Under Extension Azdor Form

What is the Under Extension Azdor

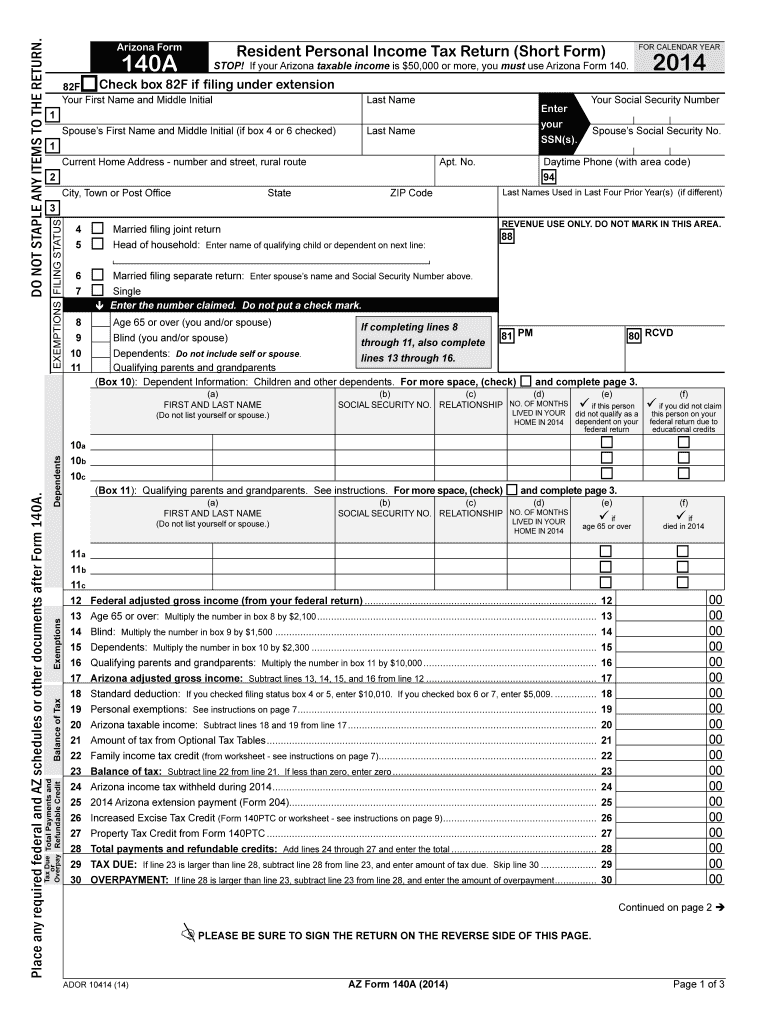

The Under Extension Azdor is a specific form utilized in various legal and administrative contexts. It serves as a formal request for an extension related to specific obligations or deadlines. This form is particularly relevant in scenarios where individuals or businesses need additional time to fulfill certain requirements, such as tax filings or regulatory submissions. Understanding its purpose and implications is essential for compliance and effective management of deadlines.

How to Use the Under Extension Azdor

Using the Under Extension Azdor involves several straightforward steps. First, ensure that you have the correct version of the form, as variations may exist based on specific requirements or jurisdictions. Next, gather all necessary information, including personal or business details, the reason for the extension, and any relevant dates. After completing the form, review it for accuracy before submission. This careful approach helps ensure that your request is processed smoothly.

Steps to Complete the Under Extension Azdor

Completing the Under Extension Azdor requires attention to detail. Follow these steps for successful submission:

- Obtain the latest version of the form from a reliable source.

- Fill in your personal or business information accurately.

- Clearly state the reason for requesting the extension.

- Provide any necessary supporting documentation, if applicable.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate channel, whether online or by mail.

Legal Use of the Under Extension Azdor

The Under Extension Azdor is legally binding when completed correctly and submitted in accordance with relevant laws. It is crucial to adhere to the specific regulations governing the use of this form to ensure its validity. This includes understanding the legal implications of the extension being requested and ensuring compliance with any applicable deadlines. Failure to follow legal guidelines may result in penalties or denial of the extension.

Key Elements of the Under Extension Azdor

Several key elements must be included in the Under Extension Azdor to ensure its effectiveness:

- Personal or Business Information: Accurate identification of the individual or entity requesting the extension.

- Reason for Extension: A clear and concise explanation of why the extension is needed.

- Requested New Deadline: The specific date by which the obligation will be fulfilled.

- Signature: The form must be signed by the individual or an authorized representative to validate the request.

Examples of Using the Under Extension Azdor

The Under Extension Azdor can be used in various scenarios. For instance, a business may use it to request additional time for tax filings due to unforeseen circumstances. Similarly, an individual might submit this form to extend the deadline for submitting required documentation for a loan application. Each use case emphasizes the importance of timely communication with relevant authorities to avoid penalties.

Quick guide on how to complete under extension azdor

Complete [SKS] effortlessly on any device

Online document management has gained popularity among enterprises and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and simplify any document-based process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes requiring the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] to ensure exceptional communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Under Extension Azdor

Create this form in 5 minutes!

How to create an eSignature for the under extension azdor

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The best way to make an e-signature straight from your smart phone

The way to make an e-signature for a PDF on iOS devices

The best way to make an e-signature for a PDF document on Android OS

People also ask

-

What is Under Extension Azdor in airSlate SignNow?

Under Extension Azdor refers to a specific set of features within airSlate SignNow that enhance document signing capabilities. This functionality allows users to manage, track, and secure their documents efficiently. It is designed to simplify the signing process and offer greater control to businesses.

-

How much does airSlate SignNow cost with the Under Extension Azdor?

airSlate SignNow offers competitive pricing plans that include the Under Extension Azdor features. Prices vary based on the number of users and the specific functionalities chosen. You can visit our pricing page for detailed information and to find a plan that suits your business needs.

-

What are the key features of Under Extension Azdor?

Key features of Under Extension Azdor include document templates, real-time tracking, and secure eSigning. These tools help streamline the document workflow and ensure that all actions are logged for compliance. Users benefit from a user-friendly interface that enhances productivity.

-

How does Under Extension Azdor improve document security?

Under Extension Azdor implements advanced encryption and authentication methods to ensure your documents are secure. With this feature, sensitive information is protected from unauthorized access. It also includes audit trails and compliance features to enhance security further.

-

Can I integrate Under Extension Azdor with other tools?

Yes, airSlate SignNow’s Under Extension Azdor supports integrations with various third-party applications. This capability allows you to connect to popular tools such as CRM systems, project management software, and more. These integrations help streamline workflows and improve overall efficiency.

-

What benefits does Under Extension Azdor offer for businesses?

Businesses using Under Extension Azdor can experience increased efficiency and reduced turnaround times for document processes. The easy-to-use interface allows teams to collaborate seamlessly while maintaining a high level of document security. Additionally, the automation features help reduce administrative burdens.

-

Is there a trial available for Under Extension Azdor?

airSlate SignNow offers a free trial that includes access to Under Extension Azdor features. This allows potential customers to experience the full functionality before committing to a subscription. Signing up for the trial is straightforward and provides a comprehensive overview of the benefits.

Get more for Under Extension Azdor

- State of tennessee form ss4247

- Price alcoholic beverages form

- Printable form for tennessee release from compulsory attendance 2016

- Attestation re personnel used in contract performance

- Official manual of the tennessee real estate commission form

- Dmv evaluation form

- Vsp enrollment forms

- Absentee ballot form 16769791

Find out other Under Extension Azdor

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract