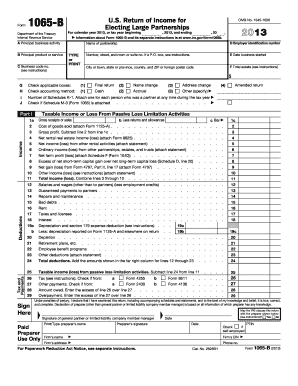

Form 1065 B Department of the Treasury Internal Revenue Service U Irs

What is the Form 1065 B Department Of The Treasury Internal Revenue Service U Irs

The Form 1065 B is a tax document used by partnerships to report income, deductions, gains, losses, and other tax-related information to the Internal Revenue Service (IRS). This form is specifically designed for certain partnerships that are eligible to file as a business entity under the IRS guidelines. It allows partnerships to report their financial activities and ensures that each partner receives the appropriate tax information needed for their individual tax returns. Understanding the purpose of Form 1065 B is crucial for partnerships to maintain compliance with federal tax regulations.

Steps to complete the Form 1065 B Department Of The Treasury Internal Revenue Service U Irs

Completing Form 1065 B involves several key steps that ensure accurate reporting of partnership income and expenses. First, gather all necessary financial documents, including income statements, expense reports, and any relevant tax documents. Next, accurately fill out the form by providing details such as the partnership's name, address, and Employer Identification Number (EIN). Report all income and deductions in the appropriate sections, ensuring that figures are precise and well-documented. After completing the form, review it thoroughly for any errors before submission. Finally, ensure that all partners receive a Schedule K-1, which outlines their share of the partnership's income, deductions, and credits.

Legal use of the Form 1065 B Department Of The Treasury Internal Revenue Service U Irs

The legal use of Form 1065 B is essential for partnerships to comply with federal tax laws. This form serves as an official record of the partnership's financial activities and is required by the IRS to ensure accurate taxation. When completed correctly, Form 1065 B provides legal protection for partnerships by documenting their income and expenses, which can be critical in the event of an audit. Moreover, the information reported on this form is used to prepare individual partners' tax returns, making it a vital component of the overall tax compliance process for partnerships.

Filing Deadlines / Important Dates

Filing deadlines for Form 1065 B are crucial for partnerships to avoid penalties. Generally, the form must be filed by the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the due date is March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Partnerships may apply for an automatic six-month extension, but they must file Form 7004 to request this extension. It is important for partnerships to adhere to these deadlines to maintain compliance and avoid late fees.

How to obtain the Form 1065 B Department Of The Treasury Internal Revenue Service U Irs

Form 1065 B can be obtained directly from the IRS website, where it is available for download in PDF format. Alternatively, partnerships can request a physical copy by contacting the IRS or visiting a local IRS office. It is essential to ensure that the most current version of the form is used, as tax regulations may change. Additionally, many tax preparation software programs include Form 1065 B, making it easier for partnerships to complete and file their tax returns electronically.

Key elements of the Form 1065 B Department Of The Treasury Internal Revenue Service U Irs

Key elements of Form 1065 B include sections for reporting partnership income, deductions, and credits. The form requires detailed information about the partnership, including its name, address, and EIN. It also contains sections for listing each partner's share of income, deductions, and tax credits through Schedule K-1. Accurate reporting in these sections is vital for ensuring compliance with IRS regulations and for providing partners with the necessary information for their individual tax filings. Understanding these key elements helps partnerships complete the form correctly and efficiently.

Quick guide on how to complete form 1065 b department of the treasury internal revenue service u irs

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Steps to Modify and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1065 B Department Of The Treasury Internal Revenue Service U Irs

Create this form in 5 minutes!

How to create an eSignature for the form 1065 b department of the treasury internal revenue service u irs

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The way to make an e-signature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The way to make an e-signature for a PDF on Android devices

People also ask

-

What is Form 1065 B Department Of The Treasury Internal Revenue Service U Irs?

Form 1065 B is a tax document used by partnerships to report income, deductions, and other information to the Department Of The Treasury Internal Revenue Service U Irs. It is essential for compliance with federal tax laws and ensures that all partners are taxed appropriately on the income generated by the partnership.

-

How can airSlate SignNow assist with Form 1065 B Department Of The Treasury Internal Revenue Service U Irs?

airSlate SignNow streamlines the process of preparing and electronically signing Form 1065 B Department Of The Treasury Internal Revenue Service U Irs. Our platform allows users to easily create, send, and eSign the document, helping businesses save time and reduce operational costs.

-

What features does airSlate SignNow offer for managing Form 1065 B Department Of The Treasury Internal Revenue Service U Irs?

airSlate SignNow provides robust features such as document templates, customizable workflows, and secure electronic signatures. These tools enable users to manage Form 1065 B Department Of The Treasury Internal Revenue Service U Irs efficiently and ensure seamless collaboration among partners.

-

Is airSlate SignNow a cost-effective solution for handling Form 1065 B Department Of The Treasury Internal Revenue Service U Irs?

Yes, airSlate SignNow is a cost-effective solution for handling Form 1065 B Department Of The Treasury Internal Revenue Service U Irs. Our competitive pricing plans are designed to accommodate businesses of all sizes, eliminating the need for expensive software or lengthy paper processes.

-

Can airSlate SignNow integrate with other software for Form 1065 B Department Of The Treasury Internal Revenue Service U Irs?

Absolutely! airSlate SignNow offers integration options with popular accounting and financial software to facilitate the management of Form 1065 B Department Of The Treasury Internal Revenue Service U Irs. This ensures that all relevant data is seamlessly transferred, simplifying the overall filing process.

-

What are the benefits of using airSlate SignNow for Form 1065 B Department Of The Treasury Internal Revenue Service U Irs?

Using airSlate SignNow for Form 1065 B Department Of The Treasury Internal Revenue Service U Irs provides numerous benefits, including increased efficiency, reduced processing time, and enhanced security. Our platform makes it easy to keep all your documents organized and accessible while ensuring compliance with IRS requirements.

-

Do I need technical skills to use airSlate SignNow for Form 1065 B Department Of The Treasury Internal Revenue Service U Irs?

No, airSlate SignNow is designed to be user-friendly, requiring no technical skills to manage Form 1065 B Department Of The Treasury Internal Revenue Service U Irs. Our intuitive interface and comprehensive support resources make it easy for anyone to get started quickly.

Get more for Form 1065 B Department Of The Treasury Internal Revenue Service U Irs

- 2010 form power of attorney

- Medical records release form river crest hospital

- Wp contentuploads201005certificate of acclimation dryfur form

- Fictitious name images california form

- Sea cadet badges in india pdf form

- City of glendale zoning use certificate form

- Imm 1295 fillable form

- Nabs annual meeting registration form sgmeet com

Find out other Form 1065 B Department Of The Treasury Internal Revenue Service U Irs

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form