40ES Alabama Department of Revenue Revenue Alabama 2014

What is the 40ES Alabama Department Of Revenue Revenue Alabama

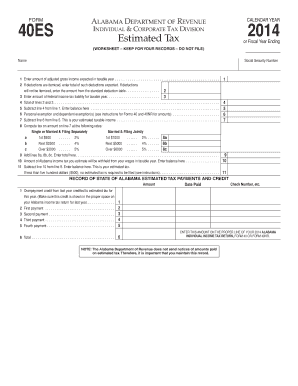

The 40ES form is a specific document issued by the Alabama Department of Revenue, primarily used for tax purposes. It is designed for individuals and businesses to report various types of income and deductions. This form plays a crucial role in ensuring compliance with state tax regulations and helps in the accurate calculation of tax liabilities. Understanding the purpose of the 40ES form is essential for taxpayers in Alabama, as it provides the necessary framework for reporting income accurately and meeting state requirements.

Steps to complete the 40ES Alabama Department Of Revenue Revenue Alabama

Completing the 40ES form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including income statements and deduction records. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to double-check all entries for any errors or omissions. Once completed, review the form to ensure it aligns with your financial records. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on your preference and the guidelines provided by the Alabama Department of Revenue.

Legal use of the 40ES Alabama Department Of Revenue Revenue Alabama

The legal use of the 40ES form is governed by state tax laws and regulations. For the form to be considered valid, it must be completed accurately and submitted within the designated filing deadlines. The information provided on the form must be truthful and supported by relevant documentation. Failure to comply with these legal requirements can result in penalties or audits by the Alabama Department of Revenue. Therefore, understanding the legal implications of the 40ES form is vital for maintaining compliance and avoiding potential legal issues.

Form Submission Methods (Online / Mail / In-Person)

Submitting the 40ES form can be done through various methods, catering to different preferences and situations. Taxpayers can choose to submit the form online via the Alabama Department of Revenue's official website, which often provides a streamlined process. Alternatively, the form can be mailed to the designated address provided by the department. For those who prefer face-to-face interactions, in-person submission at local revenue offices is also an option. Each method has its own set of guidelines and processing times, so it is important to select the one that best suits your needs.

Filing Deadlines / Important Dates

Filing deadlines for the 40ES form are critical for compliance with state tax laws. Typically, the form must be submitted by a specific date each year, often aligned with the federal tax filing deadline. It is important to stay informed about any changes to these deadlines, as they can vary from year to year. Missing a deadline can result in penalties or interest charges, making it essential for taxpayers to mark these important dates on their calendars and prepare their submissions in advance.

Required Documents

To complete the 40ES form accurately, several documents are required. Taxpayers should gather income statements, such as W-2s or 1099s, to report earnings. Additionally, any documentation related to deductions, such as receipts or invoices, should be collected. Having these documents on hand ensures that the information entered on the form is accurate and complete, which is crucial for compliance and minimizing the risk of audits.

Quick guide on how to complete 40es 2014 alabama department of revenue revenue alabama

Effortlessly Prepare 40ES Alabama Department Of Revenue Revenue Alabama on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle 40ES Alabama Department Of Revenue Revenue Alabama on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and Electronically Sign 40ES Alabama Department Of Revenue Revenue Alabama with Ease

- Locate 40ES Alabama Department Of Revenue Revenue Alabama and click Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign 40ES Alabama Department Of Revenue Revenue Alabama and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 40es 2014 alabama department of revenue revenue alabama

Create this form in 5 minutes!

How to create an eSignature for the 40es 2014 alabama department of revenue revenue alabama

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the 40ES Alabama Department Of Revenue form, and why is it important?

The 40ES Alabama Department Of Revenue form is an estimated tax payment voucher for Alabama residents. It's essential for individuals or businesses that expect to owe more than $500 in state taxes, allowing them to avoid penalties and interest by making timely payments.

-

How does airSlate SignNow streamline the submission of the 40ES Alabama Department Of Revenue?

airSlate SignNow allows users to quickly fill out and eSign the 40ES Alabama Department Of Revenue form digitally. This streamlined process eliminates the hassle of paper forms, reduces errors, and ensures that your submission is filed accurately and on time.

-

What are the pricing options for using airSlate SignNow for the 40ES Alabama Department Of Revenue?

airSlate SignNow offers various pricing plans that cater to different needs, making it a cost-effective solution for managing your 40ES Alabama Department Of Revenue submissions. Users can choose from monthly or annual plans, with options that provide access to advanced features and integrations.

-

Can airSlate SignNow integrate with other financial software for handling 40ES Alabama Department Of Revenue?

Yes, airSlate SignNow integrates seamlessly with various financial software applications, which helps in managing your 40ES Alabama Department Of Revenue documents more efficiently. This connectivity allows users to sync their data and streamline their workflow, enhancing overall productivity.

-

What features does airSlate SignNow provide for managing the 40ES Alabama Department Of Revenue?

airSlate SignNow provides features such as document templates, eSigning, real-time tracking, and secure storage for the 40ES Alabama Department Of Revenue. These features ensure that users can manage their documents efficiently and with high levels of security.

-

What benefits does airSlate SignNow offer for businesses dealing with the 40ES Alabama Department Of Revenue?

Using airSlate SignNow offers numerous benefits, including increased efficiency, reduced paperwork, and timely submissions for the 40ES Alabama Department Of Revenue. This platform empowers businesses to focus on their core activities while ensuring compliance with state tax regulations.

-

How does airSlate SignNow ensure the security of the 40ES Alabama Department Of Revenue documents?

airSlate SignNow employs advanced security measures, including encryption and secure storage, to protect your 40ES Alabama Department Of Revenue documents. This commitment to security helps users maintain confidentiality and protect sensitive information.

Get more for 40ES Alabama Department Of Revenue Revenue Alabama

Find out other 40ES Alabama Department Of Revenue Revenue Alabama

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement