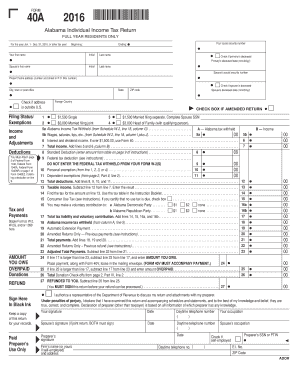

31, , or Other Tax Year Revenue Alabama Form

What is the 31, , Or Other Tax Year Revenue Alabama

The 31, , Or Other Tax Year Revenue Alabama form is a crucial document for individuals and businesses in Alabama for reporting revenue and tax obligations. This form is typically used to report income earned during a specific tax year, ensuring compliance with state tax regulations. It is essential for accurate tax reporting and helps in determining the amount of tax owed or any potential refunds. Understanding the purpose and requirements of this form is vital for effective tax management.

How to use the 31, , Or Other Tax Year Revenue Alabama

Using the 31, , Or Other Tax Year Revenue Alabama form involves several key steps. First, gather all necessary financial documents, such as income statements, receipts, and previous tax returns. Next, accurately fill out the form by providing detailed information about your income sources and any applicable deductions. Ensure that all figures are correct to avoid discrepancies. Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines set by the Alabama Department of Revenue.

Steps to complete the 31, , Or Other Tax Year Revenue Alabama

Completing the 31, , Or Other Tax Year Revenue Alabama form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documents.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring accuracy.

- Include any deductions or credits you may qualify for.

- Review the form for any errors or omissions.

- Submit the form either electronically or by mail, following the specific submission guidelines.

Legal use of the 31, , Or Other Tax Year Revenue Alabama

The legal use of the 31, , Or Other Tax Year Revenue Alabama form is governed by state tax laws. To be considered valid, the form must be filled out accurately and submitted by the designated deadlines. Electronic signatures are acceptable, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Ensuring that the form adheres to these legal standards is crucial for its acceptance by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the 31, , Or Other Tax Year Revenue Alabama form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the following year for individual taxpayers. However, businesses may have different deadlines based on their fiscal year. It is essential to stay informed about any changes to these dates and to file early to ensure compliance with state regulations.

Penalties for Non-Compliance

Failing to file the 31, , Or Other Tax Year Revenue Alabama form on time can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action from the state. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate filing. Taxpayers should be aware of their responsibilities to avoid unnecessary financial burdens.

Quick guide on how to complete 31 2016 or other tax year revenue alabama

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed files, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly and without interruptions. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes a few seconds and has the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your PC.

Eliminate the worries of lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 31, , Or Other Tax Year Revenue Alabama

Create this form in 5 minutes!

How to create an eSignature for the 31 2016 or other tax year revenue alabama

How to generate an e-signature for your PDF file in the online mode

How to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is the significance of '31, , Or Other Tax Year Revenue Alabama' in my tax documents?

The '31, , Or Other Tax Year Revenue Alabama' designation refers to the specific revenue figures you must report for your tax year in Alabama. Accurately completing this section is critical for compliance and ensuring you fulfill state tax requirements.

-

How does airSlate SignNow help with completing tax documents?

airSlate SignNow provides a streamlined process for preparing and eSigning essential documents, including those related to '31, , Or Other Tax Year Revenue Alabama.' Our platform includes templates and integrations that simplify the documentation and filing process, making compliance hassle-free.

-

What are the pricing options for airSlate SignNow?

We offer flexible pricing plans tailored to your business needs, starting from basic packages to more advanced options. Our cost-effective solution ensures that you can manage your tax-related documentation, like '31, , Or Other Tax Year Revenue Alabama,' without overspending.

-

Can I integrate airSlate SignNow with other accounting tools?

Yes, airSlate SignNow seamlessly integrates with various accounting tools to enhance your workflow. This includes integrating data for '31, , Or Other Tax Year Revenue Alabama' into your preferred accounting software, ensuring all your documents are up-to-date and easily accessible.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow helps businesses save time and reduce errors in document handling. Our user-friendly platform speeds up the eSigning process for critical documents, such as those related to '31, , Or Other Tax Year Revenue Alabama,' helping you maintain efficiency in your operations.

-

Is it secure to use airSlate SignNow for sensitive documents?

Absolutely. airSlate SignNow employs advanced security protocols to ensure that your sensitive tax documents, including '31, , Or Other Tax Year Revenue Alabama,' are protected. Our encryption and data security measures ensure compliance with industry standards.

-

How can I get started with airSlate SignNow?

Getting started with airSlate SignNow is easy! Simply sign up on our website, select the plan that suits your business needs, and begin eSigning documents such as those related to '31, , Or Other Tax Year Revenue Alabama.' Our onboarding process is straightforward with plenty of resources.

Get more for 31, , Or Other Tax Year Revenue Alabama

Find out other 31, , Or Other Tax Year Revenue Alabama

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy