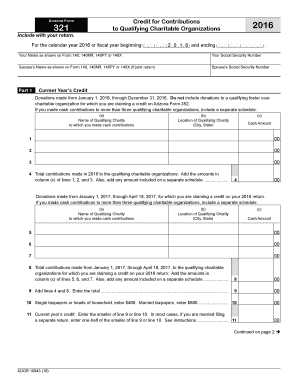

Arizona Form 321 Credit for Contributions to Qualifying Charitable Organizations

What is the Arizona Form 321 Credit for Contributions to Qualifying Charitable Organizations

The Arizona Form 321 is a tax credit form that allows individuals to receive a dollar-for-dollar credit on their Arizona state income tax for contributions made to qualifying charitable organizations. This form is designed to encourage charitable giving within the state, benefiting both taxpayers and the communities they support. The credit is applicable to donations made to organizations that provide assistance to individuals and families in need, focusing on areas such as health care, education, and housing.

How to Use the Arizona Form 321 Credit for Contributions to Qualifying Charitable Organizations

To utilize the Arizona Form 321 credit, taxpayers must first ensure that their contributions are made to qualifying organizations listed by the Arizona Department of Revenue. After making a donation, individuals should complete the form by entering their personal information, the amount donated, and details about the organization. It is crucial to retain receipts or documentation of the contributions, as these may be required for verification purposes when filing taxes.

Steps to Complete the Arizona Form 321 Credit for Contributions to Qualifying Charitable Organizations

Completing the Arizona Form 321 involves several straightforward steps:

- Gather necessary information, including personal identification details and donation receipts.

- Obtain the Arizona Form 321 from the Arizona Department of Revenue website or through tax preparation software.

- Fill out the form by providing your name, Social Security number, and the total amount of contributions made.

- List the qualifying organizations to which you contributed, including their names and the amounts donated.

- Review the completed form for accuracy, ensuring all required fields are filled.

- Submit the form along with your Arizona state tax return.

Eligibility Criteria for the Arizona Form 321 Credit for Contributions to Qualifying Charitable Organizations

To qualify for the Arizona Form 321 credit, taxpayers must meet specific eligibility criteria. Contributions must be made to organizations that are recognized as qualifying charitable entities by the Arizona Department of Revenue. Additionally, the contributions must not exceed the maximum allowable limits set by the state. Taxpayers should also ensure that they are filing their Arizona state income tax returns to claim the credit effectively.

Required Documents for the Arizona Form 321 Credit for Contributions to Qualifying Charitable Organizations

When claiming the Arizona Form 321 credit, taxpayers must prepare several important documents:

- Receipts or proof of contributions made to qualifying charitable organizations.

- A completed Arizona Form 321, accurately reflecting the contributions.

- Arizona state income tax return, where the credit will be applied.

Filing Deadlines for the Arizona Form 321 Credit for Contributions to Qualifying Charitable Organizations

Filing deadlines for the Arizona Form 321 credit align with the general deadlines for Arizona state income tax returns. Typically, individual taxpayers must file their returns by April 15. It is essential to ensure that contributions are made within the tax year for which the credit is being claimed. Taxpayers should also be aware of any extensions that may apply to their specific situations.

Quick guide on how to complete form 321

Complete form 321 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-conscious substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without hold-ups. Manage form 321 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to edit and eSign form 321 without hassle

- Obtain form 321 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight signNow sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as an ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign form 321 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 321

Create this form in 5 minutes!

How to create an eSignature for the form 321

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

How to generate an e-signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask form 321

-

What is form 321 in airSlate SignNow?

Form 321 in airSlate SignNow is a customizable document template designed to streamline the eSigning process. It allows users to create, send, and manage documents efficiently, ensuring that all signatures are captured securely and promptly.

-

How can I create a form 321 using airSlate SignNow?

To create a form 321 in airSlate SignNow, simply log into your account, select 'Create Document,' and choose the form 321 template. You can then customize fields, add your branding, and prepare it for eSigning.

-

What are the pricing options for using form 321 on airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs when using form 321. You can choose from monthly or annual subscription plans that provide unlimited eSigning and finance flow capabilities tailored to your business size.

-

What features come with form 321 on airSlate SignNow?

Form 321 on airSlate SignNow includes features such as customizable templates, secure cloud storage, multiple signing options, and automated reminders. These features enhance the user experience and optimize document workflow.

-

How does form 321 benefit businesses?

Form 321 benefits businesses by simplifying document management and accelerating the signing process. It minimizes manual errors, speeds up approvals, and provides a professional way to manage contracts and agreements digitally.

-

Can I integrate other tools with form 321 in airSlate SignNow?

Yes, airSlate SignNow allows integration with various applications to enhance the functionality of form 321. You can seamlessly connect it with CRM systems, document management software, and automation tools to streamline your workflow.

-

Is form 321 secure for confidential documents?

Absolutely! Form 321 in airSlate SignNow is built with robust security measures including encryption and authentication protocols. This ensures that your confidential documents are protected throughout the signing process.

Get more for form 321

Find out other form 321

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim