Retailers Sales Tax ST 36 Kansas Department of Revenue Form

What is the Retailers Sales Tax ST 36 Kansas Department Of Revenue

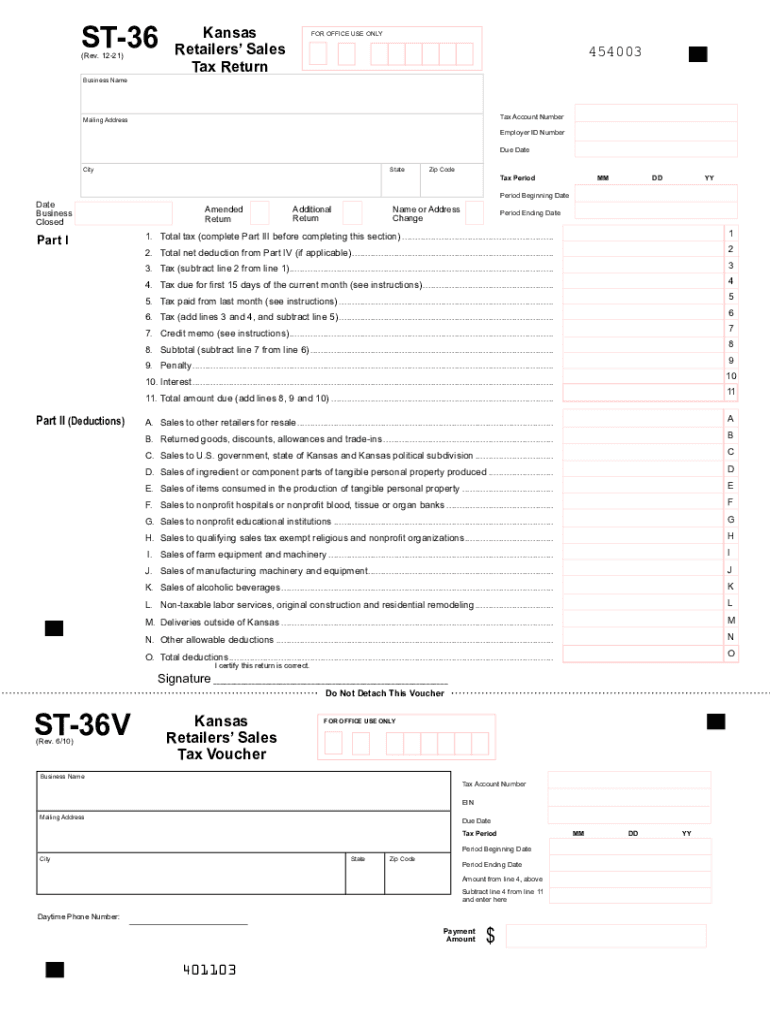

The Retailers Sales Tax ST 36 is a specific form issued by the Kansas Department of Revenue. It is used by retailers to report and remit sales tax collected from customers on taxable sales. This form is essential for compliance with state tax laws, ensuring that businesses accurately report their sales tax liabilities. The ST 36 form is designed to streamline the process of sales tax reporting, making it easier for retailers to fulfill their obligations under Kansas law.

How to use the Retailers Sales Tax ST 36 Kansas Department Of Revenue

Using the Retailers Sales Tax ST 36 involves several key steps. First, retailers must gather all relevant sales data for the reporting period. This includes total sales, taxable sales, and any exemptions. Next, the retailer fills out the form, entering the required information accurately. Once completed, the form can be submitted either online or via mail, depending on the retailer's preference. It is crucial to ensure that all calculations are correct to avoid penalties or compliance issues.

Steps to complete the Retailers Sales Tax ST 36 Kansas Department Of Revenue

Completing the Retailers Sales Tax ST 36 requires careful attention to detail. Here are the steps involved:

- Gather sales records for the reporting period.

- Determine total sales and taxable sales amounts.

- Complete the form by entering the necessary data, including sales figures and tax collected.

- Review the form for accuracy to ensure all information is correct.

- Submit the form online or mail it to the Kansas Department of Revenue by the deadline.

