2 First Payment 3 Second Payment 4 Third Payment 2024-2026

Understanding the 2024 Estimated Tax Payments

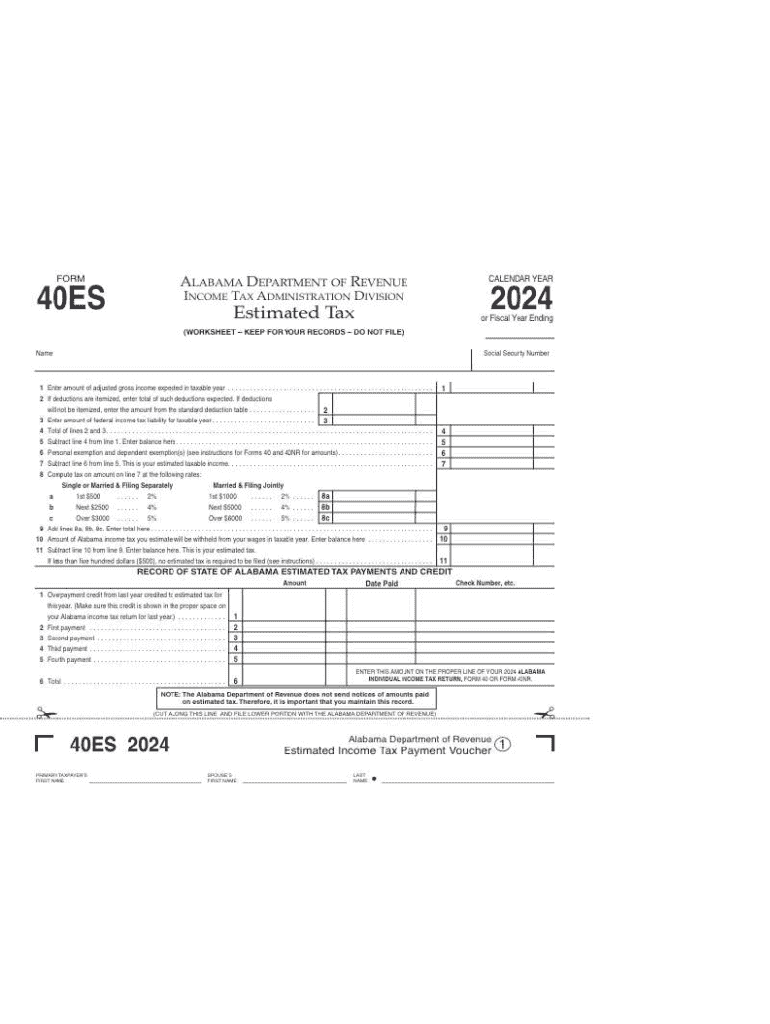

The 2024 estimated tax worksheet is essential for taxpayers who expect to owe tax of one thousand dollars or more when filing their return. This worksheet helps in calculating the estimated tax payments due for the year. Typically, there are four payments required, which are due quarterly. The first payment is due on April 15, 2024, followed by the second payment on June 15, 2024, the third payment on September 15, 2024, and the fourth payment on January 15, 2025.

Steps to Complete the 2024 Estimated Tax Worksheet

Completing the 2024 estimated tax worksheet involves several steps:

- Gather your financial information, including income sources, deductions, and credits.

- Calculate your expected adjusted gross income (AGI) for the year.

- Determine your taxable income by subtracting deductions from your AGI.

- Use the tax tables to estimate your tax liability based on your taxable income.

- Subtract any tax credits you anticipate claiming.

- Divide your estimated tax liability by four to find the amount of each quarterly payment.

Filing Deadlines for Estimated Tax Payments

It is crucial to adhere to the filing deadlines for estimated tax payments to avoid penalties. The deadlines for the 2024 estimated tax payments are:

- First payment: April 15, 2024

- Second payment: June 15, 2024

- Third payment: September 15, 2024

- Fourth payment: January 15, 2025

IRS Guidelines for Estimated Tax Payments

The IRS provides specific guidelines for making estimated tax payments. Taxpayers should refer to IRS Form 1040-ES, which includes instructions and worksheets to assist in calculating estimated taxes. It is important to review these guidelines annually, as tax laws and rates may change.

Required Documents for Estimated Tax Payments

To complete the 2024 estimated tax worksheet, several documents are typically needed:

- Previous year’s tax return for reference

- Income statements, such as W-2s or 1099s

- Documentation of deductions and credits

- Any relevant financial statements

Penalties for Non-Compliance with Estimated Tax Payments

Failing to make estimated tax payments can result in penalties. The IRS may impose a penalty if you owe more than one thousand dollars and do not pay enough tax throughout the year. It is advisable to ensure that your payments are timely and accurate to avoid these penalties.

Digital Submission Methods for Estimated Tax Payments

Taxpayers have various options for submitting their estimated tax payments. Payments can be made online through the IRS website, by mail using the appropriate payment voucher, or in person at designated IRS offices. Using digital methods can streamline the process and provide immediate confirmation of payment.

Quick guide on how to complete 2 first payment 3 second payment 4 third payment

Complete 2 First Payment 3 Second Payment 4 Third Payment effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute to traditional printed and signed forms, as you can access the correct template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Handle 2 First Payment 3 Second Payment 4 Third Payment on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign 2 First Payment 3 Second Payment 4 Third Payment without hassle

- Find 2 First Payment 3 Second Payment 4 Third Payment and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your adjustments.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it directly to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow fulfills all your needs in document management within a few clicks from any device of your choosing. Modify and eSign 2 First Payment 3 Second Payment 4 Third Payment to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2 first payment 3 second payment 4 third payment

Create this form in 5 minutes!

How to create an eSignature for the 2 first payment 3 second payment 4 third payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 estimated tax worksheet and why is it important?

The 2024 estimated tax worksheet is a tool that helps individuals and businesses calculate their expected tax liabilities for the year. It is important because it allows taxpayers to plan their finances and avoid underpayment penalties. By using this worksheet, you can ensure that you are setting aside the correct amount for taxes throughout the year.

-

How can airSlate SignNow help with the 2024 estimated tax worksheet?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning your 2024 estimated tax worksheet. With our user-friendly interface, you can easily fill out the worksheet and share it with your accountant or tax advisor for review. This streamlines the process and ensures that all necessary signatures are obtained quickly.

-

Is there a cost associated with using airSlate SignNow for the 2024 estimated tax worksheet?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, ensuring that you can manage your 2024 estimated tax worksheet without breaking the bank. You can choose a plan that fits your budget and usage requirements.

-

What features does airSlate SignNow offer for managing the 2024 estimated tax worksheet?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing your 2024 estimated tax worksheet. These features enhance efficiency and ensure that your documents are handled securely and professionally. Additionally, you can collaborate with team members in real-time.

-

Can I integrate airSlate SignNow with other software for my 2024 estimated tax worksheet?

Absolutely! airSlate SignNow offers integrations with various accounting and productivity tools, making it easy to incorporate your 2024 estimated tax worksheet into your existing workflow. This allows for seamless data transfer and enhances your overall efficiency when managing tax documents.

-

What benefits does using airSlate SignNow provide for my 2024 estimated tax worksheet?

Using airSlate SignNow for your 2024 estimated tax worksheet offers numerous benefits, including time savings, enhanced security, and improved collaboration. Our platform simplifies the document management process, allowing you to focus on your business while ensuring that your tax documents are accurate and compliant.

-

How secure is airSlate SignNow when handling my 2024 estimated tax worksheet?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your 2024 estimated tax worksheet and other sensitive documents. You can trust that your information is safe and accessible only to authorized users.

Get more for 2 First Payment 3 Second Payment 4 Third Payment

Find out other 2 First Payment 3 Second Payment 4 Third Payment

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself