Form 1099 CAP Irs

What is the Form 1099 CAP IRS

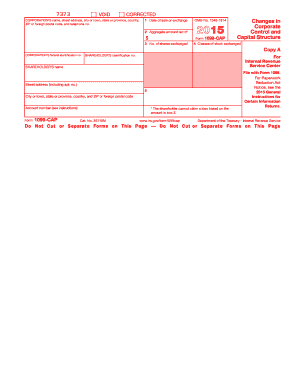

The Form 1099 CAP IRS is a tax form used to report certain types of income that are not subject to withholding. This form is primarily utilized by corporations and other entities to report contributions to capital or stock transactions. It provides the Internal Revenue Service (IRS) with essential information regarding the financial activities of businesses and helps ensure compliance with tax regulations. Understanding the purpose and requirements of this form is crucial for accurate tax reporting.

How to use the Form 1099 CAP IRS

Using the Form 1099 CAP IRS involves several key steps. First, ensure you have the correct version of the form, which can be obtained from the IRS website or through authorized providers. Next, gather all necessary information, including the recipient's name, address, and taxpayer identification number (TIN). After completing the form, it must be submitted to the IRS and a copy sent to the recipient. It's essential to follow IRS guidelines to ensure proper filing and avoid penalties.

Steps to complete the Form 1099 CAP IRS

Completing the Form 1099 CAP IRS requires careful attention to detail. Here are the steps to follow:

- Obtain the correct form from the IRS or authorized sources.

- Fill in the payer's information, including name, address, and TIN.

- Enter the recipient's information accurately, ensuring the TIN is correct.

- Report the amount of capital contributions or stock transactions in the appropriate box.

- Review the form for accuracy before submission.

Once completed, submit the form to the IRS by the specified deadline and provide a copy to the recipient.

Legal use of the Form 1099 CAP IRS

The legal use of the Form 1099 CAP IRS is governed by IRS regulations. It is essential to ensure that the information reported is accurate and complete to avoid issues with compliance. Filing this form correctly helps maintain transparency in financial reporting and ensures that all parties adhere to tax obligations. Businesses must retain copies of the filed forms for their records in case of audits or inquiries from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 CAP IRS are critical to avoid penalties. Typically, the form must be submitted to the IRS by the end of February if filed on paper, or by the end of March if filed electronically. Recipients should receive their copies by January 31. It is advisable to check the IRS website for any updates or changes to these deadlines each tax year.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Form 1099 CAP IRS can result in significant penalties. The IRS imposes fines for late submissions, incorrect information, or failure to file altogether. These penalties can accumulate quickly, making it essential for businesses to ensure timely and accurate filing. Understanding the consequences of non-compliance can help motivate proper adherence to tax regulations.

Quick guide on how to complete form 1099 cap irs

Effortlessly Prepare Form 1099 CAP Irs on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers a superb eco-friendly alternative to conventional printed and signed paperwork, as you can easily find the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Handle Form 1099 CAP Irs on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form 1099 CAP Irs with ease

- Find Form 1099 CAP Irs and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to send your form — via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form 1099 CAP Irs, ensuring clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1099 cap irs

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an e-signature from your smartphone

How to create an e-signature for a PDF file on iOS devices

How to create an e-signature for a PDF file on Android

People also ask

-

What is Form 1099 CAP Irs?

Form 1099 CAP Irs is a tax form used by the Internal Revenue Service to report payments made to contractors and freelancers. It is important for businesses to correctly file this form to ensure compliance with tax regulations and avoid penalties.

-

How can airSlate SignNow help with Form 1099 CAP Irs?

airSlate SignNow offers a user-friendly solution for electronically signing and sending Form 1099 CAP Irs. This streamlines the process, making it easy to manage and send tax documents securely.

-

What are the pricing options for using airSlate SignNow for Form 1099 CAP Irs?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes. You can choose between monthly and annual subscriptions, ensuring you only pay for the features you need when processing Form 1099 CAP Irs.

-

Are there any integrations available for airSlate SignNow when handling Form 1099 CAP Irs?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software systems. This integration allows users to efficiently manage and send Form 1099 CAP Irs without disrupting their existing workflows.

-

What features does airSlate SignNow offer for managing Form 1099 CAP Irs?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure storage. These tools simplify the process of creating and delivering Form 1099 CAP Irs, enhancing overall efficiency.

-

Is airSlate SignNow safe for sending sensitive documents like Form 1099 CAP Irs?

Absolutely, airSlate SignNow prioritizes security and utilizes encryption to protect sensitive documents like Form 1099 CAP Irs. This ensures that your information remains confidential and secure throughout the signing process.

-

Can airSlate SignNow users track the status of their Form 1099 CAP Irs?

Yes, airSlate SignNow provides tracking features that allow users to monitor the status of sent Form 1099 CAP Irs. This helps ensure that documents are received and signed in a timely manner.

Get more for Form 1099 CAP Irs

- Mississippi covenants form

- Petition sell real estate form

- Petition for approval and authority to sell real property mississippi form

- Order approving contract for the sale and purchase of real estate and authority to sell real property mississippi form

- Mississippi tax sales form

- Void tax form

- Tax sale mississippi form

- Complaint to vacate and or alter a recorded plat and for other relief mississippi form

Find out other Form 1099 CAP Irs

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF