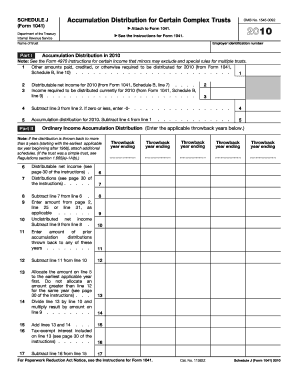

SCHEDULE J Form 1041 Department of the Treasury Internal Revenue Service Name of Trust Accumulation Distribution for Certain Com

Understanding the Schedule J Form 1041

The Schedule J Form 1041 is a crucial document used by complex trusts to report income distributions to beneficiaries. This form is required by the Department of the Treasury Internal Revenue Service and is essential for ensuring that the trust complies with tax obligations. It specifically addresses the accumulation and distribution of income, allowing trusts to allocate income to beneficiaries in a tax-efficient manner. This form is particularly relevant for trusts that have income that is accumulated rather than distributed, as it helps in calculating the tax implications for both the trust and the beneficiaries.

Steps to Complete the Schedule J Form 1041

Completing the Schedule J Form 1041 involves several key steps:

- Gather Required Information: Collect all necessary financial documents related to the trust's income, expenses, and distributions.

- Fill Out the Form: Accurately enter the income and distribution amounts as required. Pay close attention to the specific lines that pertain to accumulated income and distributions to beneficiaries.

- Review for Accuracy: Double-check all entries to ensure that the information is correct and complete. Errors can lead to compliance issues.

- Sign and Date: Ensure that the form is signed and dated by the appropriate trustee or representative before submission.

Legal Use of the Schedule J Form 1041

The Schedule J Form 1041 is legally binding and must be used in accordance with IRS regulations. It is important for trustees to understand the legal implications of the information reported on this form. Failure to accurately report distributions can result in penalties or additional tax liabilities for both the trust and its beneficiaries. Compliance with the IRS guidelines ensures that the trust operates within the legal framework, protecting the interests of both the trust and its beneficiaries.

Obtaining the Schedule J Form 1041

The Schedule J Form 1041 can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is advisable to use the most current version of the form to ensure compliance with any updates or changes in tax law. Additionally, tax professionals can provide assistance in obtaining and completing the form correctly.

Filing Deadlines for the Schedule J Form 1041

Timely filing of the Schedule J Form 1041 is essential to avoid penalties. The form is typically due on the same date as the trust's income tax return, which is usually the fifteenth day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year basis, this means the form is due by April fifteenth. If additional time is needed, trustees may file for an extension, but it is crucial to ensure that any taxes owed are paid by the original due date to avoid interest and penalties.

Examples of Using the Schedule J Form 1041

Trustees often utilize the Schedule J Form 1041 in various scenarios, such as:

- When a trust accumulates income rather than distributing it to beneficiaries, allowing for tax planning strategies.

- In cases where beneficiaries receive distributions that are subject to different tax rates, thus necessitating careful reporting.

- To ensure compliance with IRS regulations when making distributions that may affect the trust's overall tax liability.

Quick guide on how to complete schedule j form 1041

Easily Prepare schedule j form 1041 on Any Device

The management of online documents has gained signNow traction among organizations and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to quickly create, edit, and electronically sign your documents without any hold-ups. Manage schedule j form 1041 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric task today.

The Easiest Way to Edit and Electronically Sign schedule j form 1041

- Find schedule j form 1041 and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Mark important sections or redact sensitive details using the specialized tools provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious searches for forms, and mistakes that force you to print new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and electronically sign schedule j form 1041 while ensuring outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to schedule j form 1041

Create this form in 5 minutes!

How to create an eSignature for the schedule j form 1041

The way to make an e-signature for a PDF document online

The way to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an e-signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask schedule j form 1041

-

What is the Schedule J Form 1041?

The Schedule J Form 1041 is a tax form used to make adjustments to the income distribution of estates and trusts. It allows you to allocate income or deductions among beneficiaries. Understanding how to correctly fill out the Schedule J Form 1041 can simplify your tax reporting process.

-

How can airSlate SignNow help with the Schedule J Form 1041?

With airSlate SignNow, you can easily send and eSign your Schedule J Form 1041 securely and efficiently. The platform streamlines document management by allowing you to prepare and share forms electronically, ultimately saving you time and ensuring accuracy.

-

Is there a cost associated with using airSlate SignNow for the Schedule J Form 1041?

Yes, airSlate SignNow offers subscription plans that provide various features for eSigning and document management. Pricing is competitive and tailored to meet the needs of businesses looking to efficiently handle forms like the Schedule J Form 1041.

-

What features does airSlate SignNow offer for managing the Schedule J Form 1041?

airSlate SignNow includes features such as templates for common forms, secure eSignature capabilities, and automated reminders to help you manage the Schedule J Form 1041 effectively. These features facilitate a smoother workflow for tax-related documentation.

-

Can I integrate airSlate SignNow with other tools for the Schedule J Form 1041?

Absolutely! airSlate SignNow easily integrates with various software solutions, enhancing your ability to manage the Schedule J Form 1041. This ensures a seamless workflow, allowing you to sync data and documents with other applications you already use.

-

What benefits does airSlate SignNow provide for filing the Schedule J Form 1041?

Utilizing airSlate SignNow for filing the Schedule J Form 1041 allows for improved accuracy, faster processing times, and increased security for your sensitive tax documents. The intuitive interface makes it user-friendly even for those unfamiliar with tax forms.

-

How secure is my information when using airSlate SignNow for the Schedule J Form 1041?

Security is a priority at airSlate SignNow. When managing your Schedule J Form 1041, your data is protected through encryption and secure storage. This ensures that all sensitive information remains confidential and safeguarded against unauthorized access.

Get more for schedule j form 1041

Find out other schedule j form 1041

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself