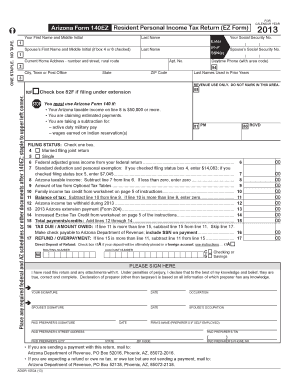

Arizona Form 140EZ Resident Personal Income Tax Return EZ Form Last Name Spouse S First Name and Middle Initial If Box 4 or 6 Ch

Understanding the Arizona Form 140EZ

The Arizona Form 140EZ is a simplified state income tax return specifically designed for residents with straightforward tax situations. This form is intended for individuals who meet certain eligibility criteria, including filing status and income limits. It allows taxpayers to report their income, claim deductions, and determine their tax liability in a streamlined manner. The 140EZ is particularly beneficial for those who do not have complex financial situations, making it easier to complete and submit.

Steps to Complete the Arizona Form 140EZ

Completing the Arizona Form 140EZ involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2 forms and any other income statements. Next, follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your filing status and any applicable exemptions.

- Report your total income, including wages, interest, and any other sources.

- Claim any deductions you are eligible for, such as the standard deduction.

- Calculate your tax liability using the tax tables provided.

- Sign and date the form before submitting it.

Ensure all entries are accurate to avoid delays or penalties.

Eligibility Criteria for the Arizona Form 140EZ

To qualify for using the Arizona Form 140EZ, taxpayers must meet specific eligibility criteria. These include:

- Filing as a single or married couple with no dependents.

- Having a total income below the threshold set by the Arizona Department of Revenue.

- Not claiming certain credits or deductions that require a more complex form.

Reviewing these criteria before starting the form can save time and ensure compliance with state tax laws.

Legal Use of the Arizona Form 140EZ

The Arizona Form 140EZ is legally recognized for filing state income taxes, provided it is completed accurately and submitted on time. Electronic signatures are valid, ensuring that the form can be submitted digitally without the need for physical paperwork. Compliance with state tax regulations is essential, as failure to adhere to filing requirements can result in penalties or interest on unpaid taxes.

Form Submission Methods for the Arizona Form 140EZ

Taxpayers have multiple options for submitting the Arizona Form 140EZ. These methods include:

- Online Submission: Use the Arizona Department of Revenue's online portal to file electronically.

- Mail: Print the completed form and send it to the designated tax office address.

- In-Person: Visit a local tax office for assistance and to submit the form directly.

Selecting the appropriate submission method can enhance the efficiency of the filing process and ensure timely processing of your tax return.

Filing Deadlines for the Arizona Form 140EZ

Filing deadlines for the Arizona Form 140EZ typically align with federal tax deadlines. Generally, individual taxpayers must submit their returns by April fifteenth each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines to avoid late fees or penalties.

Quick guide on how to complete arizona form 140ez resident personal income tax return ez form last name spouse s first name and middle initial if box 4 or 6

Manage Arizona Form 140EZ Resident Personal Income Tax Return EZ Form Last Name Spouse S First Name And Middle Initial if Box 4 Or 6 Ch effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Arizona Form 140EZ Resident Personal Income Tax Return EZ Form Last Name Spouse S First Name And Middle Initial if Box 4 Or 6 Ch on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

How to modify and eSign Arizona Form 140EZ Resident Personal Income Tax Return EZ Form Last Name Spouse S First Name And Middle Initial if Box 4 Or 6 Ch effortlessly

- Locate Arizona Form 140EZ Resident Personal Income Tax Return EZ Form Last Name Spouse S First Name And Middle Initial if Box 4 Or 6 Ch and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your requirements in document management in just a few clicks from any device you prefer. Modify and eSign Arizona Form 140EZ Resident Personal Income Tax Return EZ Form Last Name Spouse S First Name And Middle Initial if Box 4 Or 6 Ch and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140ez resident personal income tax return ez form last name spouse s first name and middle initial if box 4 or 6

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an e-signature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an e-signature for a PDF on Android

People also ask

-

What is the AZ 140EZ printable form?

The AZ 140EZ printable form is a simplified tax form designed for Arizona residents with straightforward tax situations. This form helps users efficiently report their taxable income and claim applicable deductions without complicated calculations.

-

How can I use the AZ 140EZ printable form with airSlate SignNow?

You can easily upload the AZ 140EZ printable form to airSlate SignNow for electronic signing and submission. Our platform allows you to send the form to recipients for eSignature, ensuring that all parties can complete it conveniently and securely.

-

Is there a cost associated with using the AZ 140EZ printable form feature?

Using the AZ 140EZ printable form through airSlate SignNow is part of our overall service, which offers competitive pricing plans. Depending on the plan you choose, you can utilize features for eSigning forms without additional costs specifically for processing the AZ 140EZ printable form.

-

What are the key benefits of using airSlate SignNow for the AZ 140EZ printable form?

Using airSlate SignNow for the AZ 140EZ printable form provides several benefits, including convenience, security, and efficiency. You can electronically sign documents from any device, reducing the need for physical paperwork while ensuring compliance with legal standards.

-

Can I integrate airSlate SignNow with other applications while using the AZ 140EZ printable form?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage your AZ 140EZ printable form alongside other business tools. This integration can streamline your workflow by connecting with CRM systems, cloud storage, and more.

-

Is airSlate SignNow secure for handling the AZ 140EZ printable form?

Absolutely! airSlate SignNow uses advanced encryption and security protocols to ensure that all signed documents, including the AZ 140EZ printable form, are protected against unauthorized access. Your data safety is our top priority.

-

How do I start using the AZ 140EZ printable form feature in airSlate SignNow?

To start using the AZ 140EZ printable form feature, simply sign up for an account on airSlate SignNow, upload your form, and begin sending it for signatures. Our user-friendly interface guides you through each step, making the process hassle-free.

Get more for Arizona Form 140EZ Resident Personal Income Tax Return EZ Form Last Name Spouse S First Name And Middle Initial if Box 4 Or 6 Ch

Find out other Arizona Form 140EZ Resident Personal Income Tax Return EZ Form Last Name Spouse S First Name And Middle Initial if Box 4 Or 6 Ch

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form