Sc 1040 Schedule Nr Form 2017

What is the Sc 1040 Schedule Nr Form

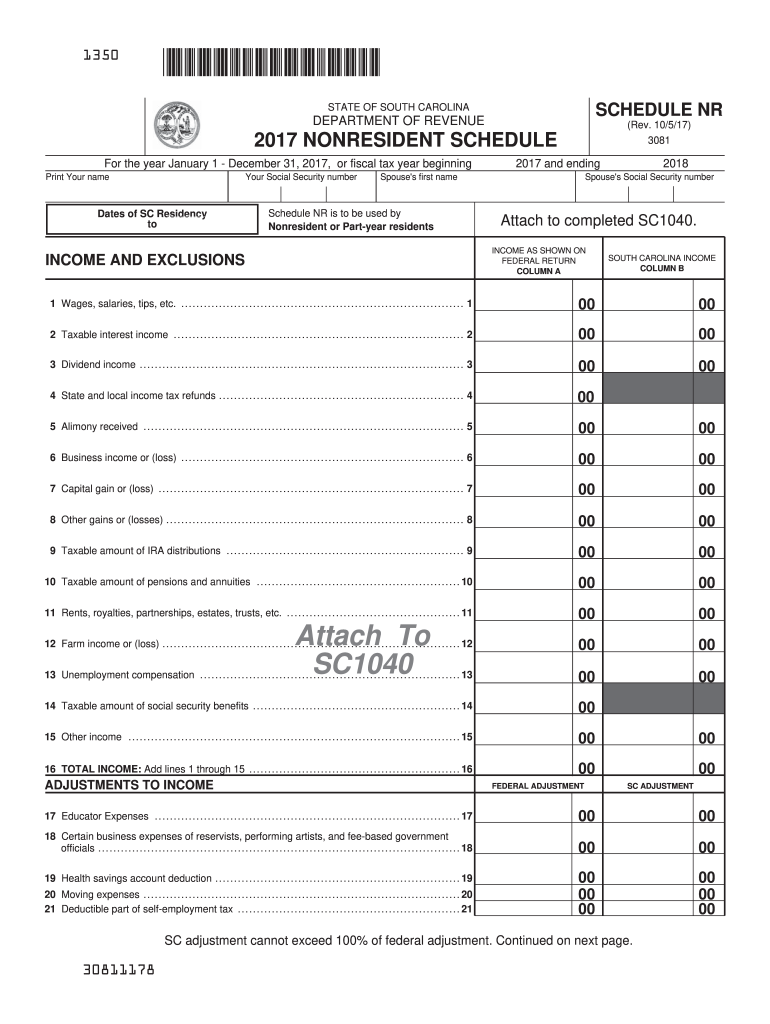

The Sc 1040 Schedule Nr Form is a tax document used by residents of South Carolina to report income that is not subject to state income tax. This form is specifically designed for individuals who have income from sources that are exempt from state taxation. Understanding this form is crucial for ensuring compliance with state tax regulations.

How to use the Sc 1040 Schedule Nr Form

To use the Sc 1040 Schedule Nr Form, taxpayers must first gather all necessary financial information, including income statements and documentation of exempt sources. The form requires individuals to list their income, specify the type of income, and provide supporting details. It is essential to fill out the form accurately to avoid any issues with the South Carolina Department of Revenue.

Steps to complete the Sc 1040 Schedule Nr Form

Completing the Sc 1040 Schedule Nr Form involves several steps:

- Gather all relevant income documentation, including W-2s and 1099s.

- Identify the sources of income that qualify for exemption from state taxation.

- Fill in personal information at the top of the form, including your name and Social Security number.

- List all exempt income sources in the designated sections of the form.

- Review the form for accuracy before submission.

Legal use of the Sc 1040 Schedule Nr Form

The Sc 1040 Schedule Nr Form is legally recognized by the South Carolina Department of Revenue for reporting exempt income. It is important to ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties or audits. Taxpayers should retain copies of the completed form and any supporting documents for their records.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Sc 1040 Schedule Nr Form. Typically, the deadline for submitting this form coincides with the federal tax return deadline, which is usually April fifteenth. However, it is advisable to check for any updates or extensions that may apply in a given tax year.

Form Submission Methods (Online / Mail / In-Person)

The Sc 1040 Schedule Nr Form can be submitted through various methods:

- Online: Taxpayers can complete and submit the form electronically through the South Carolina Department of Revenue's online portal.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Individuals may also choose to deliver the form in person at their local Department of Revenue office.

Quick guide on how to complete sc 1040 schedule nr 2016 2017 form

Your assistance manual on how to prepare your Sc 1040 Schedule Nr Form

If you’re curious about how to generate and transmit your Sc 1040 Schedule Nr Form, here are some brief guidelines on how to make tax submission easier.

To get started, you simply need to establish your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, create, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to amend information as necessary. Streamline your tax processes with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Sc 1040 Schedule Nr Form in just a few minutes:

- Set up your account and start working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; navigate through editions and schedules.

- Click Get form to access your Sc 1040 Schedule Nr Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and rectify any errors.

- Save alterations, print your copy, send it to your recipient, and download it to your device.

Refer to this guide to file your taxes online with airSlate SignNow. Please remember that submitting on paper can increase errors and delay refunds. Of course, before electronically filing your taxes, review the IRS website for declaration guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct sc 1040 schedule nr 2016 2017 form

FAQs

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How could I reduce 2017 income using 2016 expenses on buying the land and how correctly show the expences in 1040 and its schedules? How could I make repayments from business account to me and my friend including interest? What taxes should be paid?

You can only use expenses made in the tax year you are using them for. 2016 expenses can only be used on a 2016 tax return.Generally, repayments to yourself from your business would be considered repayment of a loan you gave to your company. You can only take off the interest as an expense from a loan, so unless you charged yourself interest, which you have to prove, you can’t take it as a deduction for your business. You can take the money out of the business, but you can’t use it as a tax right off. If you did charge your company interest for your loan to the company, you will have to pay taxes for the income you received (the interest) on your personal taxes. It would probably be better for you not to charge interest to the company. As for your friend, if he is also a part owner, it wouldn’t really make sense for him to charge interest, but if he isn’t, you can do that, but you will probably need to issue him a 1099 if the interest was more than $600.00. Right now, if you issue a 1099 for 2017, you will owe a $100 penalty for late issuance (1099s had to be filed by January 2017.)

Create this form in 5 minutes!

How to create an eSignature for the sc 1040 schedule nr 2016 2017 form

How to generate an electronic signature for the Sc 1040 Schedule Nr 2016 2017 Form in the online mode

How to generate an electronic signature for the Sc 1040 Schedule Nr 2016 2017 Form in Chrome

How to generate an eSignature for putting it on the Sc 1040 Schedule Nr 2016 2017 Form in Gmail

How to create an electronic signature for the Sc 1040 Schedule Nr 2016 2017 Form straight from your smart phone

How to generate an electronic signature for the Sc 1040 Schedule Nr 2016 2017 Form on iOS

How to create an electronic signature for the Sc 1040 Schedule Nr 2016 2017 Form on Android devices

People also ask

-

What is the SC 1040 Schedule NR Form?

The SC 1040 Schedule NR Form is a document used by non-residents to report their income and calculate their tax liability in South Carolina. It's essential for anyone earning income in the state but who does not reside there. Completing this form accurately ensures compliance with South Carolina tax laws.

-

How can airSlate SignNow help me with the SC 1040 Schedule NR Form?

AirSlate SignNow simplifies the process of completing and signing the SC 1040 Schedule NR Form by providing an easy-to-use platform for document creation and eSignature. With our solution, you can quickly fill out the form, gather required signatures, and submit your tax documents securely and efficiently.

-

Is airSlate SignNow cost-effective for managing the SC 1040 Schedule NR Form?

Yes, airSlate SignNow offers a cost-effective solution for managing your SC 1040 Schedule NR Form. Our pricing plans are designed to cater to businesses of all sizes, allowing you to save on operational costs while ensuring your documents are handled with care and precision.

-

What features does airSlate SignNow offer for the SC 1040 Schedule NR Form?

AirSlate SignNow provides numerous features that enhance the handling of the SC 1040 Schedule NR Form, including customizable templates, secure cloud storage, and real-time tracking of document statuses. These features streamline your workflow, making it easier to manage tax documents from anywhere.

-

Can I integrate airSlate SignNow with other software for the SC 1040 Schedule NR Form?

Absolutely! AirSlate SignNow integrates seamlessly with various applications, allowing you to work on the SC 1040 Schedule NR Form alongside your favorite tools. This integration capability enhances productivity by letting you connect with CRM systems, cloud storage, and accounting software.

-

How does eSigning the SC 1040 Schedule NR Form work with airSlate SignNow?

eSigning the SC 1040 Schedule NR Form with airSlate SignNow is a straightforward process. After completing the form, you can invite signers to review and sign electronically, ensuring the process is fast and legally binding. All signatures are securely stored for your records.

-

What benefits do I gain from using airSlate SignNow for the SC 1040 Schedule NR Form?

Using airSlate SignNow for the SC 1040 Schedule NR Form offers numerous benefits, including improved efficiency in document handling, enhanced security for sensitive information, and reduced turnaround times for signatures. This leads to a smoother tax filing process and peace of mind.

Get more for Sc 1040 Schedule Nr Form

- Form 8903

- Ancient rome revision cloze exercise fill in the blanks form

- Printable st 556 form 100068947

- Blank nco reports form

- Bbs weekly summary of hours 203292829 form

- Ap1 form application for admission to primary and post primary schools

- Working time directive opt out agreement form

- Application form for school place manchester city council

Find out other Sc 1040 Schedule Nr Form

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form