Arizona Form 140ES Individual Estimated Tax Payment Azdor

What is the Arizona Form 140ES Individual Estimated Tax Payment Azdor

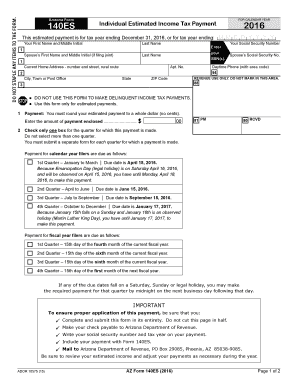

The Arizona Form 140ES is a tax form used by individuals to make estimated tax payments to the Arizona Department of Revenue (ADOR). This form is crucial for taxpayers who expect to owe tax of $1,000 or more when they file their annual return. It allows individuals to pay their estimated tax liability in four installments throughout the year, ensuring compliance with state tax obligations.

How to use the Arizona Form 140ES Individual Estimated Tax Payment Azdor

To effectively use the Arizona Form 140ES, taxpayers must first determine their estimated tax liability for the year. This involves calculating expected income, deductions, and credits. Once the estimated amount is established, individuals can fill out the form with their personal information, including name, address, and Social Security number. Payments can be made electronically or by check, and the completed form should be submitted according to the specified deadlines.

Steps to complete the Arizona Form 140ES Individual Estimated Tax Payment Azdor

Completing the Arizona Form 140ES involves several key steps:

- Gather necessary financial information, including income and deductions.

- Calculate your estimated tax liability for the year.

- Fill out the form with your personal details and estimated payment amounts.

- Choose your payment method: electronic payment or check.

- Submit the form by the due date to avoid penalties.

Legal use of the Arizona Form 140ES Individual Estimated Tax Payment Azdor

The Arizona Form 140ES is legally binding when completed and submitted according to state regulations. To ensure its validity, taxpayers must provide accurate information and adhere to the deadlines set by the Arizona Department of Revenue. Electronic submissions are accepted and are considered legally enforceable, provided they comply with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form 140ES are essential for maintaining compliance. Estimated payments are typically due on the 15th of April, June, September, and January of the following year. Taxpayers should mark these dates on their calendars to avoid late fees and penalties associated with non-compliance.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Arizona Form 140ES. The form can be filed online through the Arizona Department of Revenue's website, allowing for quick processing. Alternatively, individuals may choose to mail the completed form along with their payment or submit it in person at designated locations. Each method has its advantages, such as convenience or immediate confirmation of submission.

Quick guide on how to complete arizona form 140es individual estimated tax payment azdor

Easily prepare Arizona Form 140ES Individual Estimated Tax Payment Azdor on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents quickly without delays. Handle Arizona Form 140ES Individual Estimated Tax Payment Azdor on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Arizona Form 140ES Individual Estimated Tax Payment Azdor effortlessly

- Locate Arizona Form 140ES Individual Estimated Tax Payment Azdor and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that reason.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional signature with ink.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Arizona Form 140ES Individual Estimated Tax Payment Azdor to guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140es individual estimated tax payment azdor

How to make an e-signature for your PDF in the online mode

How to make an e-signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the Arizona Form 140ES Individual Estimated Tax Payment Azdor?

The Arizona Form 140ES Individual Estimated Tax Payment Azdor is a form used by individual taxpayers in Arizona to calculate and pay their estimated income taxes. This form helps ensure that taxpayers meet their tax obligations throughout the year, avoiding penalties and interest charges.

-

How can airSlate SignNow assist with the Arizona Form 140ES Individual Estimated Tax Payment Azdor?

airSlate SignNow simplifies the process of signing and sending the Arizona Form 140ES Individual Estimated Tax Payment Azdor electronically. With our user-friendly platform, users can complete, eSign, and share this essential tax form quickly and efficiently.

-

Are there any fees associated with using airSlate SignNow for the Arizona Form 140ES Individual Estimated Tax Payment Azdor?

Using airSlate SignNow comes with a subscription fee that provides access to all features, including the ability to eSign the Arizona Form 140ES Individual Estimated Tax Payment Azdor. The pricing plans are designed to be cost-effective, making it an affordable solution for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other tools for managing Arizona Form 140ES Individual Estimated Tax Payment Azdor?

Yes, airSlate SignNow integrates seamlessly with various tools and software, enhancing your ability to manage the Arizona Form 140ES Individual Estimated Tax Payment Azdor and other documents. This integration streamlines your workflow, allowing you to focus on your business while ensuring your tax documents are handled efficiently.

-

What are the benefits of using airSlate SignNow for the Arizona Form 140ES Individual Estimated Tax Payment Azdor?

Using airSlate SignNow for the Arizona Form 140ES Individual Estimated Tax Payment Azdor provides numerous benefits, including time savings, increased efficiency, and a secure way to handle sensitive information. Additionally, our platform ensures that you can access and manage your documents from any device at any time.

-

Is it secure to use airSlate SignNow for the Arizona Form 140ES Individual Estimated Tax Payment Azdor?

Absolutely, airSlate SignNow prioritizes security for all documents, including the Arizona Form 140ES Individual Estimated Tax Payment Azdor. Our platform employs advanced encryption and security protocols to protect your data, ensuring that your personal and financial information remains confidential.

-

How quickly can I complete the Arizona Form 140ES Individual Estimated Tax Payment Azdor using airSlate SignNow?

With airSlate SignNow, you can complete the Arizona Form 140ES Individual Estimated Tax Payment Azdor very quickly. Our intuitive interface allows users to fill out and eSign documents in just a few minutes, signNowly speeding up the process compared to traditional paper methods.

Get more for Arizona Form 140ES Individual Estimated Tax Payment Azdor

- Essential legal life documents for new parents mississippi form

- Power of attorney for care and custody of child or children mississippi form

- Mississippi business form

- Company employment policies and procedures package mississippi form

- Revocation of power of attorney for care and custody of child or children mississippi form

- Newly divorced individuals package mississippi form

- Contractors forms package mississippi

- Power of attorney for sale of motor vehicle mississippi form

Find out other Arizona Form 140ES Individual Estimated Tax Payment Azdor

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe