Az Form 309

What is the AZ Form 309?

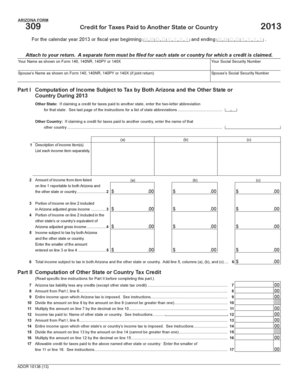

The AZ Form 309 is a document used in the state of Arizona, primarily for tax-related purposes. It serves as a means for individuals or businesses to report specific information to the Arizona Department of Revenue. This form is essential for ensuring compliance with state tax regulations and can impact tax liabilities and refunds. Understanding the purpose and requirements of the AZ Form 309 is crucial for anyone filing taxes in Arizona.

How to Obtain the AZ Form 309

To obtain the AZ Form 309, individuals can visit the Arizona Department of Revenue’s official website. The form is usually available for download in PDF format, allowing users to print it for completion. Additionally, physical copies may be available at local tax offices or public libraries. Ensuring you have the correct version of the form is important, as updates may occur annually.

Steps to Complete the AZ Form 309

Completing the AZ Form 309 involves several key steps:

- Gather necessary information, including personal details and financial data relevant to your tax situation.

- Download and print the AZ Form 309 from the Arizona Department of Revenue website.

- Carefully fill out the form, ensuring all required fields are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form according to the instructions provided, either online or by mail.

Legal Use of the AZ Form 309

The AZ Form 309 is legally binding when filled out and submitted according to state regulations. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or audits. The form must be signed and dated by the appropriate parties to validate its authenticity. Compliance with the legal requirements surrounding this form is essential for maintaining good standing with the Arizona Department of Revenue.

Key Elements of the AZ Form 309

Key elements of the AZ Form 309 include:

- Personal Information: This section requires the taxpayer's name, address, and identification numbers.

- Financial Data: Taxpayers must provide details regarding income, deductions, and credits applicable to their situation.

- Signature Section: A signature is required to certify the accuracy of the information provided.

- Submission Instructions: Clear guidelines on how and where to submit the form.

Form Submission Methods

The AZ Form 309 can be submitted through various methods, depending on the taxpayer's preference and the specific instructions provided. Common submission methods include:

- Online Submission: Some forms may be submitted electronically through the Arizona Department of Revenue's online portal.

- Mail: Completed forms can be sent via postal mail to the designated address provided on the form.

- In-Person: Taxpayers may also choose to deliver the form directly to local tax offices for processing.

Quick guide on how to complete az form 309

Effortlessly Prepare Az Form 309 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can easily obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Az Form 309 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to Edit and Electronically Sign Az Form 309 with Ease

- Obtain Az Form 309 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to submit your form—via email, SMS, or invite link—or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Az Form 309 to maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the az form 309

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an e-signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the AZ Form 309?

The AZ Form 309 is a state-specific document used for various administrative purposes in Arizona. Utilizing airSlate SignNow, you can easily fill out and eSign AZ Form 309 online, streamlining your document management process. This makes it convenient for businesses and individuals alike.

-

How can airSlate SignNow help with AZ Form 309?

airSlate SignNow simplifies the process of completing and signing AZ Form 309 by providing a user-friendly platform for electronic signatures. Users can manage the document efficiently, reducing time spent on paperwork. Moreover, the platform enhances compliance and security for sensitive documents.

-

Is there a cost associated with using airSlate SignNow for AZ Form 309?

Yes, airSlate SignNow offers various pricing plans depending on your needs, allowing you to choose a cost-effective solution for managing AZ Form 309. Each plan includes features suited for individual or business use. You can start with a free trial to explore the platform's benefits.

-

What features does airSlate SignNow offer for managing AZ Form 309?

airSlate SignNow provides numerous features to enhance the management of AZ Form 309, including real-time collaboration, customizable templates, and automated reminders. These features ensure that you can complete your documents efficiently and keep track of all signatures. Additionally, integrations with popular applications enhance functionality.

-

Can I integrate airSlate SignNow with other applications while working on AZ Form 309?

Absolutely! airSlate SignNow offers seamless integrations with various applications, which can enhance your experience while working on AZ Form 309. This allows you to connect with CRM software, cloud storage, and other essential tools for increased productivity and streamlined workflows.

-

What are the benefits of using airSlate SignNow for AZ Form 309?

Using airSlate SignNow for AZ Form 309 greatly enhances efficiency by reducing the time spent on document handling. The platform also ensures security and compliance, which is vital when dealing with sensitive information. Overall, it transforms a cumbersome process into a seamless experience.

-

Is it easy to get started with airSlate SignNow for AZ Form 309?

Yes, airSlate SignNow is designed to be user-friendly, making it easy to get started with AZ Form 309. Simply sign up for an account, choose the appropriate plan, and you can begin uploading, editing, and eSigning your documents within minutes. The intuitive interface guides you every step of the way.

Get more for Az Form 309

- Warranty deed one individual to two individuals montana form

- Subcontractors request corporation or llc montana form

- Property intestate succession form

- Montana response form

- Montana quitclaim deed form

- Mt deed 497316112 form

- Quitclaim deed one individual to four individuals montana form

- Warranty deed three individuals to two individuals montana form

Find out other Az Form 309

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself