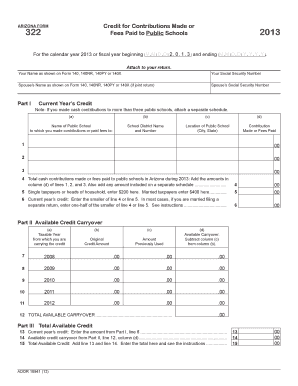

Credit for Contributions Made or Form

What is the Credit For Contributions Made Or

The Credit For Contributions Made Or is a tax form that allows eligible taxpayers to claim a credit for specific contributions made during the tax year. This credit is designed to incentivize charitable giving and support various causes, thereby providing financial relief to those who contribute. Understanding the purpose and function of this form is essential for anyone looking to maximize their tax benefits while supporting their community.

How to use the Credit For Contributions Made Or

Using the Credit For Contributions Made Or involves a few straightforward steps. First, gather all necessary documentation related to your contributions, such as receipts or acknowledgment letters from the organizations you supported. Next, complete the form by accurately entering your personal information and the details of your contributions. Finally, ensure that you file the form with your tax return to claim your credit. Keeping thorough records will help facilitate this process and ensure compliance with IRS guidelines.

Steps to complete the Credit For Contributions Made Or

Completing the Credit For Contributions Made Or requires careful attention to detail. Follow these steps for successful submission:

- Collect all relevant documentation for your contributions, including receipts and letters of acknowledgment.

- Obtain the Credit For Contributions Made Or form from the IRS website or your tax preparation software.

- Fill out the form, ensuring that you provide accurate information regarding your contributions and personal details.

- Review the completed form for any errors or omissions.

- Attach the form to your tax return and submit it by the appropriate deadline.

Eligibility Criteria

To qualify for the Credit For Contributions Made Or, taxpayers must meet specific eligibility criteria. Generally, the contributions must be made to qualifying charitable organizations recognized by the IRS. Additionally, taxpayers must itemize their deductions on their tax returns to claim the credit. It is essential to verify that the organizations you contribute to are eligible to ensure that you can claim the credit without issues.

IRS Guidelines

The IRS provides comprehensive guidelines regarding the Credit For Contributions Made Or. These guidelines outline the types of contributions that qualify, the documentation required, and the process for claiming the credit. Taxpayers should familiarize themselves with these rules to ensure compliance and maximize their potential tax benefits. Understanding IRS guidelines can also help prevent common mistakes that may lead to delays or denials of the credit.

Required Documents

When filing the Credit For Contributions Made Or, certain documents are necessary to support your claim. These typically include:

- Receipts or acknowledgment letters from charitable organizations.

- Bank statements showing the contributions made.

- Any additional documentation required by the IRS to substantiate your claims.

Having these documents organized and readily available will streamline the filing process and ensure that you meet all requirements.

Quick guide on how to complete credit for contributions made or

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained momentum among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your files swiftly and without delays. Manage [SKS] on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow effectively addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Credit For Contributions Made Or

Create this form in 5 minutes!

How to create an eSignature for the credit for contributions made or

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is 'Credit For Contributions Made Or' in the context of eSigning?

The term 'Credit For Contributions Made Or' refers to the acknowledgment of digital signatures provided under specific circumstances. Understanding this concept is crucial for businesses utilizing eSigning services like airSlate SignNow, as it ensures compliance and authenticity in signed documents.

-

How can airSlate SignNow help me manage 'Credit For Contributions Made Or'?

airSlate SignNow streamlines the management of 'Credit For Contributions Made Or' by offering a secure platform for eSigning documents. Our solutions provide audit trails and verification features, ensuring that all contributions and signatures are effectively tracked and credited, which is essential for transparency in business transactions.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs. Depending on the features you require related to 'Credit For Contributions Made Or,' you can choose from different tiers that best suit your budget and usage levels, ensuring excellent value for your investment.

-

Does airSlate SignNow integrate with other software tools I use?

Yes, airSlate SignNow seamlessly integrates with a variety of software tools, enhancing your workflow related to 'Credit For Contributions Made Or.' This means you can connect our eSigning platform with CRM systems, document management tools, and other applications, streamlining your business processes.

-

What features does airSlate SignNow offer for managing document workflows?

airSlate SignNow provides robust features to manage your document workflows efficiently. Tools specifically designed for handling 'Credit For Contributions Made Or' include template creation, bulk sending for mass signatures, and real-time tracking of document status, ensuring nothing falls through the cracks.

-

Can I customize my eSigning process in airSlate SignNow?

Absolutely! With airSlate SignNow, you can customize your eSigning process to suit your specific requirements related to 'Credit For Contributions Made Or.' This includes personalized workflows, custom branding, and adaptable templates, giving you complete control over how documents are signed and managed.

-

Is airSlate SignNow compliant with legal standards for eSigning?

Yes, airSlate SignNow adheres to various legal standards and regulations for eSigning, ensuring that processes related to 'Credit For Contributions Made Or' are compliant. Our platform meets both U.S. and international eSignature laws, providing you with confidence in the legal validity of your signed documents.

Get more for Credit For Contributions Made Or

Find out other Credit For Contributions Made Or

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document