Arizona Form 140A Arizona Department of Revenue Azdor

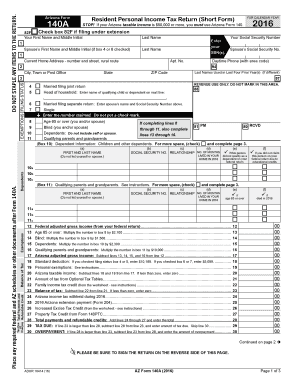

What is the Arizona Form 140A?

The Arizona Form 140A is a tax return form used by residents of Arizona to report their income to the Arizona Department of Revenue (ADOR). This form is specifically designed for individuals who have a straightforward tax situation and are filing as single or married filing jointly. It allows taxpayers to claim various deductions and credits available under Arizona tax law, ensuring compliance with state tax regulations.

How to obtain the Arizona Form 140A

Taxpayers can obtain the Arizona Form 140A through several methods. The most convenient way is to download the form directly from the Arizona Department of Revenue's official website. Additionally, physical copies of the form are available at local ADOR offices and various public libraries throughout the state. It is essential to ensure that you are using the most current version of the form to avoid any issues during submission.

Steps to complete the Arizona Form 140A

Completing the Arizona Form 140A involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, making sure to include all sources of income.

- Claim any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability and determine if you owe taxes or are due a refund.

- Review the completed form for accuracy before submission.

Form Submission Methods

Taxpayers have multiple options for submitting the Arizona Form 140A. The form can be filed electronically through the Arizona Department of Revenue's e-file system, which is a secure and efficient method. Alternatively, taxpayers may choose to mail the completed form to the appropriate address provided in the form instructions. In-person submissions are also accepted at designated ADOR offices, though this option may require an appointment.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the Arizona Form 140A. Typically, the deadline for filing is April 15 of each year, coinciding with the federal tax filing deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also keep in mind any extensions they may apply for, which can provide additional time to file their returns.

Key elements of the Arizona Form 140A

The Arizona Form 140A includes several key elements that taxpayers must complete accurately:

- Personal Information: This section requires basic identification details.

- Income Reporting: Taxpayers must report all sources of income to determine their total income.

- Deductions and Credits: This section allows taxpayers to claim deductions that may lower their taxable income.

- Tax Calculation: Taxpayers must calculate their tax liability based on their reported income and deductions.

Quick guide on how to complete arizona form 140a arizona department of revenue azdor

Effortlessly Prepare Arizona Form 140A Arizona Department Of Revenue Azdor on Any Device

Managing documents online has gained traction among companies and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed materials, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle Arizona Form 140A Arizona Department Of Revenue Azdor on any gadget using airSlate SignNow's Android or iOS apps and streamline any document-related process today.

How to Alter and eSign Arizona Form 140A Arizona Department Of Revenue Azdor with Ease

- Find Arizona Form 140A Arizona Department Of Revenue Azdor and then click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive details using features that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal validity as a conventional ink signature.

- Review all your details carefully and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Don't worry about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Arizona Form 140A Arizona Department Of Revenue Azdor while ensuring outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140a arizona department of revenue azdor

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to make an e-signature straight from your mobile device

The way to make an e-signature for a PDF file on iOS

The best way to make an e-signature for a PDF document on Android devices

People also ask

-

What is the Arizona Form 140A and why do I need to send it?

The Arizona Form 140A is used for individual income tax filing in Arizona. Understanding where to send the Arizona Form 140A is crucial for timely processing and to avoid penalties. This form allows taxpayers to report their income accurately and claim any applicable deductions.

-

Where should I send my Arizona Form 140A?

To ensure your Arizona Form 140A is processed correctly, you can send it to the Arizona Department of Revenue at the address specified on the form. If you're filing it electronically, follow the instructions provided by your e-filing service. Knowing exactly where to send the Arizona Form 140A can streamline your filing process.

-

What are the main features of airSlate SignNow for eSigning documents?

airSlate SignNow offers a variety of features for eSigning documents, including a user-friendly interface and security measures to protect your data. You can easily upload, edit, and send documents for signing. Additionally, it provides options to track the status of your document, ensuring you know where your Arizona Form 140A is throughout the process.

-

How does airSlate SignNow help with form submissions like the Arizona Form 140A?

airSlate SignNow simplifies the submission process for forms such as the Arizona Form 140A by enabling electronic signatures and secure document management. This means you can quickly fill out and eSign your forms, eliminating the need for printing and mailing. The platform ensures you know precisely where to send the Arizona Form 140A after completion.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a range of pricing plans tailored to meet different business needs, from individual users to large enterprises. Each plan includes features such as unlimited document signing and access to templates. To find the best fit, you can visit their website and explore which tier suits your requirements for tasks like sending the Arizona Form 140A.

-

Can I integrate airSlate SignNow with other business tools?

Yes, airSlate SignNow allows seamless integration with a variety of business applications, enhancing your workflow. Whether you're using CRM software or document management tools, these integrations help you to manage documents more efficiently. This can be particularly useful when handling forms like the Arizona Form 140A alongside other administrative tasks.

-

What benefits does airSlate SignNow provide for businesses handling tax forms?

By using airSlate SignNow, businesses can signNowly reduce the time spent on paperwork, including tax forms like the Arizona Form 140A. The platform enhances compliance with electronic records and ensures fast submissions. This efficiency helps businesses mitigate the risk of late filings and associated penalties.

Get more for Arizona Form 140A Arizona Department Of Revenue Azdor

- Discovery interrogatories from plaintiff to defendant with production requests montana form

- Discovery interrogatories from defendant to plaintiff with production requests montana form

- Interrogatories document form

- Montana quitclaim deed 497316120 form

- Mineral deed form 497316121

- Montana quitclaim deed 497316122 form

- Warranty deed from two individuals to one individual montana form

- Gift deed from husband and wifetwo individuals to husband and wifetwo individuals montana form

Find out other Arizona Form 140A Arizona Department Of Revenue Azdor

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form