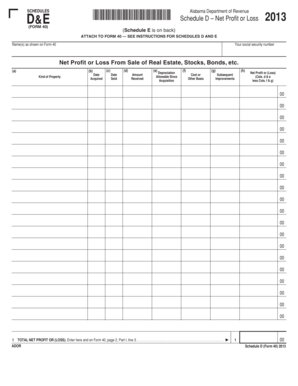

Schedule E is on Back Revenue Alabama Form

What is the Schedule E Is On Back Revenue Alabama

The Schedule E Is On Back Revenue Alabama is a specific tax form used by individuals and businesses in Alabama to report income or losses from various sources, including rental properties and partnerships. This form is essential for accurately documenting income that may not be reported on a standard tax return. Understanding the purpose of this form is crucial for compliance with Alabama tax regulations.

How to use the Schedule E Is On Back Revenue Alabama

Using the Schedule E Is On Back Revenue Alabama involves several steps to ensure accurate reporting of income. Taxpayers must gather all necessary financial information related to their income sources. This includes details about rental properties, partnerships, or any other income-generating activities. After collecting the required data, individuals can fill out the form, ensuring all sections are completed accurately to reflect their financial situation.

Steps to complete the Schedule E Is On Back Revenue Alabama

Completing the Schedule E Is On Back Revenue Alabama requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income statements and expense records.

- Fill out personal information at the top of the form, ensuring accuracy.

- Detail each income source, including rental income and partnership earnings, in the appropriate sections.

- Calculate total income and any deductions applicable to your situation.

- Review the completed form for accuracy before submission.

Legal use of the Schedule E Is On Back Revenue Alabama

The Schedule E Is On Back Revenue Alabama must be used in compliance with state tax laws. This means that all information reported must be truthful and accurate. Misrepresentation or failure to report income can lead to legal penalties. It is essential to keep thorough records and documentation to support the information provided on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule E Is On Back Revenue Alabama typically align with the federal tax filing deadlines. Taxpayers should be aware of these dates to avoid penalties. Generally, the deadline for filing individual income tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any specific state extensions or changes to these deadlines.

Required Documents

To complete the Schedule E Is On Back Revenue Alabama, several documents are required. These may include:

- Income statements from rental properties or partnerships.

- Expense records related to the income-generating activities.

- Previous tax returns for reference.

- Any supporting documentation for deductions claimed.

Who Issues the Form

The Schedule E Is On Back Revenue Alabama is issued by the Alabama Department of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with state tax laws. Taxpayers can obtain the form directly from the department’s website or through authorized tax preparation services.

Quick guide on how to complete schedule e is on back revenue alabama

Effortlessly Complete [SKS] on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with the airSlate SignNow applications for Android or iOS, and enhance your document-driven processes today.

How to Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive data using the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to submit your form, via email, SMS, an invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule E Is On Back Revenue Alabama

Create this form in 5 minutes!

How to create an eSignature for the schedule e is on back revenue alabama

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an e-signature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an e-signature for a PDF file on Android OS

People also ask

-

What is Schedule E Is On Back Revenue Alabama?

Schedule E Is On Back Revenue Alabama refers to a specific tax form used for reporting income from rental properties, royalties, partnerships, and S corporations in Alabama. Understanding this form is crucial for accurate tax filing and compliance, especially for property owners and businesses operating in multiple states.

-

How does airSlate SignNow help with Schedule E Is On Back Revenue Alabama forms?

airSlate SignNow provides an efficient way to manage and eSign your Schedule E Is On Back Revenue Alabama forms electronically. With our platform, you can streamline the signing process, ensuring that all necessary documents are properly executed and maintained for tax seasons.

-

What are the pricing options for using airSlate SignNow for Schedule E Is On Back Revenue Alabama?

airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes needing to handle Schedule E Is On Back Revenue Alabama. We provide flexible subscription options that allow you to choose a plan that best fits your document management needs without breaking the bank.

-

Can airSlate SignNow integrate with other accounting software for Schedule E Is On Back Revenue Alabama?

Yes, airSlate SignNow can seamlessly integrate with various accounting and financial software to assist in preparing your Schedule E Is On Back Revenue Alabama. Our API allows for easy data transfer, ensuring you can manage your forms and financial records efficiently.

-

What are the key features of airSlate SignNow for handling Schedule E Is On Back Revenue Alabama?

Key features of airSlate SignNow include user-friendly document management, robust eSigning capabilities, and secure data storage. These features make it easier to handle your Schedule E Is On Back Revenue Alabama effectively, providing peace of mind throughout your transactions.

-

Is airSlate SignNow secure for handling sensitive information like Schedule E Is On Back Revenue Alabama?

Absolutely! airSlate SignNow employs state-of-the-art security protocols to ensure that your sensitive information, including Schedule E Is On Back Revenue Alabama details, is protected. We utilize encryption and secure cloud storage to safeguard all your documents.

-

What benefits do I gain from using airSlate SignNow for Schedule E Is On Back Revenue Alabama?

Using airSlate SignNow for your Schedule E Is On Back Revenue Alabama documents offers several benefits, including reduced processing time, enhanced collaboration, and simplified compliance. Our platform ensures that you can focus on growing your business while we take care of your document needs.

Get more for Schedule E Is On Back Revenue Alabama

Find out other Schedule E Is On Back Revenue Alabama

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document