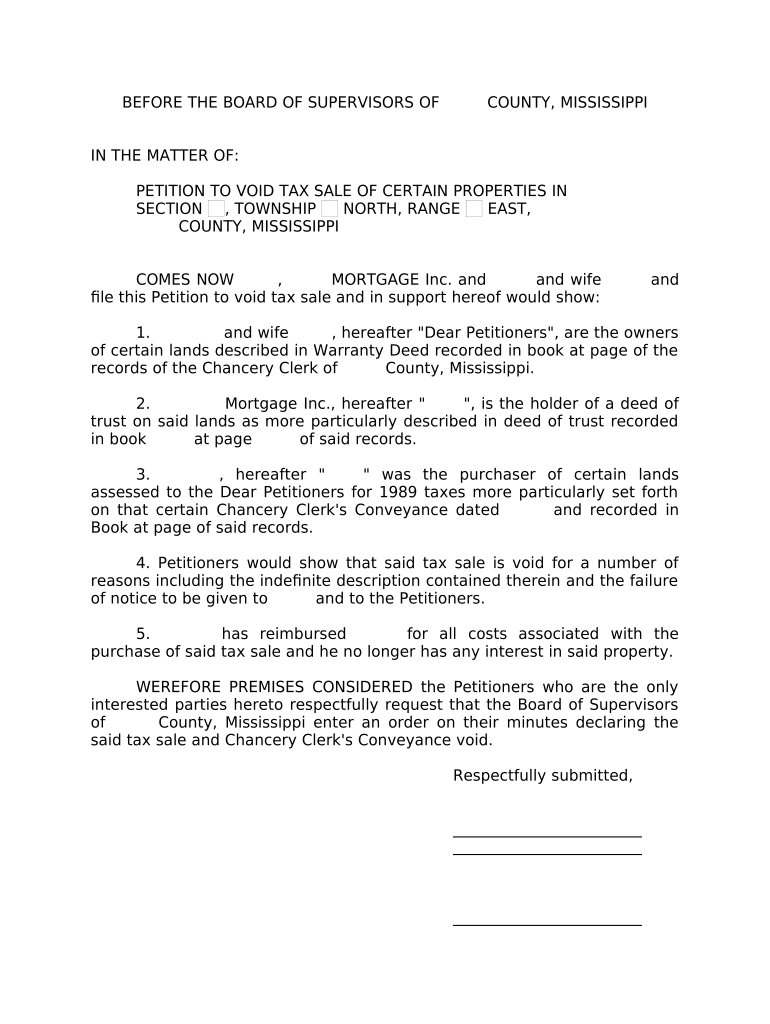

Void Tax Form

What is the Void Tax?

The Void Tax refers to a specific tax form that allows taxpayers to nullify a previously submitted tax return. This form is essential for correcting errors or omissions that may have occurred in the original filing. By submitting the Void Tax, individuals can ensure that their tax records accurately reflect their financial situation, which is crucial for compliance with state and federal tax regulations.

How to Use the Void Tax

Using the Void Tax involves a straightforward process. Taxpayers must first identify the specific tax return they wish to void. Once identified, they should complete the Void Tax form, ensuring that all required information is accurately filled out. After completing the form, it should be submitted to the appropriate tax authority, either online or through traditional mail, depending on the guidelines provided by the state.

Steps to Complete the Void Tax

Completing the Void Tax requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents related to the original tax return.

- Obtain the Void Tax form from the relevant tax authority's website or office.

- Fill out the form, ensuring all information matches the original filing.

- Review the form for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal Use of the Void Tax

The legal use of the Void Tax is governed by specific regulations that vary by state. It is important for taxpayers to understand these regulations to ensure compliance. The Void Tax must be submitted within a designated timeframe following the original filing to be considered valid. Additionally, it is crucial to keep records of the submission for future reference in case of audits or inquiries.

Required Documents

When filing the Void Tax, certain documents are typically required to support the request. These may include:

- A copy of the original tax return that is being voided.

- Any supporting documentation that substantiates the need for the void.

- Identification information, such as Social Security numbers or taxpayer identification numbers.

Filing Deadlines / Important Dates

Filing deadlines for the Void Tax can vary by state and the specific tax year in question. It is essential for taxpayers to be aware of these deadlines to avoid penalties. Generally, the Void Tax must be filed within a certain period after the original return was submitted, often within one year. Checking with the state tax authority for specific dates is advisable.

Penalties for Non-Compliance

Failing to properly file the Void Tax can result in penalties. Taxpayers may face fines or interest on any unpaid taxes associated with the original return. Additionally, not addressing errors in a timely manner can lead to complications during audits or future filings. Understanding the potential consequences of non-compliance is critical for maintaining good standing with tax authorities.

Quick guide on how to complete void tax

Complete Void Tax effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to generate, modify, and electronically sign your documents swiftly without complications. Manage Void Tax on any device using airSlate SignNow Android or iOS applications and streamline any document-centric task today.

How to modify and electronically sign Void Tax with ease

- Find Void Tax and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you want to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Void Tax and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Mississippi tax properties?

Mississippi tax properties refer to real estate properties that have delinquent taxes. These properties can be acquired through tax lien auctions or tax deed sales, making them an attractive option for investors looking to purchase property at a lower cost.

-

How can airSlate SignNow help with Mississippi tax properties?

airSlate SignNow streamlines the documentation process for transactions involving Mississippi tax properties. With our eSigning solution, you can easily obtain signatures on important documents quickly and securely, ensuring that your transactions are smooth and efficient.

-

What features does airSlate SignNow offer for managing Mississippi tax properties?

Our platform provides a wide range of features ideal for managing Mississippi tax properties, including customizable templates, automated workflows, and secure storage. These features help you handle all necessary paperwork without hassle while ensuring legal compliance.

-

Is airSlate SignNow cost-effective for businesses dealing with Mississippi tax properties?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses handling Mississippi tax properties. Our competitive pricing structure allows you to save money while benefiting from robust features that enhance efficiency and productivity.

-

Can airSlate SignNow integrate with other tools related to Mississippi tax properties?

Absolutely! airSlate SignNow offers seamless integrations with various CRM and property management systems, making it easy to incorporate our eSigning solution into your existing workflows. This integration helps streamline processes related to Mississippi tax properties management.

-

What are the benefits of using airSlate SignNow for Mississippi tax properties?

Using airSlate SignNow for Mississippi tax properties offers numerous benefits, including faster transaction times, reduced paperwork, and enhanced security for your documents. Our platform ensures that you can manage your properties efficiently while complying with legal requirements.

-

How secure is airSlate SignNow when dealing with Mississippi tax properties?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols and stringent security measures to protect your documents related to Mississippi tax properties. You can trust that your sensitive information remains safe and secure.

Get more for Void Tax

- 580 3286 8 application for good cause waiver form

- Illinois state library budget amendment request form

- Www oid ok govwp contentuploadslicense surrender oklahoma insurance department form

- Contact usunited pentecostal church int upci form

- Fillable online llc license application forms rc l 200b

- Designationchange of beneficiary form

- Www bupa co ukmediabupa cash plan claim form

- Fillable online application form for readmission riba fax

Find out other Void Tax

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile