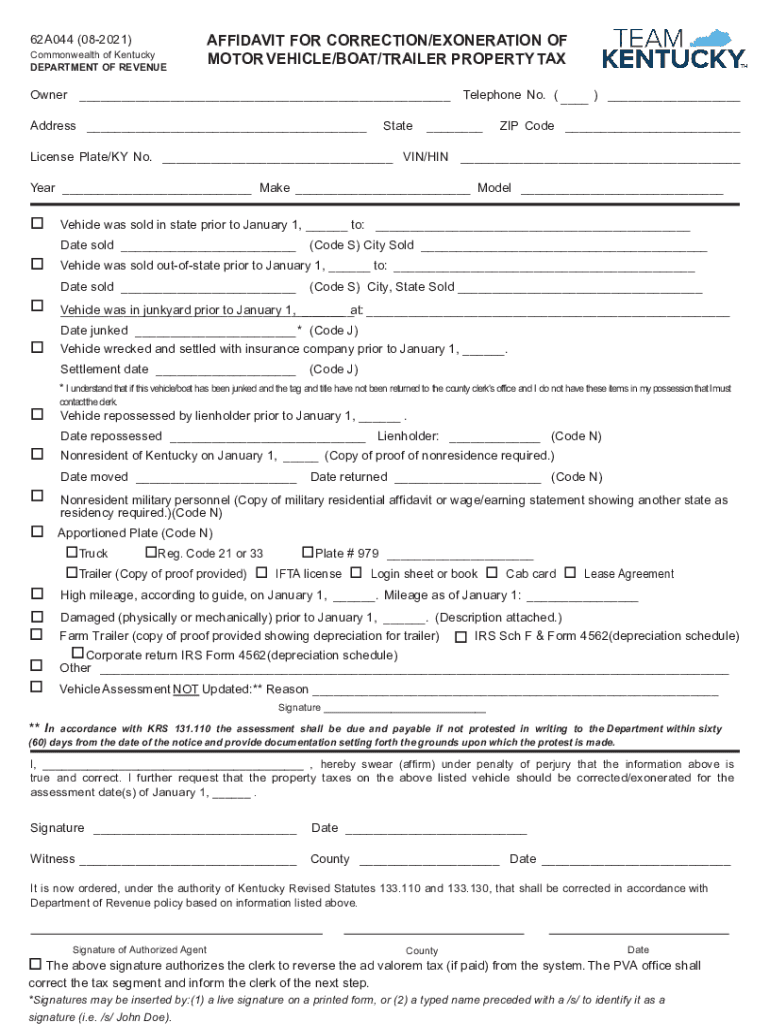

The Kentucky Form 62A044, commonly referred to as the Kentucky affidavit correction, is a crucial document for individuals needing to amend information related to their vehicle registration or property tax records. This form is typically used to correct errors in previously submitted documents, ensuring that all information is accurate and up to date. The form is essential for maintaining compliance with state regulations and avoiding potential penalties.

Steps to Complete the Kentucky Form 62A044

Completing the Kentucky Form 62A044 involves several key steps to ensure accuracy and compliance. Begin by downloading the form in PDF format from the official state website. Next, carefully read the instructions provided with the form to understand what information is required. Fill out the necessary fields, including your personal details and the specific corrections needed. It is important to double-check all entries for accuracy before signing the form. Once completed, submit the form according to the guidelines provided.

Legal Use of the Kentucky Form 62A044

The Kentucky Form 62A044 is legally binding when filled out correctly and submitted in accordance with state laws. To ensure its validity, the form must be signed by the individual making the corrections and may require additional documentation to support the changes being requested. Compliance with eSignature regulations is also essential if the form is submitted electronically, as it helps establish the authenticity of the signatures and the legitimacy of the corrections made.

Form Submission Methods for Kentucky Form 62A044

The Kentucky Form 62A044 can be submitted through various methods, depending on the preferences of the individual. Options typically include online submission through the Kentucky Department of Revenue's website, mailing the completed form to the appropriate office, or delivering it in person. Each submission method may have specific requirements, so it is advisable to review the instructions carefully to ensure proper handling of the form.

