40ES Revenue Alabama Form

What is the 40ES Revenue Alabama

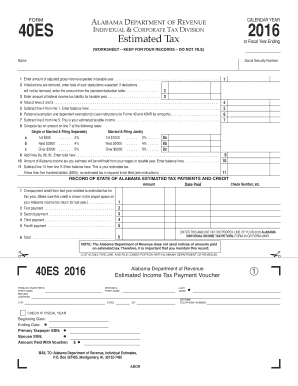

The 40ES Revenue Alabama form is a state-specific tax document used by individuals and businesses to report estimated tax payments to the Alabama Department of Revenue. This form is essential for taxpayers who expect to owe a certain amount in taxes and wish to make payments throughout the year instead of in a lump sum at tax time. By submitting this form, taxpayers can avoid penalties for underpayment and ensure they remain compliant with state tax laws.

How to use the 40ES Revenue Alabama

Using the 40ES Revenue Alabama form involves several steps. Taxpayers must first determine their estimated tax liability for the year. This involves calculating expected income, deductions, and credits. Once the estimated amount is determined, taxpayers can fill out the 40ES form, providing necessary personal and financial information. It is crucial to ensure that all figures are accurate to avoid issues with the Alabama Department of Revenue.

Steps to complete the 40ES Revenue Alabama

Completing the 40ES Revenue Alabama form requires careful attention to detail. The following steps outline the process:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your estimated tax liability based on expected income for the year.

- Fill out the 40ES form, ensuring all required fields are completed accurately.

- Review the form for errors or omissions before submission.

- Submit the completed form to the Alabama Department of Revenue via the preferred method.

Legal use of the 40ES Revenue Alabama

The 40ES Revenue Alabama form is legally binding when completed and submitted according to state regulations. It is essential for taxpayers to understand that submitting this form signifies their agreement with the estimated tax liability reported. Compliance with the Alabama Department of Revenue's guidelines ensures that the form is recognized as valid, protecting taxpayers from potential legal issues related to tax payments.

Filing Deadlines / Important Dates

Timely submission of the 40ES Revenue Alabama form is critical to avoid penalties. The deadlines for filing estimated tax payments typically align with quarterly due dates. Taxpayers should be aware of the following key dates:

- April 15: First estimated payment due

- June 15: Second estimated payment due

- September 15: Third estimated payment due

- January 15 of the following year: Final estimated payment due

Form Submission Methods

The 40ES Revenue Alabama form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the Alabama Department of Revenue's website.

- Mailing a physical copy of the form to the designated address.

- In-person submission at local Alabama Department of Revenue offices.

Quick guide on how to complete 40es 2016 revenue alabama

Complete [SKS] effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign [SKS] without hassle

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or black out sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device of your choice. Edit and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 40ES Revenue Alabama

Create this form in 5 minutes!

How to create an eSignature for the 40es 2016 revenue alabama

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is 40ES Revenue Alabama and how can airSlate SignNow help with it?

40ES Revenue Alabama refers to the specific guidelines set by the state for managing revenue-related documents. AirSlate SignNow can streamline the process by allowing businesses to eSign and send these essential documents efficiently, ensuring compliance with the state regulations.

-

How does airSlate SignNow ensure compliance with 40ES Revenue Alabama?

AirSlate SignNow helps ensure compliance with 40ES Revenue Alabama by providing templates that meet state requirements and by offering robust security features. It keeps documents secure and legally binding, enabling businesses to fulfill their regulatory obligations without hassle.

-

What are the pricing options for airSlate SignNow when managing 40ES Revenue Alabama forms?

AirSlate SignNow offers flexible pricing options, making it accessible for businesses of all sizes managing 40ES Revenue Alabama forms. You can choose plans based on your needs, ensuring you only pay for the features that matter most to your revenue processes.

-

What features does airSlate SignNow provide for eSigning 40ES Revenue Alabama documents?

AirSlate SignNow provides features tailored for 40ES Revenue Alabama documents, including customizable templates, secure eSigning, and automated workflows. This empowers users to manage their documentation effortlessly and eliminates the need for physical signatures.

-

Can airSlate SignNow integrate with other tools for handling 40ES Revenue Alabama?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, enhancing your workflow for 40ES Revenue Alabama. This allows businesses to connect their current systems and manage documents without switching platforms.

-

How does airSlate SignNow benefit businesses dealing with 40ES Revenue Alabama?

AirSlate SignNow benefits businesses dealing with 40ES Revenue Alabama by providing a fast and efficient way to manage required documents. This cost-effective solution minimizes delays and improves productivity, allowing teams to focus on their core operations.

-

Is it easy for users to get started with airSlate SignNow for 40ES Revenue Alabama?

Absolutely! AirSlate SignNow is designed for ease of use, making it simple for users to get started with managing 40ES Revenue Alabama documents. With a user-friendly interface, even those with minimal experience can navigate and utilize its features effectively.

Get more for 40ES Revenue Alabama

Find out other 40ES Revenue Alabama

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF