Form 1041 Schedule J Accumulation Distribution for Certain Complex Trusts Irs

What is the Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts IRS

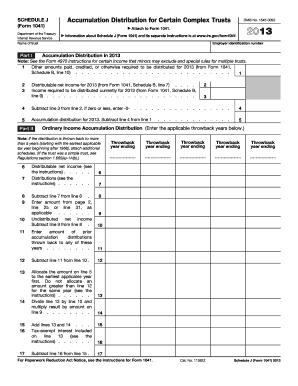

The Form 1041 Schedule J is specifically designed for certain complex trusts to report accumulation distributions. This form allows trustees to indicate the amounts that are distributed to beneficiaries from the trust's income, which may have been accumulated in previous years. Understanding this form is crucial for ensuring compliance with IRS regulations and for proper tax reporting. It helps in determining the taxable income of beneficiaries and the tax obligations of the trust itself.

Steps to Complete the Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts IRS

Completing the Form 1041 Schedule J involves several important steps:

- Gather all relevant financial records related to the trust's income and distributions.

- Fill out the trust's basic information, including its name, address, and Employer Identification Number (EIN).

- Report the total income of the trust for the tax year, including any accumulated income from prior years.

- Detail the distributions made to beneficiaries, specifying the amounts and the corresponding beneficiaries.

- Calculate the taxable income for the beneficiaries based on the distributions reported.

- Review the completed form for accuracy before submission.

Legal Use of the Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts IRS

The legal use of Form 1041 Schedule J is essential for trustees managing complex trusts. This form ensures that the trust complies with federal tax laws regarding distributions. Properly completing and filing the form helps prevent legal issues related to tax liabilities for both the trust and its beneficiaries. It is advisable for trustees to consult with tax professionals to ensure all legal requirements are met.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1041 Schedule J. These guidelines outline the eligibility criteria for using the form, the necessary information to include, and the deadlines for submission. Following these guidelines is vital to avoid penalties and ensure that the trust's tax obligations are met accurately. Trustees should familiarize themselves with the IRS instructions to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 Schedule J are critical for compliance. Generally, the form must be filed by the 15th day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year basis, this typically means an April 15 deadline. It is important for trustees to mark these dates on their calendars to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

Trustees have several options for submitting the Form 1041 Schedule J. The form can be filed electronically using IRS-approved e-filing software, which is often the most efficient method. Alternatively, trustees can mail a paper copy of the form to the appropriate IRS address. In-person submissions are generally not available for this form. It is important to choose the method that best fits the trust's needs while ensuring timely submission.

Quick guide on how to complete 2013 form 1041 schedule j accumulation distribution for certain complex trusts irs

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed forms, allowing you to access the appropriate documents and securely store them online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and efficiently. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The simplest method to edit and electronically sign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Mark important sections of your documents or hide sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your updates.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or the need to print new copies due to errors. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 1041 schedule j accumulation distribution for certain complex trusts irs

The way to make an e-signature for your PDF in the online mode

The way to make an e-signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs?

Form 1041 Schedule J is a crucial tax document used by complex trusts to report income distributions that are accumulated. Specifically, it calculates the amount that can be distributed to beneficiaries while complying with IRS regulations. Understanding this form is essential for trustees to ensure proper tax reporting.

-

How can airSlate SignNow help with Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs?

airSlate SignNow offers an intuitive platform that allows you to easily prepare, send, and sign Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs. Our electronic signature solution streamlines the process, making it efficient and compliant with IRS regulations. This ensures that your trust’s documentation is handled accurately and timely.

-

What features does airSlate SignNow provide for managing Form 1041 Schedule J?

With airSlate SignNow, you get features such as customizable templates, secure storage, and team collaboration tools that simplify the management of Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs. Additionally, automated reminders and notifications help keep track of deadlines for filing and distribution, ensuring you never miss an important date.

-

Is airSlate SignNow cost-effective for businesses handling complex trusts?

Absolutely! airSlate SignNow offers competitive pricing plans designed for businesses of all sizes, making it an affordable choice for managing Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs. The value you get from our features far outweighs traditional methods of document management, saving you time and resources.

-

Can airSlate SignNow integrate with my existing accounting software for tax preparation?

Yes, airSlate SignNow is designed to integrate seamlessly with popular accounting and tax preparation software. This integration allows for a smooth workflow when managing Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs, ensuring that your data is consistent and easily accessible across platforms.

-

What are the benefits of eSigning Form 1041 Schedule J with airSlate SignNow?

Using airSlate SignNow for eSigning Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs offers streamlined processes and improved compliance. eSigning is legally binding, enhances security with encrypted documents, and speeds up the approval process, allowing you to focus on other important tasks.

-

How secure is my data when using airSlate SignNow for tax documents?

airSlate SignNow prioritizes the security of your data with state-of-the-art encryption and compliance with industry-standard security protocols. When managing Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs, you can trust that your sensitive information is protected from unauthorized access.

Get more for Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs

- Cms 10126 form

- Gloucester salem board realtors standard form

- Nc power of attorney form

- Order for series ee us savings bonds form

- Bir 1901 form download

- Form 18 a

- Bir form 1702qpdffillercom

- Vendor registration form contact information name use this form if you are purchasing vending space for the sale of automotive

Find out other Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now