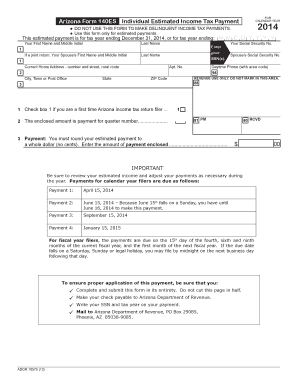

Arizona Form 140es

What is the Arizona Form 140es

The Arizona Form 140es is a state-specific tax form used by individuals to make estimated income tax payments. This form is essential for taxpayers who expect to owe tax of $1,000 or more when they file their annual return. By submitting this form, individuals can ensure they meet their tax obligations throughout the year, rather than facing a large tax bill at the end of the tax season. The 140es form is particularly relevant for self-employed individuals, freelancers, and those with additional income that is not subject to withholding.

How to use the Arizona Form 140es

To effectively use the Arizona Form 140es, individuals should first determine their estimated tax liability for the year. This involves calculating expected income, deductions, and credits. After estimating the tax, taxpayers can complete the form by providing their personal information, including name, address, and Social Security number. It's important to accurately report income sources, as this affects the estimated tax amount. Once completed, the form can be submitted along with the estimated payment to the Arizona Department of Revenue.

Steps to complete the Arizona Form 140es

Completing the Arizona Form 140es involves several key steps:

- Gather necessary information: Collect documents such as W-2s, 1099s, and other income statements.

- Estimate your tax liability: Use previous year’s tax return as a reference to project your income and deductions for the current year.

- Fill out the form: Enter your personal details and estimated tax amounts accurately on the form.

- Review your entries: Double-check all calculations and information for accuracy.

- Submit the form: Send the completed form along with any required payment to the Arizona Department of Revenue by the due date.

Legal use of the Arizona Form 140es

The Arizona Form 140es is legally binding when completed and submitted according to state regulations. It is crucial that taxpayers adhere to the guidelines set forth by the Arizona Department of Revenue to avoid penalties. The form must be filled out truthfully and accurately, as providing false information can lead to legal consequences. Additionally, maintaining records of submitted forms and payments is advisable for future reference and in case of audits.

Filing Deadlines / Important Dates

Taxpayers using the Arizona Form 140es should be aware of important filing deadlines to ensure compliance. Typically, estimated tax payments are due quarterly, with deadlines falling on the 15th of April, June, September, and January of the following year. It is essential to mark these dates on your calendar to avoid late fees and penalties. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form 140es can be submitted through various methods to accommodate different preferences. Taxpayers can file the form online through the Arizona Department of Revenue's website, which offers a secure and efficient way to submit payments. Alternatively, the form can be mailed to the appropriate address provided by the department. For those who prefer in-person interactions, visiting a local tax office is also an option, although this may require an appointment.

Quick guide on how to complete arizona 2012 form 140es

Complete Arizona Form 140es effortlessly on any device

Digital document management has grown in popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Arizona Form 140es on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Arizona Form 140es comfortably

- Find Arizona Form 140es and click Get Form to begin.

- Make use of the tools provided to complete your form.

- Emphasize pertinent sections of the documents or hide sensitive details using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Update and eSign Arizona Form 140es and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona 2012 form 140es

How to make an e-signature for a PDF document in the online mode

How to make an e-signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

The best way to make an e-signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is Arizona Form 140es?

Arizona Form 140es is an estimated income tax payment form required for Arizona residents. It allows taxpayers to submit their estimated tax liabilities to the Arizona Department of Revenue. Proper submission of this form can help avoid penalties for underpayment.

-

How do I complete Arizona Form 140es using airSlate SignNow?

To complete Arizona Form 140es using airSlate SignNow, simply upload the form to our platform. From there, you can easily fill out the necessary fields, apply your eSignature, and securely send it to the appropriate authority. Our user-friendly interface streamlines this process for efficiency.

-

What are the costs associated with using airSlate SignNow for Arizona Form 140es?

airSlate SignNow offers cost-effective pricing plans that cater to various business needs. You can choose from monthly, yearly, or pay-as-you-go options, depending on how often you need to handle documents like the Arizona Form 140es. Check our website for the latest pricing details.

-

What features does airSlate SignNow offer for managing Arizona Form 140es?

airSlate SignNow provides multiple features to manage Arizona Form 140es including eSigning, document templates, and real-time collaboration. You can also track your form statuses and receive notifications when documents are signed. These tools make handling tax forms more straightforward.

-

Can I integrate airSlate SignNow with other software for Arizona Form 140es management?

Yes, airSlate SignNow allows integrations with various software applications to enhance your workflow for handling Arizona Form 140es. You can connect it with CRM tools, cloud storage solutions, and more, ensuring a seamless experience in document management.

-

What are the benefits of using airSlate SignNow for Arizona Form 140es submissions?

Using airSlate SignNow for Arizona Form 140es submissions offers several benefits such as time savings, increased accuracy, and enhanced security. Our platform allows you to submit forms quickly and securely while reducing the risk of errors that can occur in manual submissions.

-

Is airSlate SignNow user-friendly for first-time users managing Arizona Form 140es?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it suitable for first-time users navigating Arizona Form 140es. Our intuitive platform provides guides and support, helping you understand each step of the signing and submission process.

Get more for Arizona Form 140es

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497308487 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497308488 form

- Louisiana letter in form

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497308490 form

- Louisiana tenant in form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497308492 form

- Letter from landlord to tenant as notice to tenant to inform landlord of tenants knowledge of condition causing damage to 497308493

- Landlord tenant law 497308494 form

Find out other Arizona Form 140es

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document