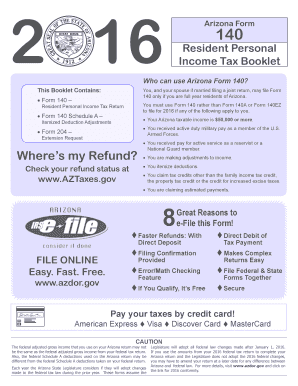

You, and Your Spouse If Married Filing a Joint Return, May File Form Azdor

What is the You, And Your Spouse If Married Filing A Joint Return, May File Form Azdor

The form "You, And Your Spouse If Married Filing A Joint Return, May File Form Azdor" is a tax document specifically designed for couples who are married and choose to file their taxes jointly. This form allows both spouses to report their combined income, deductions, and credits on a single return, which can often result in tax benefits. Filing jointly typically simplifies the process and may provide access to various tax credits and deductions that are not available for those filing separately.

Steps to complete the You, And Your Spouse If Married Filing A Joint Return, May File Form Azdor

Completing the form involves several key steps to ensure accuracy and compliance with tax regulations. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements for both spouses. Next, fill out the form by entering your combined income, deductions, and credits. Be sure to review the instructions provided with the form to ensure that all required fields are completed correctly. After filling out the form, both spouses must sign it, either electronically or in ink, to validate the submission.

How to obtain the You, And Your Spouse If Married Filing A Joint Return, May File Form Azdor

The form can typically be obtained from the state’s Department of Revenue website or through authorized tax preparation software. Many tax professionals also have access to the form and can assist with its completion. If you prefer to fill out the form electronically, ensure you use a reliable eSignature platform, which can streamline the process and enhance security.

Legal use of the You, And Your Spouse If Married Filing A Joint Return, May File Form Azdor

This form is legally binding when completed correctly and signed by both spouses. To ensure its validity, it must comply with federal and state tax laws. Utilizing an electronic signature solution that meets legal standards, such as those outlined in the ESIGN Act and UETA, can enhance the form's legal standing. It is important to keep a copy of the filed form for your records, as it may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the form typically align with the annual tax filing season, which usually concludes on April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to filing dates, as well as any extensions that may be available. Keeping track of these dates can help avoid penalties and ensure timely submission.

Required Documents

To successfully complete the "You, And Your Spouse If Married Filing A Joint Return, May File Form Azdor," you will need several documents. These include:

- W-2 forms from employers for both spouses

- 1099 forms for any additional income

- Records of deductible expenses, such as mortgage interest or medical expenses

- Identification numbers, such as Social Security numbers for both spouses

Having these documents ready will facilitate a smoother filing process.

Examples of using the You, And Your Spouse If Married Filing A Joint Return, May File Form Azdor

Couples may use the form in various scenarios, such as when both partners are employed and wish to combine their incomes for tax benefits. Another example includes one spouse being self-employed, allowing the couple to report business income alongside personal income. Filing jointly can also be advantageous for couples with children, as it may provide access to tax credits like the Child Tax Credit, which can significantly reduce overall tax liability.

Quick guide on how to complete you and your spouse if married filing a joint return may file form azdor

Effortlessly Prepare [SKS] on Any Device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with the tools airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to You, And Your Spouse If Married Filing A Joint Return, May File Form Azdor

Create this form in 5 minutes!

How to create an eSignature for the you and your spouse if married filing a joint return may file form azdor

How to make an e-signature for a PDF document online

How to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

The best way to make an e-signature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the process for You, And Your Spouse If Married Filing A Joint Return, May File Form Azdor?

To file Form Azdor, you and your spouse need to gather the necessary financial documents for your joint return. Once you have your information ready, you can easily complete the form using airSlate SignNow, which provides an efficient eSigning experience. You will simply sign the document electronically and submit it to the Arizona Department of Revenue.

-

How much does it cost to use airSlate SignNow for filing Form Azdor?

airSlate SignNow offers various pricing plans to cater to different needs, including a free trial for new users. As a couple, you may find that our affordable subscription plans will allow you to effectively eSign documents while filing Form Azdor. You, And Your Spouse If Married Filing A Joint Return, May File Form Azdor without the high costs typically associated with traditional filing methods.

-

What features does airSlate SignNow offer to assist with Form Azdor?

airSlate SignNow provides several features designed to simplify the process of filing Form Azdor. Key features include customizable templates, secure eSignature capabilities, document sharing, and milestone tracking. These tools help ensure that both you and your spouse can efficiently manage your joint tax return.

-

Can airSlate SignNow help with other forms besides Form Azdor?

Yes, airSlate SignNow supports a variety of forms and documents, beyond just Form Azdor. This means that you, And Your Spouse If Married Filing A Joint Return, May File Form Azdor while also having access to solutions for other necessary paperwork throughout the tax season. Our platform's versatility is aimed at meeting all your document needs.

-

Is airSlate SignNow secure for filing my tax documents?

Absolutely! airSlate SignNow takes security seriously, ensuring that your data remains confidential and protected. By using top-notch encryption and compliance with industry standards, you can confidently file Form Azdor. Rest assured that you and your spouse’s sensitive information is safe with airSlate SignNow.

-

What integrations does airSlate SignNow offer for tax filing?

airSlate SignNow seamlessly integrates with many popular applications that can assist with tax filing and document management. These integrations allow you to streamline your workflow when preparing Form Azdor. You, And Your Spouse If Married Filing A Joint Return, May File Form Azdor more efficiently by using your favorite software tools.

-

How can I get support if I have questions about filing Form Azdor?

If you have any questions while filing Form Azdor, airSlate SignNow offers excellent customer support. You can access help via live chat, email, or an extensive online knowledge base. Our team is dedicated to ensuring that you and your spouse have the assistance needed for a smooth filing process.

Get more for You, And Your Spouse If Married Filing A Joint Return, May File Form Azdor

- Form 3200 111 aquatic plant management herbicide treatment dnr wi

- Pre tenancy application form

- Kelseytrailcom application from form

- F30 fire guard study material form

- City of chico conditional use permit form

- Asbestos abatement and demolitionrenovation notification form elibrary dep state pa

- Police forms 15979295

- Form 1 annexure rural purposeprimary producerrecreational

Find out other You, And Your Spouse If Married Filing A Joint Return, May File Form Azdor

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document