Supplemental Schedule CT 1040WH Form

What is the Supplemental Schedule CT 1040WH

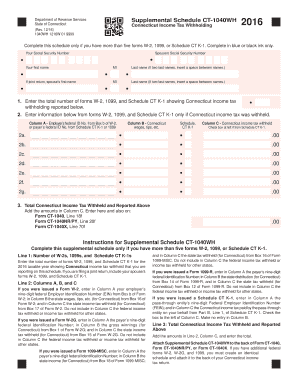

The Supplemental Schedule CT 1040WH is a tax form used by residents of Connecticut to report their withholding tax information. This form is specifically designed to assist taxpayers in calculating the amount of state income tax withheld from their wages or other income sources. By accurately completing this form, individuals can ensure they meet their tax obligations and potentially receive a refund if too much tax has been withheld throughout the year.

How to use the Supplemental Schedule CT 1040WH

To use the Supplemental Schedule CT 1040WH effectively, taxpayers must first gather all relevant income documents, including W-2 forms and any other statements indicating income received. The form requires you to input details about your total income, the amount withheld, and any adjustments that may apply. This information helps determine your overall tax liability and ensures that the correct amount of tax has been paid to the state.

Steps to complete the Supplemental Schedule CT 1040WH

Completing the Supplemental Schedule CT 1040WH involves several key steps:

- Gather all necessary documents, such as W-2 forms and 1099 statements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Indicate the total amount of state tax withheld as shown on your income documents.

- Make any necessary adjustments based on credits or other deductions.

- Review the completed form for accuracy before submission.

Legal use of the Supplemental Schedule CT 1040WH

The Supplemental Schedule CT 1040WH is legally binding when completed accurately and submitted on time. It complies with state tax laws and regulations, ensuring that taxpayers fulfill their obligations to the Connecticut Department of Revenue Services. To maintain legal validity, it is essential to provide truthful information and retain copies of submitted forms for personal records.

Filing Deadlines / Important Dates

Filing deadlines for the Supplemental Schedule CT 1040WH typically align with the federal tax filing deadlines. For most taxpayers, this means the form must be submitted by April 15 of the year following the tax year in question. It is crucial to stay informed about any changes to deadlines or extensions that may be announced by the Connecticut Department of Revenue Services.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Supplemental Schedule CT 1040WH through various methods. The form can be filed online via the Connecticut Department of Revenue Services website, allowing for a quick and efficient submission process. Alternatively, individuals may choose to mail their completed form to the appropriate address provided by the state or submit it in person at designated offices. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Quick guide on how to complete ct 1040wh

Handle ct 1040wh with ease on any gadget

Digital document management has gained traction among companies and individuals alike. It offers a sustainable alternative to conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage ct 1040wh on any gadget using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The simplest way to alter and electronically sign ct 1040wh effortlessly

- Find ct 1040wh and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information thoroughly and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, and mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign ct 1040wh and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ct 1040wh

Create this form in 5 minutes!

How to create an eSignature for the ct 1040wh

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask ct 1040wh

-

What is the ct 1040wh form and how does it relate to airSlate SignNow?

The ct 1040wh form is a withholding tax form used in Connecticut for individual income tax. airSlate SignNow simplifies the process of signing and sending this form electronically, ensuring a fast and secure method to manage your tax documents.

-

How does airSlate SignNow help with filling out the ct 1040wh form?

With airSlate SignNow, users can easily fill out the ct 1040wh form using our intuitive interface. The platform offers pre-built templates and guided filling options to ensure accuracy, making tax season a breeze.

-

Is there a fee associated with using airSlate SignNow for the ct 1040wh form?

airSlate SignNow offers competitive pricing plans that cater to various user needs when handling the ct 1040wh form. Whether you are an individual or a business, our plans are designed to be cost-effective and affordable, starting with a free trial to get you started.

-

What features does airSlate SignNow offer for eSigning the ct 1040wh form?

airSlate SignNow provides a range of features for eSigning the ct 1040wh form, including secure electronic signatures, real-time tracking of document status, and customizable workflows. These features ensure that you can sign and send your tax forms efficiently and securely.

-

Can airSlate SignNow integrate with other software for managing the ct 1040wh form?

Yes, airSlate SignNow integrates seamlessly with various applications, enabling users to connect with their favorite tools and streamline their workflow when handling the ct 1040wh form. This means you can easily integrate with popular accounting or tax software for enhanced efficiency.

-

What benefits does airSlate SignNow offer for businesses using the ct 1040wh form?

Businesses using the ct 1040wh form can benefit from improved efficiency, reduced processing times, and enhanced security with airSlate SignNow. Our platform provides a user-friendly experience that helps organizations manage their tax documents with confidence.

-

How secure is airSlate SignNow for submitting the ct 1040wh form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and comply with industry standards to ensure that your ct 1040wh form and personal information are always protected during transmission and storage.

Get more for ct 1040wh

- California earthquake authority form

- Solar reflectance index sri calculation worksheet sri ws energy ca form

- Cf1r ncb 01 e form

- Committee meeting minutes california state board of equalization boe ca form

- Fg1313a california fish and game commission state of california fgc ca form

- International certificate of good health form 77 043

- 190 form

- H apps formflow forms chp809frp printing california chp ca

Find out other ct 1040wh

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free