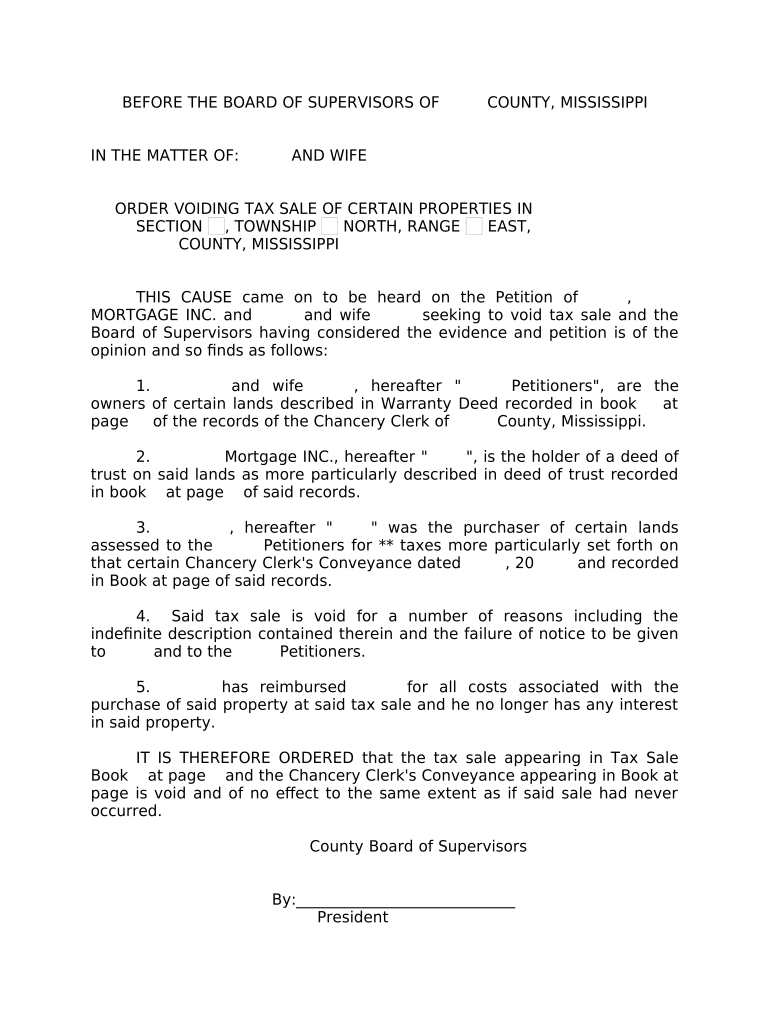

Tax Sale Mississippi Form

What is the Tax Sale Mississippi

The tax sale in Mississippi refers to the process through which local governments sell properties to recover unpaid property taxes. When property owners fail to pay their taxes, the county or municipality can initiate a tax sale to reclaim the owed amounts. This process typically involves public auctions where interested buyers can bid on tax sale properties. The winning bidder receives a tax lien certificate, which may lead to ownership of the property if the original owner does not settle their tax debt within a specified redemption period.

Steps to complete the Tax Sale Mississippi

Completing the tax sale process in Mississippi involves several key steps:

- Research available tax sale properties by checking local government websites or tax assessor offices.

- Review the terms and conditions of the tax sale, including any redemption periods and fees.

- Register for the auction, ensuring you meet any eligibility requirements.

- Participate in the auction, placing bids on properties of interest.

- If successful, pay the winning bid amount and obtain the tax lien certificate.

Legal use of the Tax Sale Mississippi

The legal framework governing tax sales in Mississippi is established by state law. This includes compliance with regulations that dictate how tax sales must be conducted, notification requirements for property owners, and the rights of bidders. Understanding these legal aspects is crucial for ensuring that the tax sale process is conducted fairly and transparently. Additionally, all documentation related to the tax sale must adhere to the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA) to be considered legally binding.

Key elements of the Tax Sale Mississippi

Several key elements define the tax sale process in Mississippi:

- Redemption Period: Property owners typically have a specified period to redeem their property after a tax sale, during which they can pay the owed taxes plus interest.

- Bid Process: Auctions are usually conducted in person or online, with properties sold to the highest bidder.

- Tax Lien Certificate: Winning bidders receive a certificate that grants them a lien on the property, which can lead to ownership if the original owner fails to redeem.

- Notification Requirements: Local governments must notify property owners of impending tax sales, ensuring transparency in the process.

Who Issues the Form

The tax sale form in Mississippi is typically issued by the local tax collector's office or the county treasurer. These offices are responsible for managing property tax collections and conducting tax sales. It is important for potential bidders to obtain the correct forms and ensure they are completed accurately to avoid any issues during the bidding process.

Required Documents

To participate in a tax sale in Mississippi, bidders may need to provide several documents, including:

- A valid government-issued identification to verify identity.

- Proof of funds or a deposit to demonstrate financial capability to bid.

- Completed registration forms as required by the local tax authority.

Quick guide on how to complete tax sale mississippi

Accomplish Tax Sale Mississippi effortlessly across any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can obtain the required form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Tax Sale Mississippi on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

How to modify and electronically sign Tax Sale Mississippi with ease

- Find Tax Sale Mississippi and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Underline pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your adjustments.

- Select how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Tax Sale Mississippi and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a tax sale, and how can airSlate SignNow assist with it?

A tax sale is a process where properties are sold to recover unpaid property taxes. airSlate SignNow simplifies the documentation involved in tax sales by providing a secure platform for sending and eSigning essential documents. This not only speeds up the process but also ensures compliance with legal requirements.

-

How does pricing work for airSlate SignNow when handling tax sale documents?

airSlate SignNow offers competitive pricing plans tailored to various business needs, including those involved in tax sales. You can choose from different subscription tiers, each providing features that streamline document management, eSigning, and tracking, making it a cost-effective choice for handling tax sale transactions.

-

What features does airSlate SignNow provide for managing tax sale documentation?

airSlate SignNow offers features such as customizable templates, bulk sending, and real-time tracking, all of which are crucial for managing tax sale documents efficiently. These tools allow you to prepare, distribute, and store your tax sale-related documents securely, ensuring a smooth workflow.

-

Can airSlate SignNow help with compliance during tax sales?

Yes, airSlate SignNow is designed to help businesses maintain compliance during tax sales by providing legally binding eSignatures and audit trails. This ensures that all transactions are recorded accurately, meeting the necessary legal standards for tax sales.

-

What are the benefits of using airSlate SignNow for tax sales?

Using airSlate SignNow for tax sales enhances efficiency, saves time, and reduces paperwork. By leveraging its intuitive interface and robust features, businesses can ensure that tax sale documents are processed quickly and securely, leading to a more streamlined operation.

-

Does airSlate SignNow integrate with other tools for tax sale management?

Absolutely! airSlate SignNow integrates seamlessly with various applications commonly used in tax sale management, such as CRM and accounting software. This integration boosts productivity by allowing you to manage tax sale documents alongside your existing tools.

-

Is airSlate SignNow secure for handling sensitive tax sale information?

Yes, airSlate SignNow prioritizes security and complies with industry standards to protect sensitive information during tax sales. It utilizes advanced encryption and robust security protocols, ensuring that your documentation and data remain safe throughout the eSigning process.

Get more for Tax Sale Mississippi

- Nyseg bulletin 86 01 form

- Brainstorming bubble chart form

- Ch 100 request for civil harassment restraining orders judicial council forms courtinfo ca

- 1 866 4 uswage www wagehour dol gov united states dol form

- Indoor volleyball team roster and waiver form

- Joyce hudman texas state directory online form

- Travis county water control ampamp improvement district 173812 eck lane form

- Public access option form city of dallas city secretary s office

Find out other Tax Sale Mississippi

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation