Www pdfFiller Com447640639 State of RhodeFillable Online State of Rhode Island Division of Taxation Form

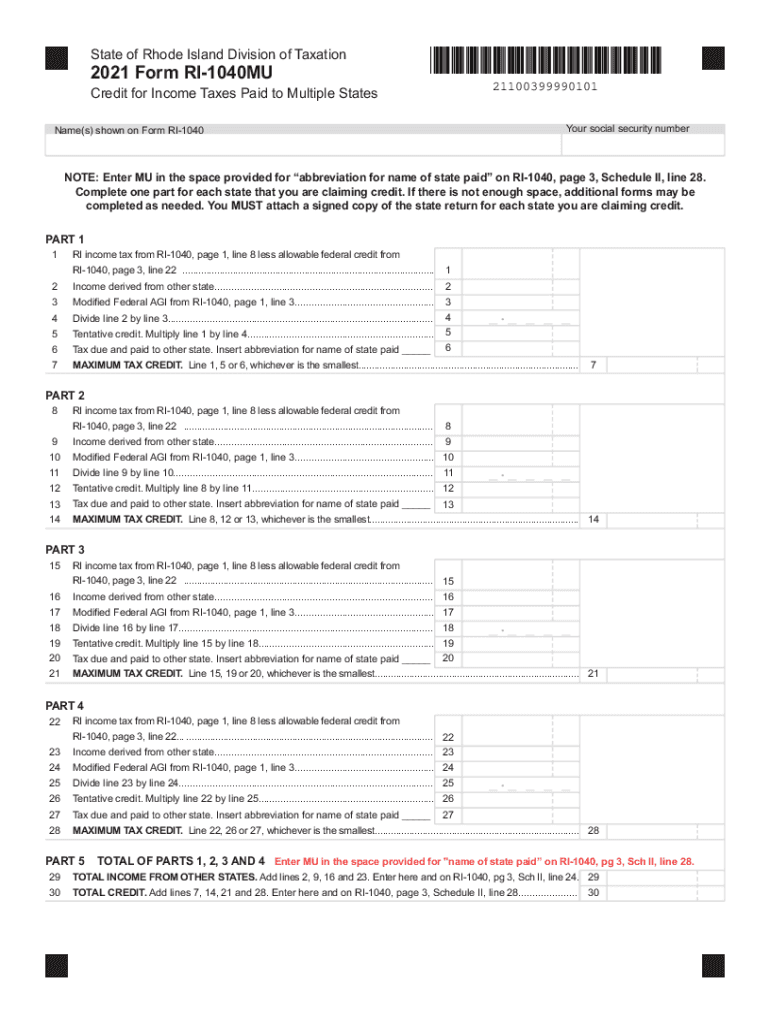

Understanding the ri 1040mu Form

The ri 1040mu form is a crucial document for residents of Rhode Island, serving as the state income tax return. This form is used to report income, calculate tax liability, and determine eligibility for various credits and deductions. It is essential for individuals to accurately complete this form to ensure compliance with state tax laws.

Steps to Complete the ri 1040mu Form

Completing the ri 1040mu form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income, including wages, interest, dividends, and any other sources.

- Calculate your adjustments to income, if applicable, to arrive at your adjusted gross income (AGI).

- Determine your tax liability by applying the appropriate tax rates to your taxable income.

- Claim any credits or deductions for which you qualify, such as the Earned Income Tax Credit.

- Review your completed form for accuracy before submitting it.

Filing Deadlines for the ri 1040mu Form

It is important to be aware of the filing deadlines for the ri 1040mu form to avoid penalties. Typically, the deadline for filing is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension, but they must still pay any taxes owed by the original deadline to avoid interest and penalties.

Required Documents for Submission

When filing the ri 1040mu form, you will need to provide several key documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income, such as rental or investment income

- Documentation for deductions and credits, such as receipts and statements

Legal Use of the ri 1040mu Form

The ri 1040mu form must be completed and submitted in accordance with Rhode Island tax laws. This includes ensuring that all information is accurate and truthful. Filing an incorrect or fraudulent return can result in severe penalties, including fines and potential legal action. It is advisable to consult with a tax professional if you have questions about the legal implications of your filing.

Digital vs. Paper Version of the ri 1040mu Form

Taxpayers have the option to file the ri 1040mu form either digitally or via paper submission. Digital filing is often faster and allows for immediate confirmation of receipt. It also reduces the risk of errors associated with manual entry. On the other hand, some individuals may prefer paper filing for various reasons, including a lack of access to technology or personal preference.

Quick guide on how to complete wwwpdffillercom447640639 state of rhodefillable online state of rhode island division of taxation

Complete Www pdffiller com447640639 State of RhodeFillable Online State Of Rhode Island Division Of Taxation effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Www pdffiller com447640639 State of RhodeFillable Online State Of Rhode Island Division Of Taxation on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Www pdffiller com447640639 State of RhodeFillable Online State Of Rhode Island Division Of Taxation with ease

- Locate Www pdffiller com447640639 State of RhodeFillable Online State Of Rhode Island Division Of Taxation and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Www pdffiller com447640639 State of RhodeFillable Online State Of Rhode Island Division Of Taxation and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwwpdffillercom447640639 state of rhodefillable online state of rhode island division of taxation

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The way to create an e-signature straight from your smartphone

The best way to make an e-signature for a PDF on iOS

The way to create an e-signature for a PDF document on Android

People also ask

-

What is the RI 1040MU form and why is it important?

The RI 1040MU form is a crucial document for individuals filing their income tax in Rhode Island. It helps taxpayers report their income accurately and claim any applicable credits or deductions. Understanding this form can simplify your tax preparations and ensure compliance with state regulations.

-

How can airSlate SignNow help with the RI 1040MU form?

airSlate SignNow offers a seamless solution for signing and managing your RI 1040MU form digitally. With its easy-to-use interface, you can quickly send, receive, and eSign documents, making the tax filing process more efficient and less time-consuming.

-

What features does airSlate SignNow provide for eSigning the RI 1040MU?

airSlate SignNow provides several features for eSigning the RI 1040MU, including template creation, remote signing, and mobile support. These features enhance convenience and speed up the entire signing process, ensuring that your documents are completed and submitted on time.

-

Is airSlate SignNow a cost-effective solution for RI 1040MU filings?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing RI 1040MU filings. With various pricing plans available, you can choose one that fits your budget and enjoy value-added features that streamline the document signing process.

-

Can airSlate SignNow integrate with tax preparation software for RI 1040MU?

Absolutely! airSlate SignNow integrates with various tax preparation software, making it easy to manage your RI 1040MU forms alongside your other tax documents. This integration helps reduce data entry errors and increases overall productivity during tax season.

-

What are the benefits of using airSlate SignNow for my RI 1040MU?

Using airSlate SignNow for your RI 1040MU offers multiple benefits, including enhanced security for your documents and improved collaboration with tax professionals. The platform also allows for quicker turnaround times on document signing, ensuring that you meet tax deadlines without hassle.

-

How secure is airSlate SignNow for handling sensitive RI 1040MU information?

airSlate SignNow is highly secure, implementing end-to-end encryption and robust authentication measures to protect your sensitive RI 1040MU information. You can trust that your documents are safely handled, which is crucial for maintaining privacy and compliance during tax filings.

Get more for Www pdffiller com447640639 State of RhodeFillable Online State Of Rhode Island Division Of Taxation

Find out other Www pdffiller com447640639 State of RhodeFillable Online State Of Rhode Island Division Of Taxation

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement