Arizona Schedule APYN Itemized Deductions for Part Year Residents Form

What is the Arizona Schedule APYN Itemized Deductions For Part Year Residents

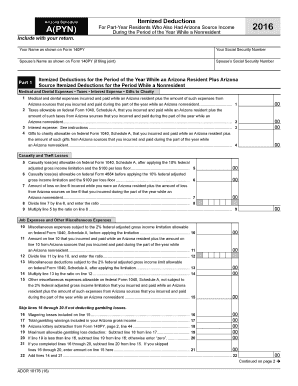

The Arizona Schedule APYN is a tax form specifically designed for part-year residents of Arizona who wish to itemize their deductions. This form allows individuals who have moved in or out of Arizona during the tax year to report their eligible deductions accurately. It is essential for ensuring that taxpayers only claim deductions for the portion of the year they were residents of the state. The Schedule APYN is part of the Arizona tax return process and must be filed along with the Arizona Form 140 or 140A, depending on the taxpayer's situation.

Steps to complete the Arizona Schedule APYN Itemized Deductions For Part Year Residents

Completing the Arizona Schedule APYN involves several steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099s, and receipts for deductible expenses. Next, determine the total amount of itemized deductions available to you, such as medical expenses, mortgage interest, and property taxes. It is crucial to prorate these deductions based on the time you were a resident in Arizona. Fill out the form carefully, ensuring that all calculations are correct. Finally, review the completed form for any errors before submitting it with your Arizona tax return.

Key elements of the Arizona Schedule APYN Itemized Deductions For Part Year Residents

The Arizona Schedule APYN includes several key elements that taxpayers must understand. These elements consist of various categories of deductions, such as medical and dental expenses, state and local taxes, mortgage interest, and charitable contributions. Each category may have specific limits or requirements that must be adhered to. Additionally, taxpayers must provide detailed information about their residency status and the time spent in Arizona during the tax year. Accurate reporting of these elements is vital for ensuring compliance with state tax laws.

Legal use of the Arizona Schedule APYN Itemized Deductions For Part Year Residents

The legal use of the Arizona Schedule APYN requires adherence to state tax laws and regulations. Taxpayers must ensure that they are eligible to itemize deductions and that their claims are substantiated with appropriate documentation. The form must be signed and dated, indicating that the information provided is accurate to the best of the taxpayer's knowledge. Failure to comply with these legal requirements can result in penalties or audits by the Arizona Department of Revenue.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when filing the Arizona Schedule APYN. Generally, the deadline for filing state tax returns, including the Schedule APYN, aligns with the federal tax deadline, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable for taxpayers to check for any updates or changes to filing deadlines each tax year to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Schedule APYN can be submitted through various methods. Taxpayers have the option to file electronically using approved tax software, which often streamlines the process and reduces errors. Alternatively, individuals can print the completed form and mail it to the appropriate address provided by the Arizona Department of Revenue. In-person submissions may also be possible at designated tax offices, but it is essential to check the current policies regarding in-person filing, especially during peak tax season.

Quick guide on how to complete arizona schedule apyn itemized deductions for part year residents 397778377

Handle [SKS] effortlessly on any device

Web-based document management has become favored by companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow offers you all the resources required to generate, modify, and electronically sign your documents promptly without any holdups. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign [SKS] without hassle

- Locate [SKS] and then click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Select crucial sections of your documents or obscure sensitive details with features that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then hit the Done button to save your modifications.

- Decide how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona schedule apyn itemized deductions for part year residents 397778377

How to make an e-signature for your PDF document in the online mode

How to make an e-signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the Arizona Schedule APYN Itemized Deductions For Part Year Residents?

The Arizona Schedule APYN Itemized Deductions For Part Year Residents is a tax form that allows part-year residents to deduct specific expenses on their state tax return. By accurately completing this form, individuals can ensure they optimize their tax savings while complying with Arizona tax regulations. Using this schedule helps in effectively managing tax liability for those who have lived in Arizona only part of the year.

-

How can I eSign the Arizona Schedule APYN Itemized Deductions For Part Year Residents using airSlate SignNow?

With airSlate SignNow, you can easily eSign the Arizona Schedule APYN Itemized Deductions For Part Year Residents through a secure and user-friendly platform. Simply upload your document and invite your signers to eSign digitally, saving time and ensuring the document is legally binding. The process is streamlined to enhance efficiency for busy taxpayers.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for handling your tax documents, including the Arizona Schedule APYN Itemized Deductions For Part Year Residents, offers numerous advantages. It provides a cost-effective solution to send, receive, and manage documents securely. Additionally, the platform enhances collaboration through real-time updates and notifications, ensuring all parties are informed throughout the signing process.

-

Is there a cost associated with using airSlate SignNow for the Arizona Schedule APYN Itemized Deductions For Part Year Residents?

Yes, airSlate SignNow offers various pricing plans to cater to different user needs when managing documents such as the Arizona Schedule APYN Itemized Deductions For Part Year Residents. These plans are designed to be budget-friendly while providing powerful features that simplify the eSigning process. You can choose a plan that fits your usage needs and take advantage of a free trial to explore its capabilities.

-

Can I integrate airSlate SignNow with other tools for managing my tax documents?

Absolutely! airSlate SignNow seamlessly integrates with various applications to enhance your document management process, including those used for filing the Arizona Schedule APYN Itemized Deductions For Part Year Residents. These integrations allow for streamlined workflows, enabling you to connect your eSigning tasks with other software you already use. This helps keep all your operations synchronized and efficient.

-

What features does airSlate SignNow offer for tax documentation?

airSlate SignNow boasts a range of features tailored for tax documentation, such as customizable templates, secure storage, and advanced security protocols. For the Arizona Schedule APYN Itemized Deductions For Part Year Residents, these features ensure that your sensitive information is protected while allowing for easy access and collaboration among users. The platform's intuitive design makes it simple to work with complex forms.

-

How does airSlate SignNow improve collaboration for part-year residents preparing tax documents?

airSlate SignNow enhances collaboration for part-year residents filing the Arizona Schedule APYN Itemized Deductions by facilitating efficient communication between signers. Users can comment, request changes, and track the status of documents in real-time, making the process straightforward and transparent. This collaborative approach ensures that all parties involved are aligned before submitting important tax forms.

Get more for Arizona Schedule APYN Itemized Deductions For Part Year Residents

Find out other Arizona Schedule APYN Itemized Deductions For Part Year Residents

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe