Credit for Contributions Made or Form

What is the Credit For Contributions Made Or

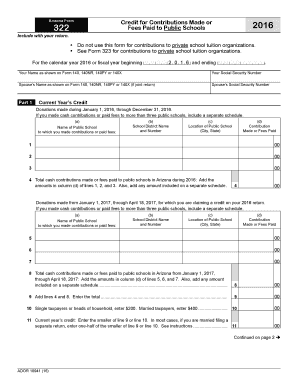

The Credit For Contributions Made Or is a specific tax credit available to eligible taxpayers who make contributions to certain organizations or funds. This credit is designed to incentivize charitable giving and support various causes that benefit the community. Understanding the eligibility criteria and the types of contributions that qualify is essential for maximizing potential tax benefits.

How to use the Credit For Contributions Made Or

To effectively use the Credit For Contributions Made Or, taxpayers must first determine their eligibility based on the types of contributions they have made. Eligible contributions may include donations to qualified charities, educational institutions, or specific funds designated for public benefit. Once eligibility is confirmed, the taxpayer should complete the appropriate tax form, ensuring all necessary information is accurately provided to claim the credit on their tax return.

Steps to complete the Credit For Contributions Made Or

Completing the Credit For Contributions Made Or involves several key steps:

- Gather documentation for all contributions made during the tax year.

- Verify that the organizations receiving contributions are qualified under IRS guidelines.

- Fill out the appropriate tax form, including the section for the credit.

- Attach any required supporting documents, such as receipts or acknowledgment letters from the organizations.

- Review the completed form for accuracy before submission.

Legal use of the Credit For Contributions Made Or

The legal use of the Credit For Contributions Made Or is governed by IRS regulations. Taxpayers must adhere to specific guidelines to ensure that their contributions qualify for the credit. This includes maintaining accurate records of contributions and ensuring that the organizations they support are recognized as tax-exempt under Section 501(c)(3) of the Internal Revenue Code. Failure to comply with these regulations may result in the denial of the credit during tax assessment.

Eligibility Criteria

To qualify for the Credit For Contributions Made Or, taxpayers must meet certain eligibility criteria, including:

- Being a resident of the United States.

- Making contributions to eligible organizations as defined by the IRS.

- Filing a tax return that includes the appropriate forms for claiming the credit.

Required Documents

When claiming the Credit For Contributions Made Or, taxpayers should prepare and submit several required documents:

- Receipts or acknowledgment letters from the organizations receiving contributions.

- Completed tax forms that include the credit section.

- Any additional documentation requested by the IRS to verify eligibility.

Quick guide on how to complete credit for contributions made or 394714980

Complete [SKS] effortlessly on any device

Web-based document handling has become popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can find the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Credit For Contributions Made Or

Create this form in 5 minutes!

How to create an eSignature for the credit for contributions made or 394714980

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the 'Credit For Contributions Made Or' feature in airSlate SignNow?

The 'Credit For Contributions Made Or' feature in airSlate SignNow allows users to manage and track credits effectively for contributions made during document transactions. This feature ensures that businesses can maintain accurate records, thereby enhancing transparency and accountability in their operations.

-

How does airSlate SignNow handle pricing for credits?

Pricing for credits in airSlate SignNow is designed to be flexible and cost-effective. Depending on your organization's needs, you can choose from various plans that provide different levels of access to the 'Credit For Contributions Made Or' feature, ensuring you only pay for what you need.

-

Can I integrate the 'Credit For Contributions Made Or' system with other software?

Yes, airSlate SignNow seamlessly integrates with various business applications to enhance your workflow. By connecting with existing software, you can streamline processes related to the 'Credit For Contributions Made Or' feature and improve overall efficiency.

-

What are the key benefits of using airSlate SignNow for documenting credits?

Using airSlate SignNow for documenting credits provides several benefits, including easy tracking of contributions and user-friendly eSigning capabilities. The 'Credit For Contributions Made Or' feature ensures clarity in transactions, ultimately helping businesses to minimize disputes and enhance relationships with clients.

-

Is there customer support available for 'Credit For Contributions Made Or' queries?

Yes, airSlate SignNow offers robust customer support to assist with any inquiries regarding the 'Credit For Contributions Made Or' feature. Our support team is available via various channels to help you navigate any issues you may face, ensuring you can maximize the benefits of our platform.

-

How can 'Credit For Contributions Made Or' enhance my business process?

Implementing the 'Credit For Contributions Made Or' feature in airSlate SignNow can signNowly enhance your business processes by improving documentation accuracy. This leads to better decision-making and fosters trust with clients, as they can easily verify the contributions made during transactions.

-

What types of documents can I eSign that involve credits?

airSlate SignNow allows you to eSign a variety of documents that may involve credits, including contracts, invoices, and contribution agreements. Utilizing the 'Credit For Contributions Made Or' feature ensures that all relevant transactions are captured accurately in your documentation.

Get more for Credit For Contributions Made Or

Find out other Credit For Contributions Made Or

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online