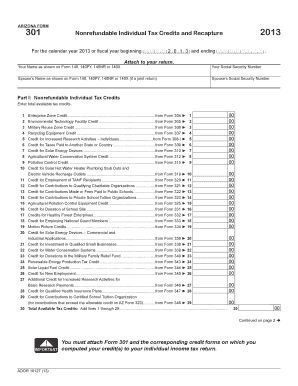

ARIZONA FORM 301 Nonrefundable Individual Tax Credits and Recapture Fiscal Year Beginning MM for the Calendar Year , or D D Y Y

Understanding the ARIZONA FORM 301 Nonrefundable Individual Tax Credits

The ARIZONA FORM 301 is a crucial document for individuals seeking to claim nonrefundable tax credits in Arizona. This form is specifically designed for taxpayers who want to report their tax credits and any potential recapture for a fiscal year beginning in a specified month and year. It is essential for ensuring compliance with state tax regulations while maximizing available tax benefits. The form captures necessary details such as the fiscal year, the specific credits being claimed, and any recapture amounts that may apply.

Steps to Complete the ARIZONA FORM 301

Completing the ARIZONA FORM 301 requires careful attention to detail. Here are the key steps to follow:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Specify the fiscal year for which you are claiming the credits, noting the start and end dates accurately.

- List the nonrefundable individual tax credits you are claiming, ensuring you have documentation to support each claim.

- Calculate any recapture amounts, if applicable, based on the guidelines provided in the form instructions.

- Review your entries for accuracy before signing and dating the form.

Obtaining the ARIZONA FORM 301

The ARIZONA FORM 301 can be obtained through various channels. Taxpayers can download the form directly from the Arizona Department of Revenue's official website. Additionally, physical copies may be available at local tax offices or public libraries. It is advisable to ensure you are using the most current version of the form to avoid any compliance issues.

Legal Use of the ARIZONA FORM 301

The ARIZONA FORM 301 is legally binding when completed correctly and submitted in accordance with state regulations. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by the Arizona Department of Revenue. This includes providing accurate information, signing the form, and submitting it by the specified deadlines. Utilizing a reliable electronic signature solution can enhance the legitimacy of the submission process.

Key Elements of the ARIZONA FORM 301

Several key elements are essential for the proper completion of the ARIZONA FORM 301. These include:

- Taxpayer Information: Accurate personal and financial details are critical.

- Fiscal Year Dates: Clearly indicate the beginning and ending months and years.

- Credit Details: Specify the types of nonrefundable credits being claimed.

- Recapture Information: Provide calculations for any recapture amounts, if applicable.

Filing Deadlines and Important Dates

Timely submission of the ARIZONA FORM 301 is essential to avoid penalties. Taxpayers should be aware of the specific deadlines for filing, which are typically aligned with the state tax return deadlines. It is advisable to check the Arizona Department of Revenue's website for the most current information regarding filing dates to ensure compliance.

Quick guide on how to complete arizona form 301 2012 nonrefundable individual tax credits and recapture fiscal year beginning mm for the calendar year 2012 or

Complete [SKS] effortlessly on any device

Online document management has gained increased popularity among businesses and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, edit, and eSign your documents promptly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or black out confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ARIZONA FORM 301 Nonrefundable Individual Tax Credits And Recapture Fiscal Year Beginning MM For The Calendar Year , Or D D Y Y

Create this form in 5 minutes!

How to create an eSignature for the arizona form 301 2012 nonrefundable individual tax credits and recapture fiscal year beginning mm for the calendar year 2012 or

The best way to create an e-signature for a PDF document online

The best way to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

The way to generate an e-signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is ARIZONA FORM 301 Nonrefundable Individual Tax Credits?

ARIZONA FORM 301 Nonrefundable Individual Tax Credits allows taxpayers to claim certain tax credits that reduce their tax liability for the fiscal year. This form is essential for accurately reporting and recapturing any credits utilized during the tax year, particularly for businesses and individuals who qualify.

-

How can airSlate SignNow assist with ARIZONA FORM 301?

airSlate SignNow streamlines the signing and submission process for ARIZONA FORM 301 Nonrefundable Individual Tax Credits. Our platform allows users to securely eSign documents and manage tax credits efficiently, ensuring compliance and ease in fulfilling tax obligations.

-

What are the key features of airSlate SignNow for tax forms?

Key features of airSlate SignNow include secure eSigning, document templates, and cloud storage integration, which are vital for managing ARIZONA FORM 301 Nonrefundable Individual Tax Credits. These features enhance the accuracy and speed of tax form handling, benefiting both individuals and businesses.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow operates on a subscription-based pricing model, offering various plans to suit different needs. Each plan provides access to essential features for managing ARIZONA FORM 301 Nonrefundable Individual Tax Credits and other important documents, ensuring cost-effectiveness.

-

What are the benefits of using airSlate SignNow for ARIZONA FORM 301?

Using airSlate SignNow for ARIZONA FORM 301 Nonrefundable Individual Tax Credits provides benefits like increased efficiency, reduced paper waste, and enhanced security. The platform ensures that your tax documents are handled accurately and swiftly, making the filing process seamless.

-

Can I integrate airSlate SignNow with other accounting software?

Yes, airSlate SignNow can be integrated with various accounting software, allowing for smooth management of ARIZONA FORM 301 Nonrefundable Individual Tax Credits. This integration helps streamline the workflow and maintain consistent record-keeping across platforms.

-

What kind of support does airSlate SignNow offer for tax-related queries?

Our support team is dedicated to helping users navigate issues related to ARIZONA FORM 301 Nonrefundable Individual Tax Credits. We offer various resources, including tutorials and live support, to assist you in utilizing our platform effectively for your tax needs.

Get more for ARIZONA FORM 301 Nonrefundable Individual Tax Credits And Recapture Fiscal Year Beginning MM For The Calendar Year , Or D D Y Y

Find out other ARIZONA FORM 301 Nonrefundable Individual Tax Credits And Recapture Fiscal Year Beginning MM For The Calendar Year , Or D D Y Y

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word