AZ Form 301 Azdor

What is the AZ Form 301 Azdor

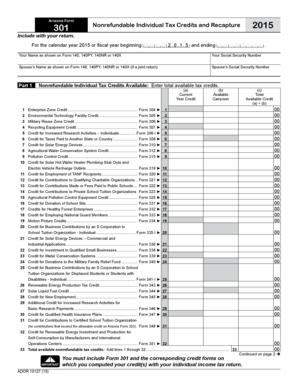

The AZ Form 301 Azdor is a crucial document used in the state of Arizona for various tax-related purposes. This form is primarily associated with the Arizona Department of Revenue and is essential for individuals and businesses to report income and calculate tax liabilities accurately. Understanding the specific use and requirements of this form is vital for compliance with state tax laws.

How to use the AZ Form 301 Azdor

To effectively use the AZ Form 301 Azdor, individuals and businesses must first determine their eligibility and the specific tax situation that necessitates the form. Once the purpose is established, users should gather all necessary financial documents and information required to complete the form accurately. After filling out the form, it can be submitted to the Arizona Department of Revenue through the designated channels, ensuring that all instructions are followed meticulously to avoid any issues.

Steps to complete the AZ Form 301 Azdor

Completing the AZ Form 301 Azdor involves several key steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Carefully read the instructions provided with the form to understand each section's requirements.

- Fill out the form accurately, ensuring that all information is complete and correct.

- Review the completed form for any errors or omissions before submission.

- Submit the form via the appropriate method, whether online, by mail, or in person, as specified by the Arizona Department of Revenue.

Legal use of the AZ Form 301 Azdor

The legal use of the AZ Form 301 Azdor is governed by Arizona state tax laws. This form must be completed and submitted in compliance with these laws to ensure that it holds legal validity. Proper use of the form not only aids in accurate tax reporting but also helps avoid potential legal repercussions, such as penalties for non-compliance. It is essential to keep records of the submitted form and any correspondence with the Arizona Department of Revenue.

Key elements of the AZ Form 301 Azdor

The AZ Form 301 Azdor contains several key elements that users must be aware of:

- Identification Information: This includes the taxpayer's name, address, and identification number.

- Income Reporting: Sections for reporting various sources of income, including wages, business income, and other earnings.

- Deductions and Credits: Areas to claim applicable deductions and tax credits that can reduce overall tax liability.

- Signature and Date: A section for the taxpayer's signature, affirming the accuracy of the information provided.

Form Submission Methods (Online / Mail / In-Person)

The AZ Form 301 Azdor can be submitted through various methods, providing flexibility for users. The available submission methods include:

- Online Submission: Users can complete and submit the form electronically through the Arizona Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided in the instructions.

- In-Person: Taxpayers may also choose to deliver the form in person at designated Arizona Department of Revenue offices.

Quick guide on how to complete az form 301 azdor

Finalize [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about missing or lost files, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to AZ Form 301 Azdor

Create this form in 5 minutes!

How to create an eSignature for the az form 301 azdor

The best way to create an e-signature for your PDF online

The best way to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an e-signature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an e-signature for a PDF on Android

People also ask

-

What is AZ Form 301 Azdor and how does it work?

AZ Form 301 Azdor is a specific form used for Arizona tax purposes, allowing businesses to efficiently report and manage their taxes online. By utilizing airSlate SignNow, users can seamlessly eSign and submit this form, ensuring compliance and saving time in the process.

-

How can airSlate SignNow assist with completing AZ Form 301 Azdor?

airSlate SignNow provides an intuitive platform to easily fill out AZ Form 301 Azdor electronically. Users can add signatures, initials, and data fields, making it simpler to complete the form accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for AZ Form 301 Azdor?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. These plans include features suitable for managing AZ Form 301 Azdor efficiently, ensuring you get value for your investment.

-

What features does airSlate SignNow offer for managing AZ Form 301 Azdor?

AirSlate SignNow provides features such as multiple signing options, document templates, and automated reminders to help manage AZ Form 301 Azdor efficiently. These functionalities streamline the signing process and enhance user experience.

-

Can I integrate airSlate SignNow with other software for handling AZ Form 301 Azdor?

Absolutely! airSlate SignNow integrates seamlessly with numerous third-party applications and tools, enhancing workflow automation for AZ Form 301 Azdor. This capability allows users to combine different software solutions for a more effective document management process.

-

What are the benefits of using airSlate SignNow for AZ Form 301 Azdor?

Using airSlate SignNow for AZ Form 301 Azdor offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. The eSignature option ensures your forms are legally binding and securely stored.

-

How secure is the information I provide when using airSlate SignNow for AZ Form 301 Azdor?

AirSlate SignNow prioritizes user security with advanced encryption and compliant data storage solutions. When using AZ Form 301 Azdor, you can rest assured that your sensitive information remains protected throughout the signing process.

Get more for AZ Form 301 Azdor

Find out other AZ Form 301 Azdor

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement