Colorado Fiduciary Income Tax Filing Guide Colorado Gov Colorado Form

Understanding the Colorado Fiduciary Income Tax Filing Guide

The Colorado Fiduciary Income Tax Filing Guide is a crucial resource for fiduciaries managing the income tax obligations of estates and trusts in Colorado. This guide outlines the specific requirements and processes involved in filing fiduciary income tax returns. It provides detailed information on how to report income, deductions, and credits that apply to fiduciary entities. Understanding these elements is essential for ensuring compliance with state tax laws and avoiding potential penalties.

Steps to Complete the Colorado Fiduciary Income Tax Filing Guide

Completing the Colorado Fiduciary Income Tax Filing Guide involves several key steps:

- Gather necessary documents, including income statements, deductions, and any relevant tax forms.

- Review the instructions provided in the guide to understand the specific requirements for your situation.

- Fill out the required forms accurately, ensuring all information is complete and correct.

- Calculate the taxable income and any applicable credits or deductions.

- Submit the completed forms either online or by mail, depending on your preference and the options available.

Key Elements of the Colorado Fiduciary Income Tax Filing Guide

Several key elements are essential when utilizing the Colorado Fiduciary Income Tax Filing Guide:

- Fiduciary Responsibilities: Understanding the legal obligations of fiduciaries in managing and reporting income.

- Tax Rates: Familiarity with the current tax rates applicable to fiduciary entities in Colorado.

- Deductions and Credits: Identifying available deductions and credits that can reduce the overall tax liability.

- Filing Deadlines: Awareness of important deadlines to ensure timely submission of tax returns.

Legal Use of the Colorado Fiduciary Income Tax Filing Guide

The legal use of the Colorado Fiduciary Income Tax Filing Guide is vital for ensuring that fiduciaries meet their tax obligations. The guide serves as an official document that outlines the legal requirements for filing fiduciary income taxes. Adhering to the guidelines helps protect fiduciaries from legal repercussions and ensures that all tax filings are compliant with state laws.

Filing Deadlines and Important Dates

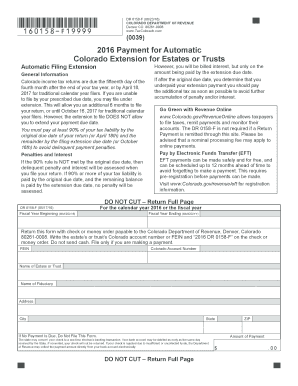

It is essential to be aware of the filing deadlines associated with the Colorado Fiduciary Income Tax Filing Guide. Typically, fiduciary income tax returns are due on the 15th day of the fourth month following the close of the tax year. For estates and trusts, this means that the deadline is often April 15, unless it falls on a weekend or holiday. Keeping track of these dates helps avoid late fees and penalties.

Form Submission Methods

Fiduciaries have several options for submitting the Colorado Fiduciary Income Tax Filing Guide. These methods include:

- Online Submission: Many fiduciaries prefer to file electronically for convenience and speed.

- Mail: Paper forms can be printed and mailed to the appropriate tax authority.

- In-Person: Some may choose to deliver their forms directly to a local tax office.

Required Documents for Filing

To complete the Colorado Fiduciary Income Tax Filing Guide, certain documents are required. These typically include:

- Income statements for the estate or trust.

- Records of any deductions or credits being claimed.

- Previous tax returns, if applicable.

- Any supporting documentation that substantiates the reported income and expenses.

Quick guide on how to complete colorado fiduciary income tax

Effortlessly Prepare colorado fiduciary income tax on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents promptly without any delays. Manage colorado fiduciary income tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and Electronically Sign colorado fiduciary income tax

- Obtain colorado fiduciary income tax and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and select the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign colorado fiduciary income tax and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to colorado fiduciary income tax

Create this form in 5 minutes!

How to create an eSignature for the colorado fiduciary income tax

The way to create an e-signature for your PDF file online

The way to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

How to create an e-signature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an e-signature for a PDF on Android devices

People also ask colorado fiduciary income tax

-

What is Colorado fiduciary income tax?

Colorado fiduciary income tax refers to the tax imposed on the income earned by trusts and estates in the state of Colorado. This tax is calculated based on the net income of the trust or estate, and it is important for fiduciaries to understand these obligations in order to comply accurately with state laws.

-

How does airSlate SignNow help with managing Colorado fiduciary income tax documents?

airSlate SignNow provides an efficient way to manage and sign documents related to Colorado fiduciary income tax. Our platform allows users to create, send, and eSign necessary tax forms easily, ensuring a smoother process for fiduciaries handling tax obligations.

-

What features of airSlate SignNow support Colorado fiduciary income tax compliance?

Key features of airSlate SignNow that support Colorado fiduciary income tax compliance include customizable templates, secure eSignatures, and audit trails. These features ensure that all necessary documents are compliant and accessible for fiduciaries managing taxes on behalf of estates.

-

Is airSlate SignNow cost-effective for handling Colorado fiduciary income tax?

Yes, airSlate SignNow is a cost-effective solution for handling Colorado fiduciary income tax processes. By streamlining document management and eSigning, businesses save both time and money, allowing them to focus on important financial matters without breaking the bank.

-

Can I integrate airSlate SignNow with accounting software used for Colorado fiduciary income tax?

Absolutely! airSlate SignNow offers integrations with various accounting software that can help in managing Colorado fiduciary income tax obligations. This allows for seamless data transfer and efficient handling of tax-related documents within your existing systems.

-

What benefits does airSlate SignNow offer for managing fiduciary taxes in Colorado?

Using airSlate SignNow for managing fiduciary taxes in Colorado offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved compliance. Our user-friendly interface makes it easy to navigate tax processes while ensuring all documents are signed and stored securely.

-

Are there any training resources available for using airSlate SignNow to manage Colorado fiduciary income tax?

Yes, airSlate SignNow provides comprehensive training resources, including tutorials and webinars, to help users efficiently manage Colorado fiduciary income tax. These resources ensure that fiduciaries are well-prepared to utilize our platform effectively for all their tax documentation needs.

Get more for colorado fiduciary income tax

- Abc 243 form

- Qme form 315 state of california dir ca

- Flc livescan request form

- Hair salons agreement for apprenticeship form

- Ia mileage form

- How do i fill out request for exemption from mandatory electronic fingerprint form

- Pedicure log form

- Weekly summary of hours of experience california bbs ca form

Find out other colorado fiduciary income tax

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free