Sc 1120s 2018

What is the SC 1120S?

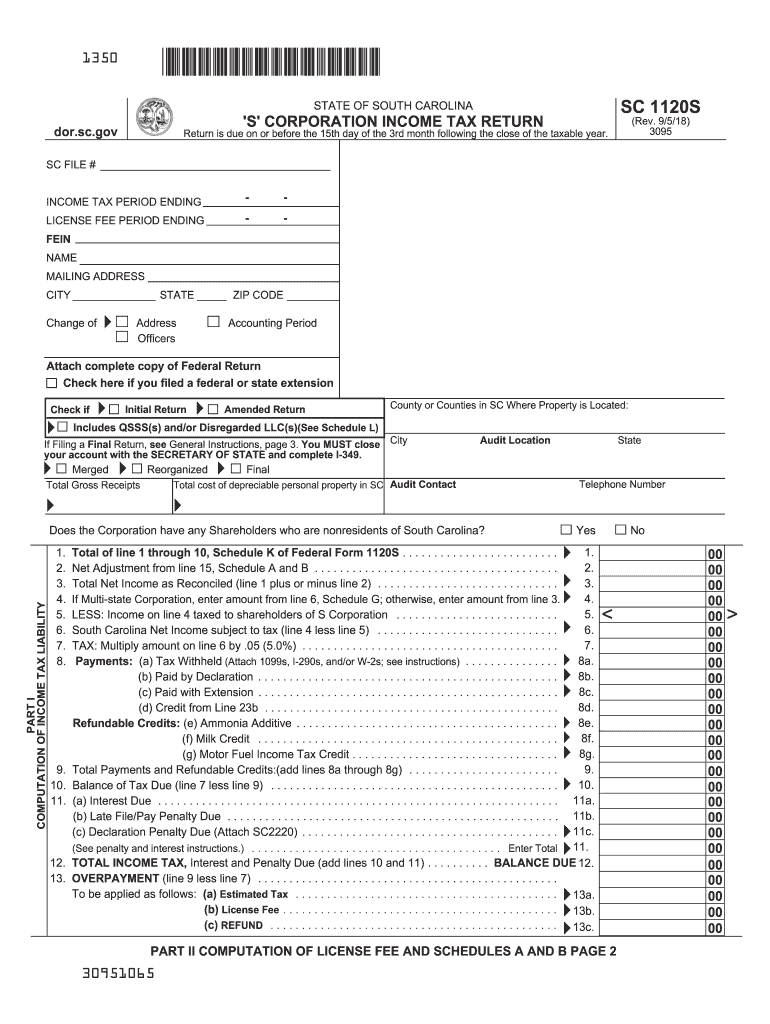

The SC 1120S is a tax form used by S corporations in South Carolina to report income, deductions, and credits. This form is essential for businesses that have elected to be taxed as S corporations under the Internal Revenue Code. The SC 1120S allows these corporations to pass income, losses, and deductions through to shareholders, who then report this information on their individual tax returns. Understanding the SC 1120S is crucial for compliance with state tax regulations and for ensuring accurate tax reporting.

How to Use the SC 1120S

Using the SC 1120S involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with the required information, such as business income, deductions, and credits. Be mindful of the specific instructions provided for each section of the form. Once completed, review the form for accuracy before submitting it to the South Carolina Department of Revenue. Utilizing a fillable version of the SC 1120S can streamline this process, allowing for easier data entry and error checking.

Steps to Complete the SC 1120S

Completing the SC 1120S requires careful attention to detail. Start by entering your business's basic information, including the name, address, and federal employer identification number (EIN). Next, report total income by summarizing revenue from all sources. Deduct allowable expenses, such as operating costs and salaries, to arrive at the net income. Ensure that you include any applicable credits and adjustments. Finally, sign and date the form, and keep a copy for your records. Each step is critical to ensure compliance and accuracy in your tax reporting.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the SC 1120S to avoid penalties. Typically, the form is due on the fifteenth day of the third month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the due date is March 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Keeping track of these important dates helps ensure timely submission and compliance with state regulations.

Legal Use of the SC 1120S

The SC 1120S must be used in accordance with South Carolina tax laws. This form is legally binding and should be filled out accurately to reflect the corporation's financial activities. Misrepresentation or failure to file can result in penalties, including fines and interest on unpaid taxes. It is advisable for businesses to consult with tax professionals to ensure that they are adhering to all legal requirements when completing and submitting the SC 1120S.

Required Documents

To complete the SC 1120S, certain documents are necessary. These typically include financial statements, such as profit and loss statements, balance sheets, and records of income and expenses. Additionally, any supporting documentation for deductions and credits claimed on the form should be gathered. Having these documents ready will facilitate a smoother completion process and help ensure that the information reported is accurate and complete.

Quick guide on how to complete sc 1120s 2018 2019 form

Your assistance manual on how to prepare your Sc 1120s

If you’re eager to learn how to create and submit your Sc 1120s, here are a few concise guidelines to simplify the tax submission process.

To begin, simply register for your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an intuitive and robust document solution that enables you to modify, generate, and complete your income tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures, and easily revert to make changes where necessary. Optimize your tax handling with enhanced PDF editing, eSigning, and convenient sharing features.

Follow the instructions below to complete your Sc 1120s in just a few minutes:

- Establish your account and start editing PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Obtain form to open your Sc 1120s in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Signature Tool to insert your legally-binding eSignature (if required).

- Review your document and correct any mistakes.

- Save your revisions, print a copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper submissions may lead to increased errors and delays in refunds. Be sure to verify filing regulations in your state on the IRS website before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct sc 1120s 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the Rai Publication Scholarship Form 2019?

Rai Publication Scholarship Exam 2019- Rai Publication Scholarship Form 5th, 8th, 10th & 12th.Rai Publication Scholarship Examination 2019 is going to held in 2019 for various standards 5th, 8th, 10th & 12th in which interested candidates can apply for the following scholarship examination going to held in 2019. This scholarship exam is organized by the Rai Publication which will held only in Rajasthan in the year 2019. Students can apply for the following scholarship examination 2019 before the last date of application that is 15 January 2019. The exam will be conducted district wise in Rajasthan State by the Rai Publication before June 2019.Students of class 5th, 8th, 10th and 12th can fill online registration for Rai Publication scholarship exam 2019. Exam is held in February in all districts of Rajasthan. Open registration form using link given below.In the scholarship examination, the scholarship will be given to the 20 topper students from each standard of 5th, 8th, 10th & 12th on the basis of lottery which will be equally distributed among all 20 students. The declaration of the prize will be announced by July 2019.राय पब्लिकेशन छात्रव्रत्ति परीक्षा का आयोजन सत्र 2019 में किया जाएगा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए, इच्छुक अभ्यार्थी आवेदन कर सकते है इस छात्रव्रत्ति परीक्षा 2019 के लिए | यह छात्रव्रत्ति परीक्षा राजस्थान में राइ पब्लिकेशन के दवारा की जयगी सत्र 2019 में | इच्छुक अभ्यार्थी एक परीक्षा कर सकते है आखरी तारीख 15 जनवरी 2019 से पहले | यह परिखा राजस्थान छेत्र में जिला स्तर पर कराई जाएगी राइ पब्लिकेशन के दवारा जून 2019 से पहले |इस छात्रव्रत्ति परीक्षा में, छात्रव्रत्ति 20 विजेता छात्र छात्राओं दो दी जयेगी जिसमे हर कक्षा के 20 छात्र होंगे जिन्हे बराबरी में बाटा जयेगा। पुरस्कार की घोसणा जुलाई 2019 में की जयेगी |Rai Publication Scholarship Exam 2019 information :This scholarship examination is conducted for 5th, 8th, 10th & 12th standard for which interested candidates can apply which a great opportunity for the students. The exam syllabus will be based according to the standards of their exam which might help them in scoring in the Rai Publication Scholarship Examination 2019. The question in the exam will be multiple choice questions (MCQ’s) and there will be 100 multiple choice questions. To apply for the above scholarship students must have to fill the application form but the 15 January 2019.यह छात्रव्रत्ति परीक्षा कक्षा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए आयोजित है जिसमे इच्छुक अभ्यार्थी पंजीकरण करा सकते है जोकि छात्र छात्राओं के लिए एक बड़ा अवसर होगा | राय पब्लिकेशन छात्रव्रत्ति परीक्षा 2019 परीक्षा का पाठ्यक्रम कक्षा अनुसार ही होगा जोकि उन्हें प्राथम आने में सहयोग प्रदान करेगा | परीक्षा के प्रश्न-पत्र में सारे प्रश्न बहुविकल्पीय प्रश्न होंगे एवं प्रश्न-पत्र में कुल 100 प्रश्न दिए जायेंगे | इस छात्रव्रत्ति परीक्षा को देने क लिए अभयार्थियो को पहले पंजीकरण करना अनिवार्य होगा जोकि ऑनलाइन होगा जिसकी आखरी तारीख 15 जनवरी 2019 है |Distribution of Rai Publication Deskwork Scholarship Exam 2019:5th Class Topper Prize Money:- 4 Lakh Rupees8th Class Topper Prize Money:- 11 Lakh Rupees10th Class Topper Prize Money:- 51 Lakh Rupees12thClass Topper Prize Money:- 39 Lakh RupeesHow to fill Rai Publication Scholarship Form 2019 :Follow the above steps to register for the for Rai Publication Scholarship Examination 2019:Candidates can follow these below given instructions to apply for the scholarship exam of Rai Publication.The Rai Publication Scholarship application form is available in the news paper (Rajasthan Patrika.) You can also download it from this page. It also can be downloaded from the last page of your desk work.Application form is also given on the official website of Rai Publication: Rai Publication - Online Book Store for REET RPSC RAS SSC Constable Patwar 1st 2nd Grade TeacherNow fill the details correctly in the application form.Now send the application form to the head office of Rai Publication.Rai Publication Website Link Click HereHead Office Address of Rai PublicationShop No: -24 & 25, Bhagwan Das Market, Chaura Rasta, Jaipur, RajasthanPIN Code:- 302003Contact No.- 0141 232 1136Source : Rai Publication Scholarship Exam 2019

-

How do I fill out the IGNOU admission form for the B.Sc in physics 2019 July session?

Now-a-days admission in IGNOU is very easy. Everything is online now.. you have to visit IGNOU website for the same. Go to admission section and follow step by step process to fill online application form.

Create this form in 5 minutes!

How to create an eSignature for the sc 1120s 2018 2019 form

How to make an eSignature for the Sc 1120s 2018 2019 Form online

How to make an eSignature for your Sc 1120s 2018 2019 Form in Google Chrome

How to make an eSignature for signing the Sc 1120s 2018 2019 Form in Gmail

How to generate an electronic signature for the Sc 1120s 2018 2019 Form right from your mobile device

How to create an eSignature for the Sc 1120s 2018 2019 Form on iOS devices

How to generate an electronic signature for the Sc 1120s 2018 2019 Form on Android OS

People also ask

-

What is the SC 1120S fillable form and why is it important?

The SC 1120S fillable form is a tax document used by S corporations to report income, deductions, and credits. It is crucial for ensuring accurate tax filings and compliance with state regulations. Using the fillable format facilitates easier completion and electronic submission, saving time and minimizing errors.

-

How can airSlate SignNow help with completing the SC 1120S fillable form?

airSlate SignNow offers a user-friendly, fillable form feature that allows users to easily complete the SC 1120S fillable form electronically. The platform enables businesses to input their information directly into the form and save their progress, enhancing efficiency and accuracy in tax preparation.

-

Is there a cost associated with using the SC 1120S fillable form through airSlate SignNow?

While accessing the SC 1120S fillable form is included with airSlate SignNow's subscription plans, pricing may vary depending on the features you choose. Our plans are designed to be cost-effective, catering to businesses of all sizes. For specific pricing details, visit our pricing page.

-

What are the benefits of using airSlate SignNow for the SC 1120S fillable form?

Using airSlate SignNow for the SC 1120S fillable form offers several benefits, including streamlined document management, enhanced security, and quick e-signature capabilities. This means you can easily gather signatures and send completed forms without hassle, reducing the time spent on tedious paperwork.

-

Can I integrate airSlate SignNow with other software for managing the SC 1120S fillable form?

Yes, airSlate SignNow supports integrations with various software solutions that can help manage your SC 1120S fillable form. This includes cloud storage services and accounting tools, which help centralize your documents and improve workflow efficiency. Check our integrations page for a full list of compatible applications.

-

Is the SC 1120S fillable form compliant with state regulations when using airSlate SignNow?

Yes, when you use the SC 1120S fillable form on airSlate SignNow, it is designed to meet the necessary compliance standards required by state tax authorities. Our platform regularly updates forms to ensure they remain current with changing regulations, giving you peace of mind during tax season.

-

How secure is my information when using the SC 1120S fillable form in airSlate SignNow?

airSlate SignNow prioritizes the security of your information, employing advanced encryption technology to protect your data while you fill out the SC 1120S fillable form. Additionally, our platform includes robust authentication measures to ensure that only authorized users can access sensitive documents.

Get more for Sc 1120s

- Ditch witch manual pdf form

- Isf form 100294167

- Horry county hospitality tax form 17028263

- Insert new ptc banner contact details telephones email etc form

- Medication administration record mar chart audit new devon ccg form

- Single sourcing justification approval form

- Practice made perfect a complete guide to veterinary form

- Newborn screening information for providers blood spot

Find out other Sc 1120s

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word