Arizona Form 140PY Arizona Department of Revenue

What is the Arizona Form 140PY Arizona Department Of Revenue

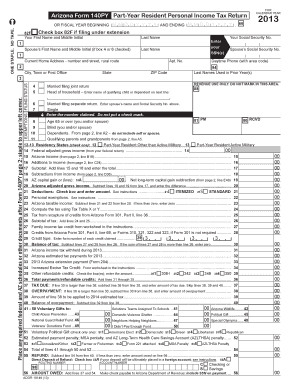

The Arizona Form 140PY is a state tax return form specifically designed for part-year residents of Arizona. This form allows individuals who have lived in Arizona for only part of the tax year to report their income, deductions, and credits accurately. It is essential for ensuring that taxpayers pay the correct amount of state tax based on the income earned while residing in Arizona.

Part-year residents must provide information regarding their total income, the portion earned while living in Arizona, and any applicable deductions or credits. This form is crucial for compliance with state tax laws and helps in determining the taxpayer's overall tax liability.

How to use the Arizona Form 140PY Arizona Department Of Revenue

Using the Arizona Form 140PY involves several steps to ensure accurate completion and submission. First, gather all necessary documents, including W-2s, 1099s, and any other income statements for the period you resided in Arizona. Next, calculate your total income and determine the portion earned while living in the state.

Once you have your income details, fill out the form by entering your information in the appropriate sections. Be sure to include any deductions or credits you qualify for, as these can significantly affect your tax liability. After completing the form, review it for accuracy before submitting it to the Arizona Department of Revenue.

Steps to complete the Arizona Form 140PY Arizona Department Of Revenue

Completing the Arizona Form 140PY involves a systematic approach to ensure all information is accurate and complete. Follow these steps:

- Gather necessary documents, including income statements and records of deductions.

- Calculate your total income for the year and identify the income earned while residing in Arizona.

- Fill out the form, starting with your personal information, including your name, address, and Social Security number.

- Report your total income and the portion earned in Arizona in the designated sections.

- Include any deductions or credits applicable to your situation.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form electronically or via mail to the Arizona Department of Revenue by the specified deadline.

Legal use of the Arizona Form 140PY Arizona Department Of Revenue

The Arizona Form 140PY is legally recognized as a valid document for reporting tax obligations for part-year residents. To ensure its legal validity, the form must be completed accurately and submitted on time, adhering to Arizona tax laws. Electronic signatures are accepted, provided they comply with the legal standards set forth by the ESIGN Act and UETA.

Filing this form correctly is essential to avoid penalties and ensure compliance with state regulations. Taxpayers should retain copies of their submitted forms and any supporting documents for their records, as these may be needed for future reference or audits.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Arizona Form 140PY. Typically, the deadline for submitting this form aligns with the federal tax return deadline, which is usually April 15. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day.

Taxpayers should also be aware of any extensions that may apply. If additional time is needed to prepare the form, a request for an extension can be filed, but it is essential to pay any estimated taxes due by the original deadline to avoid penalties.

Required Documents

To complete the Arizona Form 140PY accurately, several documents are required. These include:

- W-2 forms from employers for income earned during the year.

- 1099 forms for any freelance or contract work.

- Records of any deductions or credits you plan to claim.

- Proof of residency in Arizona for the relevant portion of the year.

- Any other income statements relevant to your tax situation.

Having these documents ready will facilitate a smoother filing process and help ensure that all income and deductions are reported accurately.

Quick guide on how to complete arizona form 140py arizona department of revenue

Easily Prepare Arizona Form 140PY Arizona Department Of Revenue on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, enabling you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the features required to create, edit, and electronically sign your documents promptly without any holdups. Manage Arizona Form 140PY Arizona Department Of Revenue on any device with airSlate SignNow's apps for Android or iOS, and streamline any document-related process today.

How to Edit and Electronically Sign Arizona Form 140PY Arizona Department Of Revenue Effortlessly

- Find Arizona Form 140PY Arizona Department Of Revenue and hit Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Arizona Form 140PY Arizona Department Of Revenue to ensure excellent communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140py arizona department of revenue

The best way to generate an e-signature for your PDF in the online mode

The best way to generate an e-signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an e-signature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an e-signature for a PDF document on Android OS

People also ask

-

What is the Arizona Form 140PY and why is it important?

The Arizona Form 140PY is a tax return form used by part-year residents of Arizona to report their income and calculate their tax liability to the Arizona Department of Revenue. It's essential for ensuring compliance with state tax laws and accurately reporting your financial information.

-

How does airSlate SignNow simplify the process of submitting the Arizona Form 140PY?

airSlate SignNow simplifies the process by allowing you to electronically sign and send your Arizona Form 140PY securely and efficiently. With its user-friendly interface, you can quickly complete and manage your documentation without any hassle.

-

Is there a cost associated with using airSlate SignNow to file the Arizona Form 140PY?

Yes, airSlate SignNow offers affordable pricing plans that suit various business needs. You'll find that the cost of using this service is a cost-effective solution for managing your Arizona Form 140PY submissions while ensuring compliance with the Arizona Department of Revenue.

-

Can airSlate SignNow integrate with other software I use for tax preparation?

Absolutely! airSlate SignNow supports multiple integrations with popular tax preparation software, making it easier for you to manage your Arizona Form 140PY alongside your financial documents. This ensures a seamless workflow that enhances productivity.

-

What features does airSlate SignNow offer for securely managing the Arizona Form 140PY?

airSlate SignNow boasts robust security features, including encryption and secure storage, which are essential for managing sensitive documents like the Arizona Form 140PY. You can trust that your information is safe while using our platform to handle your tax returns.

-

How easy is it to use airSlate SignNow for the Arizona Form 140PY?

Using airSlate SignNow for the Arizona Form 140PY is very straightforward. The platform offers an intuitive interface that allows you to upload, fill out, and eSign your documents quickly, making the tax filing process stress-free.

-

Can I use airSlate SignNow for other forms besides the Arizona Form 140PY?

Yes, you can use airSlate SignNow for a variety of forms beyond just the Arizona Form 140PY. This flexibility allows you to streamline all your document signing and management tasks in one convenient solution.

Get more for Arizona Form 140PY Arizona Department Of Revenue

- Non marital cohabitation living together agreement montana form

- Paternity case package establishment of paternity montana form

- Paternity law and procedure handbook montana form

- Bill of sale in connection with sale of business by individual or corporate seller montana form

- Petition for dissolution of marriage no children montana form

- Montana social security form

- Office lease agreement montana form

- Temporary restraining order 497316278 form

Find out other Arizona Form 140PY Arizona Department Of Revenue

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure