Application 2016-2026

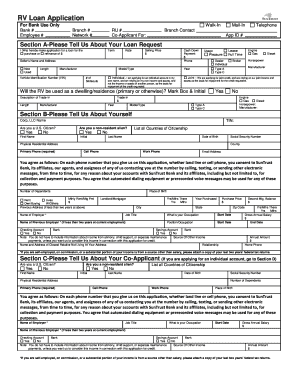

What is the RV Loan Application?

The RV loan application is a formal document used by individuals seeking financing to purchase a recreational vehicle. This application collects essential information about the borrower, including personal details, financial status, and the specifics of the RV being financed. Lenders use this information to assess creditworthiness and determine loan eligibility. The application may require details such as income, employment history, and existing debts, which help in calculating the borrower's ability to repay the loan.

Steps to Complete the RV Loan Application

Completing the RV loan application involves several key steps to ensure accuracy and completeness:

- Gather necessary documents: Collect financial documents such as pay stubs, tax returns, and bank statements.

- Fill out personal information: Provide your name, address, Social Security number, and contact details.

- Detail your financial situation: Include information about your income, employment, and any existing loans or debts.

- Specify the RV details: Describe the vehicle, including make, model, year, and purchase price.

- Review and submit: Double-check all entries for accuracy before submitting the application online or in person.

Legal Use of the RV Loan Application

Using the RV loan application legally requires adherence to federal and state regulations governing lending practices. The application must comply with the Truth in Lending Act, which mandates clear disclosure of loan terms, interest rates, and fees. Additionally, lenders must ensure that the application process does not discriminate against any applicant based on race, gender, or other protected characteristics. Understanding these legal frameworks helps protect both borrowers and lenders during the financing process.

Required Documents for the RV Loan Application

When applying for an RV loan, specific documents are typically required to verify the information provided in the application. Commonly requested documents include:

- Proof of identity: A government-issued ID such as a driver's license or passport.

- Income verification: Recent pay stubs, tax returns, or bank statements to confirm income levels.

- Credit history: Lenders may request permission to access your credit report to assess creditworthiness.

- RV purchase agreement: A copy of the purchase agreement or invoice for the RV you intend to buy.

Application Process & Approval Time

The RV loan application process typically involves several stages, from submission to approval. After submitting the application, lenders review the information and may conduct a credit check. The approval time can vary based on the lender and the complexity of the application, but it generally takes anywhere from one to five business days. Factors influencing approval time include the completeness of the application, the lender's workload, and the need for additional documentation or clarification.

Eligibility Criteria for RV Loans

Eligibility for an RV loan often depends on several factors that lenders consider when evaluating an application. Common criteria include:

- Credit score: A higher credit score typically increases the chances of loan approval and favorable interest rates.

- Debt-to-income ratio: Lenders assess your monthly debt payments compared to your income to ensure you can afford the loan.

- Employment history: A stable employment record can enhance your application, indicating reliable income.

- Down payment: A larger down payment may improve your chances of approval and reduce the loan amount needed.

Examples of Using the RV Loan Application

Understanding how the RV loan application is used can provide clarity for potential borrowers. For instance, an individual looking to purchase a new travel trailer may complete the application to secure financing, detailing their financial background and the specifics of the trailer. Similarly, a family interested in upgrading to a larger motorhome would use the application to assess their financing options based on their income and credit history. Each scenario illustrates the application’s role in facilitating the purchase of recreational vehicles.

Quick guide on how to complete rv loan application forms 2016 2019

The optimal method to obtain and authorize Application

On the scale of a whole organization, ineffective procedures related to paper authorization can consume a signNow amount of work time. Executing documents such as Application is a routine aspect of operations in any enterprise, which is why the effectiveness of each agreement's lifecycle signNowly impacts the overall performance of the company. With airSlate SignNow, authorizing your Application can be as straightforward and rapid as possible. This platform provides you with the latest version of nearly any form. Even better, you can authorize it instantly without needing to install any external software or print hard copies.

Steps to obtain and authorize your Application

- Browse our library by category or utilize the search function to find the necessary form.

- Check the form preview by clicking on Learn more to confirm it is the correct one.

- Click Get form to start editing immediately.

- Fill out your form and input any required details using the toolbar.

- Once finished, click the Sign tool to authorize your Application.

- Choose the signature method that works best for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finish editing and proceed to document-sharing options as necessary.

With airSlate SignNow, you possess everything required to handle your documents efficiently. You can find, complete, edit, and even send your Application all within a single tab without complications. Enhance your processes with a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct rv loan application forms 2016 2019

FAQs

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

How can I fill out the BITSAT Application Form 2019?

BITSAT 2019 Application Forms are available online. Students who are eligible for the admission test can apply online before 20 March 2018, 5 pm.Click here to apply for BITSAT 2019Step 1: Follow the link given aboveStep 2: Fill online application formPersonal Details12th Examination DetailsTest Centre PreferencesStep 3: Upload scanned photograph (4 kb to 50 kb) and signature ( 1 kb to 30 kb).Step 4: Pay application fee either through online payment mode or through e-challan (ICICI Bank)BITSAT-2019 Application FeeMale Candidates - Rs. 3150/-Female Candidates - Rs. 2650/-Thanks!

-

How can I fill out the COMEDK 2019 application form?

COMEDK 2019 application is fully online based and there is no need to send the application by post or by any other method. Check the below-mentioned guidelines to register for the COMEDK 2019 exam:Step 1 Visit the official website of the COMEDK UGET- comedk.orgStep 2 Click on “Engineering Application”.Step 3 After that click on “Login or Register” button.Step 4 You will be asked to enter the Application SEQ Number/User ID and Password. But since you have not registered. You need to click on the “Click here for Registration”.Step 5 Fill in the required details like “Full Name”, “DOB”, “Unique Photo ID Proof”, “Photo ID Proof Number”, “Email ID” and “Mobile Number”.Step 6 Then click on the “Generate OTP”Step 7 After that you need to enter the captcha code and then an OTP will be sent to the mobile number that you have provided.Step 8 A new window having your previously entered registration details will open where you need to enter the OTP.Step 9 Re-check all the details, enter the captcha code and click on the “Register” button.Step 10 After that a page will appear where you will be having the User ID and all the details that you entered. Also, you will be notified that you have successfully registered yourself and a User ID and Password will be sent to your mobile number and email ID.COMEDK 2019 Notification | Steps To Apply For COMEDK UGET ExamCheck the below-mentioned guidelines to fill COMEDK Application Form after COMEDK Login.Step 1 Using your User ID and Password. Log in using the User ID and passwordStep 2 You will be shown that your application form is incomplete. So you need to go to the topmost right corner and click on the “Go to application” tab.Step 3 Go to the COMEDK official website and login with these credentials.Step 4 After that click on “Go to application form”.Step 5 Select your preferred stream and course.Step 6 Click on “Save and Continue”.Step 7 Carefully enter your Personal, Category and Academic details.Step 8 Upload your Photograph and Signature, Parents Signature, your ID Proof, and Declaration.Step 9 Enter your “Payment Mode” and “Amount”.Step 10 Enter “Security code”.Step 11 Tick the “I Agree” checkbox.Step 12 Click on the “Submit” button.

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

How can I fill out the application form for the JMI (Jamia Millia Islamia) 2019?

Form for jamia school have been releaseYou can fill it from jamia siteJamia Millia Islamia And for collegeMost probably the form will out end of this month or next monthBut visit the jamia site regularly.Jamia Millia Islamiacheck whether the form is out or not for the course you want to apply.when notification is out then you have to create the account for entrance and for 2 entrance same account will be used you have to check in the account that the course you want to apply is there in listed or not ….if not then you have to create the different account for that course .If you have any doubts you can freely ask me .

-

How do I fill out the JEE Main 2019 exam application form?

Steps to fill out the JEE Mains 2019 application form?How to Fill JEE Main 2019 Application FormJEE Main 2019 Registration Process to be followed on the NTA Website:Step 1: Visit the website of NTA or CLick here.Step 2: Click on NTA exams or on Joint Entrance Examination under the Engineering Section given on the same page.Step 3: You will see the registration button as shown in the image below. Read all the eligibility criteria and click on “Registration”Step 4: Candidates will be redirected to the JEE Main 2019 official website where they have to click on “Fill Application Form”.Step 5: Now, Click on “Apply for JEE Main 2019”. Read all instructions carefully and proceed to apply online by clicking on the button given at the end of the page.Step 6: Fill in all the details as asked. Submit the authentication form with correct details.Step 7: Upload the scanned images in correct specification given on the instructions page.Step 8: Pay the Application fee and take a print out of the filled up application form.Aadhar Card Required for JEE Main 2019 RegistrationFor the last two years, Aadhar card was made mandatory for each candidate to possess for the application form filling of JEE Main. However, since JEE Main 2019 is now to be conducted by NTA, they have asked the candidates to enter their Aadhar card number. The Aadhar card number is necessary for JEE Main 2019 Application form and candidates must be ready with their Aadhar card number to enter it in the application form.JEE main 2019 Application Form will be available twice, once in the month of September for the January 2019 exam and again in the month of February for the April exam. Thus, first, the candidates have to fill out the application form of January 2019 examination in the month of September 2018.

Create this form in 5 minutes!

How to create an eSignature for the rv loan application forms 2016 2019

How to create an eSignature for your Rv Loan Application Forms 2016 2019 online

How to make an electronic signature for your Rv Loan Application Forms 2016 2019 in Google Chrome

How to create an eSignature for putting it on the Rv Loan Application Forms 2016 2019 in Gmail

How to create an electronic signature for the Rv Loan Application Forms 2016 2019 straight from your mobile device

How to generate an electronic signature for the Rv Loan Application Forms 2016 2019 on iOS devices

How to create an eSignature for the Rv Loan Application Forms 2016 2019 on Android

People also ask

-

What is an rv loan and how does it work?

An rv loan is a type of financing specifically designed for purchasing recreational vehicles. These loans allow you to spread the cost of your RV over a set period, making it more affordable. Typically, you can secure an rv loan through banks, credit unions, or specialized lenders, and you'll need to decide the loan term and monthly payment that works for your budget.

-

What factors affect rv loan interest rates?

RV loan interest rates can be influenced by several factors, including your credit score, loan term, and the age of the RV. Generally, higher credit scores can earn you lower rates, while longer loan terms may lead to higher overall costs. It's crucial to shop around and compare offers to find the best rv loan rates available.

-

What are the typical terms for an rv loan?

The terms for an rv loan usually range from 5 to 20 years, depending on the lender and the price of the vehicle. Shorter terms generally mean higher monthly payments but lower overall interest paid, while longer terms can help keep payments manageable but may increase the total interest expense over time. Always review the terms carefully to find the best fit for your financial situation.

-

Can I get pre-approved for an rv loan?

Yes, many lenders offer pre-approval for RV loans, which gives you an estimate of how much you can borrow and at what interest rate. Being pre-approved can help you budget more effectively when shopping for an RV. It also signals to dealers that you are a serious buyer, helping streamline the purchasing process.

-

What is the minimum down payment for an rv loan?

The minimum down payment for an rv loan typically ranges from 10% to 20% of the vehicle's purchase price. Some lenders may require more for newer or more expensive RVs, while other promotions may allow for lower down payments. Paying a larger down payment can reduce your monthly payments and the overall interest you'll pay.

-

Are there any special benefits for veterans applying for an rv loan?

Yes, veterans may qualify for special rv loan programs that offer lower interest rates and more favorable terms. VA loans can sometimes cover the purchase of RVs, making it easier for veterans to finance their dream vehicle. It's advisable to check with VA-approved lenders for specific benefits available to veterans.

-

How can I improve my chances of getting approved for an rv loan?

To improve your chances of getting approved for an rv loan, ensure your credit report is clean and your score is as high as possible. Paying down existing debts and avoiding large purchases before applying can also help. Additionally, providing a stable income source and a reasonable down payment can make you a more attractive candidate to lenders.

Get more for Application

- Replacement duplicate title form

- Form 8916

- T2sch125 form

- Mri ct ultrasound x ray touchstone medical imaging form

- Kern county ach vendorpayee payment enrollment form

- Instructions for form 1120 f instructions for form 1120 f u s income tax return of a foreign corporation

- Work schedule agreement template 787748732 form

- Commercial contract template form

Find out other Application

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later