Required Documents for Kentucky Form 62A044

When completing the Kentucky Form 62A044, certain documents may be required to support your corrections. These can include proof of identity, previous registration documents, and any other relevant paperwork that verifies the information being amended. Having these documents ready can facilitate a smoother submission process and help avoid delays in processing your corrections.

Penalties for Non-Compliance with Kentucky Form 62A044

Failure to submit the Kentucky Form 62A044 or inaccuracies in the information provided can lead to penalties imposed by the state. These may include fines, additional taxes, or complications with vehicle registration or property tax assessments. It is crucial to ensure that all corrections are made promptly and accurately to avoid these potential consequences.

Quick guide on how to complete revenue form k 4 42a804 11 13 kentucky

Effortlessly Prepare Revenue Form K 4 42A804 11 13 KENTUCKY on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents promptly without delays. Manage Revenue Form K 4 42A804 11 13 KENTUCKY on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The Easiest Way to Modify and eSign Revenue Form K 4 42A804 11 13 KENTUCKY with Ease

- Locate Revenue Form K 4 42A804 11 13 KENTUCKY and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and hit the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and eSign Revenue Form K 4 42A804 11 13 KENTUCKY while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the kentucky form 62a044?

The kentucky form 62a044 is a document used for various administrative purposes in Kentucky. This form is vital for ensuring compliance with local regulations, and airSlate SignNow makes it easy to fill, sign, and send it securely online. Our platform simplifies the entire process, saving you time and effort.

-

How can airSlate SignNow help with the kentucky form 62a044?

Using airSlate SignNow, you can efficiently complete the kentucky form 62a044 by utilizing our user-friendly interface. Our platform allows you to fill out the form electronically, add signatures, and send it directly to recipients, ensuring a smooth workflow. Experience enhanced productivity and reduce paper clutter with our digital solution.

-

Is airSlate SignNow suitable for businesses that frequently use kentucky form 62a044?

Absolutely! airSlate SignNow is ideal for businesses that regularly utilize the kentucky form 62a044. Its cost-effective pricing model and efficient eSigning capabilities allow businesses to streamline their document processes, saving both time and resources. Simplify your operations and improve your document management with our comprehensive tools.

-

What features does airSlate SignNow offer for the kentucky form 62a044?

With airSlate SignNow, you can expect features like customizable templates, multi-party signing, and real-time tracking for your kentucky form 62a044. Our platform also includes an intuitive dashboard that allows users to manage their documents effortlessly. These features enhance the eSigning experience, making it faster and more efficient.

-

Can I integrate airSlate SignNow with other applications while using kentucky form 62a044?

Yes, airSlate SignNow offers seamless integration with various applications such as Google Drive, Dropbox, and CRM systems. This means you can easily access and send your kentucky form 62a044 from any platform you're already using. Our integrations are designed to enhance your workflow and make document management even more efficient.

-

What are the benefits of using airSlate SignNow for the kentucky form 62a044?

The primary benefits of using airSlate SignNow for the kentucky form 62a044 include increased efficiency, enhanced security, and reduced paper usage. Our cloud-based solution allows for fast access to your documents while ensuring that they are securely stored. Additionally, electronic signatures are legally binding, providing peace of mind that your documents are compliant.

-

How do I get started with airSlate SignNow for kentucky form 62a044?

Getting started with airSlate SignNow for the kentucky form 62a044 is easy! Simply sign up for an account on our website, and you'll gain access to our comprehensive toolset. From there, you can upload the form, customize it as needed, and start sending out eSignatures in no time.

Get more for Revenue Form K 4 42A804 11 13 KENTUCKY

- Petition for approval of final accounting mississippi form

- Appointing successor form

- Petition to appoint new conservator mississippi form

- Inventory petition to approve expenses and monthly allowances and for other relief mississippi form

- Order approving inventory petition to approve expenses and monthly allowances and for other relief mississippi form

- Notice is hereby given that a subcontractor who has a contract with a contractor in privity with the owner of the following form

- Chapter 6008 rcw chattel liens access washington form

- Notice is hereby given that as a representative of a corporation does hereby claim a lien on the following property situated in form

Find out other Revenue Form K 4 42A804 11 13 KENTUCKY

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document