Legal use of the Retailers Sales Tax ST 36 Kansas Department Of Revenue

The legal use of the Retailers Sales Tax ST 36 is governed by Kansas tax laws. Retailers must use this form to report sales tax accurately and timely to avoid legal repercussions. Compliance with the regulations ensures that businesses maintain good standing with the state and avoid penalties for non-compliance. It is important for retailers to understand their responsibilities regarding sales tax collection and reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Retailers Sales Tax ST 36 are crucial for compliance. Retailers must submit their forms by the specified due date to avoid late fees and penalties. Typically, the filing frequency can be monthly, quarterly, or annually, depending on the volume of sales. It is essential for businesses to stay informed about these deadlines to ensure timely submissions.

Penalties for Non-Compliance

Failure to comply with the requirements of the Retailers Sales Tax ST 36 can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Retailers are encouraged to understand the implications of non-compliance and take proactive measures to ensure that they meet all filing and payment obligations associated with this form.

Quick guide on how to complete retailers sales tax st 36 kansas department of revenue

Effortlessly Complete Retailers Sales Tax ST 36 Kansas Department Of Revenue on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a sustainable alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly, without delays. Manage Retailers Sales Tax ST 36 Kansas Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Edit and eSign Retailers Sales Tax ST 36 Kansas Department Of Revenue with Ease

- Locate Retailers Sales Tax ST 36 Kansas Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a traditional wet signature.

- Verify all the details and click on the Done button to save your edits.

- Decide how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiresome form searches, or mistakes that require printing new copies. airSlate SignNow simplifies your document management needs within a few clicks from any device you prefer. Update and eSign Retailers Sales Tax ST 36 Kansas Department Of Revenue while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the retailers sales tax st 36 kansas department of revenue

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow, and why ST 36?

airSlate SignNow is an electronic signature platform that simplifies the process of sending and signing documents. Understanding why ST 36 is crucial is that it highlights the lightweight and versatile functionalities of the software, allowing users to integrate it seamlessly into their workflows.

-

How does airSlate SignNow pricing work, and why ST 36 is a cost-effective solution?

airSlate SignNow offers flexible pricing plans that cater to various business needs, explaining why ST 36 is a cost-effective solution. With transparent pricing structures and no hidden fees, businesses can easily manage their document workflow without straining their budgets.

-

What features does airSlate SignNow offer, and why ST 36 stands out?

AirSlate SignNow provides features like customizable templates, robust security, and real-time tracking of documents. These functionalities demonstrate why ST 36 stands out, making it easier for businesses to streamline their document management and eSigning processes.

-

What are the benefits of using airSlate SignNow, and why ST 36 is essential for businesses?

Using airSlate SignNow can greatly enhance productivity by reducing turnaround times for document signing. This efficiency is precisely why ST 36 is essential for businesses that rely on speed and reliability in their operations.

-

Can airSlate SignNow integrate with other tools, and why ST 36 is beneficial for integrations?

Yes, airSlate SignNow seamlessly integrates with various third-party applications such as Salesforce and Google Drive. This capability is why ST 36 is beneficial for businesses looking to create a cohesive document management ecosystem.

-

Is airSlate SignNow secure, and why ST 36 is a good choice for compliance?

airSlate SignNow is committed to maintaining the highest level of security with end-to-end encryption and compliance with major regulations. This security framework is part of why ST 36 is a good choice for businesses that prioritize data protection.

-

What types of documents can I sign with airSlate SignNow, and why ST 36 accommodates diverse needs?

With airSlate SignNow, users can sign a wide variety of documents, from contracts to invoices. This versatility is one reason why ST 36 accommodates diverse needs across various industries.

Get more for Retailers Sales Tax ST 36 Kansas Department Of Revenue

- Mississippi motor vehicles 497314484 form

- Final judgment form 497314485

- Mississippi motor vehicles 497314486 form

- Order dismissing case mississippi form

- Mississippi real estate form

- Release and cancellation of lease mississippi form

- Furnished apartment lease mississippi form

- Notice of dismissal mississippi form

Find out other Retailers Sales Tax ST 36 Kansas Department Of Revenue

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement