Estimated Tax Forms 2017

What is the Estimated Tax Forms

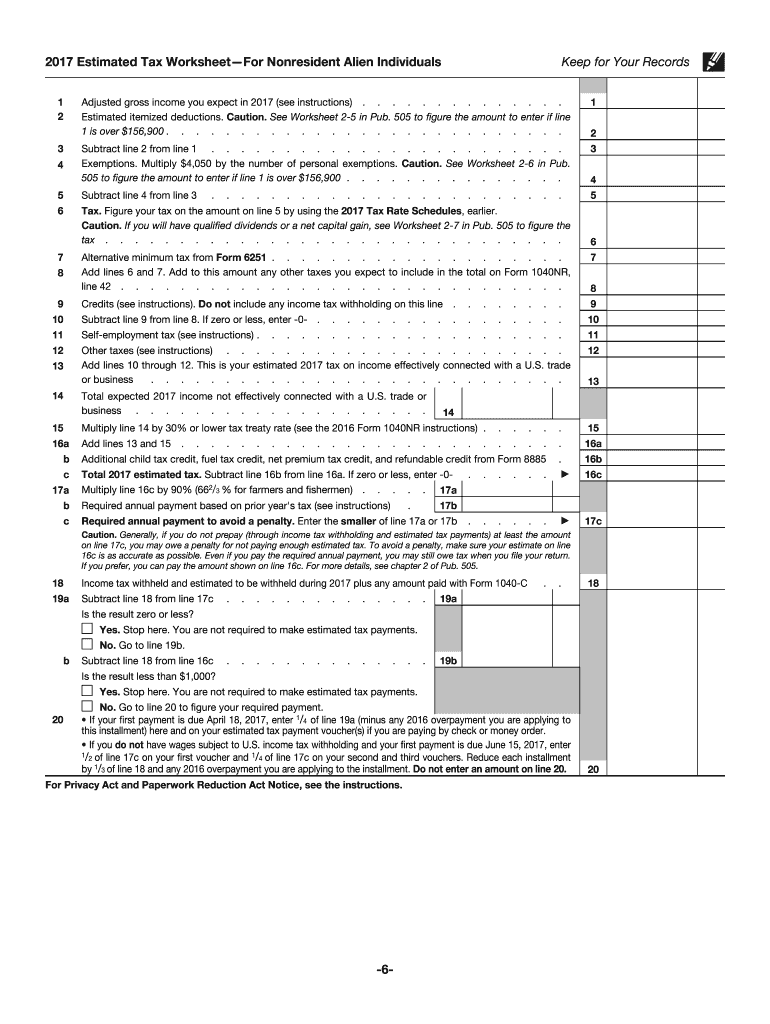

The Estimated Tax Forms are documents used by individuals and businesses to report and pay estimated taxes to the Internal Revenue Service (IRS). These forms are essential for taxpayers who expect to owe tax of one thousand dollars or more when filing their annual return. The forms help ensure that taxpayers meet their tax obligations throughout the year, rather than facing a large payment at tax time.

How to use the Estimated Tax Forms

To use the Estimated Tax Forms, taxpayers must first determine their expected tax liability for the year. This involves calculating income, deductions, and credits. Once the estimated amount is known, taxpayers can fill out the appropriate form, typically Form 1040-ES for individuals or Form 1120-W for corporations. After completing the form, payments can be made electronically or via mail, depending on the taxpayer's preference.

Steps to complete the Estimated Tax Forms

Completing the Estimated Tax Forms involves several key steps:

- Gather necessary financial information, including income sources and potential deductions.

- Calculate your expected tax liability using the IRS tax tables or tax software.

- Fill out the appropriate Estimated Tax Form, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Submit the form along with any payment due, either online or by mail.

Filing Deadlines / Important Dates

Filing deadlines for Estimated Tax Forms are crucial for compliance. Generally, estimated taxes are due quarterly, with deadlines falling on April 15, June 15, September 15, and January 15 of the following year. It is important to mark these dates on your calendar to avoid penalties and interest on late payments.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Estimated Tax Forms. Taxpayers should refer to IRS Publication 505, which outlines the rules for estimated tax, including who must pay, how to calculate payments, and the consequences of underpayment. Adhering to these guidelines helps ensure that taxpayers meet their obligations and avoid potential issues with the IRS.

Penalties for Non-Compliance

Failing to file or pay estimated taxes can result in penalties. The IRS may impose a penalty for underpayment if the taxpayer owes more than one thousand dollars at the end of the year and has not made sufficient estimated payments. Additionally, interest may accrue on any unpaid amounts. Understanding these penalties emphasizes the importance of timely and accurate submissions.

Who Issues the Form

The Estimated Tax Forms are issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides these forms to help taxpayers fulfill their tax obligations and ensure compliance with federal tax laws.

Quick guide on how to complete 2016 estimated tax forms 2017

Discover the most efficient method to complete and endorse your Estimated Tax Forms

Are you still expending time preparing your official documents on paper instead of handling it online? airSlate SignNow offers a superior way to complete and endorse your Estimated Tax Forms and analogous forms for public services. Our advanced electronic signature solution equips you with all the tools needed to manage documents swiftly and in accordance with official standards - comprehensive PDF editing, administration, security, signing, and sharing functionalities are available within a user-friendly interface.

Only a few simple steps are needed to complete and sign your Estimated Tax Forms:

- Incorporate the fillable template to the editor using the Get Form button.

- Verify what information you need to supply in your Estimated Tax Forms.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the blanks with your details.

- Update the content with Text boxes or Images from the toolbar above.

- Emphasize what is truly signNow or Conceal fields that are no longer relevant.

- Select Sign to create a legally effective electronic signature using any method you prefer.

- Include the Date next to your signature and finalize your work with the Done button.

Store your completed Estimated Tax Forms in the Documents folder within your profile, download it, or export it to your chosen cloud storage. Our solution also offers adaptable form sharing options. There’s no need to print your templates when sending them within the appropriate public office - you can do it via email, fax, or by requesting USPS “snail mail” delivery directly from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct 2016 estimated tax forms 2017

FAQs

-

How do I fill out my FAFSA?

The FAFSA isn't as scary as it seems, but it's helpful to have the documents you'll need handy before you fill it out. It's available starting January 1 of the year you'll attend school, and it's best to complete it as early as possible so you get the most aid you'll qualify for. Be especially mindful of school and state deadlines that are earlier than the federal deadline of June 2017. Check out NerdWallet's 5 Hacks to Save Time on Your 2016 FAFSA. These are the basic steps: Gather the documents you'll need to complete the form by following this checklist.Log in to the FAFSA with your Federal Student Aid ID. You'll need an FSA ID to sign and submit the form electronically, and your parent will need one too if you're a dependent student. Create one here. Follow the prompts to fill out the FAFSA. This guide will help you fill it out according to your family situation. You'll be able to save time by importing income information from the IRS starting Feb. 7, 2016. Many families don't file their 2015 income taxes until closer to the deadline of April 18. But it's a good idea to fill out your FAFSA earlier than that. Use your parents' 2014 tax information to estimate their income, then go back in and update your FAFSA using the IRS Data Retrieval Tool once they've filed their taxes. More info here: Filling Out the FAFSA.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

Can I fill out the SSC CHSL 2017 form while waiting for the 2016 results?

Yes you can.By now you should have started preparing also.We motivate students to crack govt exams while working.Join our YouTube channel SSC PATHSHALA and enjoy learning like never before.Classroom Program for English Mains: Classroom Program for English Mains - YouTube

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the 2016 estimated tax forms 2017

How to make an electronic signature for your 2016 Estimated Tax Forms 2017 in the online mode

How to make an electronic signature for your 2016 Estimated Tax Forms 2017 in Google Chrome

How to make an eSignature for putting it on the 2016 Estimated Tax Forms 2017 in Gmail

How to generate an electronic signature for the 2016 Estimated Tax Forms 2017 right from your smart phone

How to create an eSignature for the 2016 Estimated Tax Forms 2017 on iOS

How to make an electronic signature for the 2016 Estimated Tax Forms 2017 on Android OS

People also ask

-

What are Estimated Tax Forms and why do I need them?

Estimated Tax Forms are documents used to calculate and report your estimated tax payments to the IRS. They are essential for self-employed individuals or businesses that expect to owe taxes of $1,000 or more. Accurate completion of Estimated Tax Forms helps avoid penalties and ensures that you're on track with your tax obligations.

-

How can airSlate SignNow help with Estimated Tax Forms?

airSlate SignNow provides an efficient platform to electronically sign and send your Estimated Tax Forms securely. With its user-friendly interface, you can quickly fill out and eSign your forms, streamlining the tax filing process. This ensures compliance and saves you time, allowing you to focus on your business.

-

Is there a cost associated with using airSlate SignNow for Estimated Tax Forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. While there is a subscription fee, the cost is competitive and offers signNow value, especially considering the time saved in managing Estimated Tax Forms. You can choose a plan that fits your budget while benefiting from robust eSignature features.

-

What features does airSlate SignNow offer for managing Estimated Tax Forms?

airSlate SignNow includes features like templates for Estimated Tax Forms, real-time tracking of document status, and secure cloud storage. These features make it easier to manage your forms and keep track of important deadlines. Additionally, you can collaborate with your team members seamlessly within the platform.

-

Can I integrate airSlate SignNow with other software for my Estimated Tax Forms?

Absolutely! airSlate SignNow integrates with popular accounting and financial software, allowing you to streamline your workflow for managing Estimated Tax Forms. This integration helps in automatically pulling data into your forms, reducing manual entry and errors, thus enhancing your efficiency during tax season.

-

What are the benefits of using airSlate SignNow for my small business's Estimated Tax Forms?

Using airSlate SignNow for your Estimated Tax Forms offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform's easy-to-use interface allows small businesses to quickly complete and eSign documents, ensuring compliance and timely submissions. Overall, it simplifies the tax preparation process.

-

How secure is airSlate SignNow when handling Estimated Tax Forms?

airSlate SignNow prioritizes security with advanced encryption and secure data storage protocols when handling your Estimated Tax Forms. Your information is protected against unauthorized access, ensuring that sensitive tax data remains confidential. Trusting airSlate SignNow means you're using a secure solution for your tax management needs.

Get more for Estimated Tax Forms

- Mackenzie rdsp application form

- 7a cover letter to sheriff chplnj form

- Functional behavioral assessment screening form psych hsd

- Certification of health care provider for family member s serious health condition family and medical leave act certification form

- Request for alberta student number former studentsstudents complete these forms to receive their asn

- Ppt instructions ty 20256 26 24f pdf form

- Stock holding agreement template form

- Stock issuance agreement template form

Find out other Estimated Tax Forms

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document