Schedule NR, Nonresident and Part?Year Resident Computation of Illinois Tax Nonresident and Part?Year Resident Computation of Il Form

What is the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax?

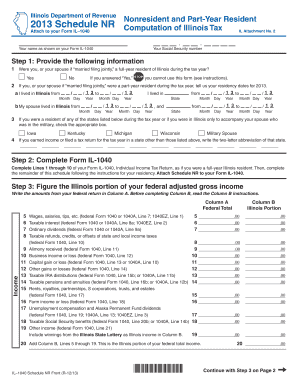

The Schedule NR is a crucial form used for calculating Illinois tax obligations for nonresidents and part-year residents. This form helps individuals determine their taxable income and the amount of tax owed to the state based on their residency status during the tax year. It is essential for those who earn income in Illinois but do not reside there full-time, as well as for individuals who may have moved in or out of the state during the year.

How to use the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax

Using the Schedule NR involves several steps to ensure accurate completion. Taxpayers must first gather all relevant income documents, including W-2 forms and any 1099s. Once the necessary information is collected, individuals will fill out the form, reporting income earned while in Illinois and any applicable deductions. It is important to follow the instructions carefully to avoid errors that could lead to delays in processing or potential penalties.

Steps to complete the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax

Completing the Schedule NR requires a systematic approach:

- Gather all income documentation, including W-2s and 1099 forms.

- Determine your residency status for the tax year.

- Fill out the form by reporting income earned in Illinois and any deductions applicable to your situation.

- Review the completed form for accuracy before submission.

- Submit the form by the appropriate deadline, either electronically or by mail.

Legal use of the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax

The Schedule NR is legally recognized for tax reporting purposes in Illinois. It must be completed accurately to ensure compliance with state tax laws. Failure to file this form correctly can result in penalties or interest on unpaid taxes. It is advisable to maintain records of all submitted forms and documentation in case of audits or inquiries from the Illinois Department of Revenue.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines when filing the Schedule NR. The general deadline for filing individual income tax returns in Illinois is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to check for any specific extensions or changes announced by the Illinois Department of Revenue each tax year.

Required Documents

To complete the Schedule NR, individuals will need several documents, including:

- W-2 forms for income earned in Illinois.

- 1099 forms for any freelance or contract work.

- Records of any other income sources relevant to the tax year.

- Documentation for any deductions or credits being claimed.

Penalties for Non-Compliance

Failing to file the Schedule NR or inaccuracies in reporting can lead to significant penalties. The Illinois Department of Revenue may impose fines for late filing or underpayment of taxes. Additionally, interest may accrue on any unpaid taxes, further increasing the total amount owed. It is crucial to file on time and ensure all information is accurate to avoid these consequences.

Quick guide on how to complete 2013 schedule nr nonresident and partyear resident computation of illinois tax nonresident and partyear resident computation of

Prepare Schedule NR, Nonresident And Part?Year Resident Computation Of Illinois Tax Nonresident And Part?Year Resident Computation Of Il effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents quickly without delays. Handle Schedule NR, Nonresident And Part?Year Resident Computation Of Illinois Tax Nonresident And Part?Year Resident Computation Of Il on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign Schedule NR, Nonresident And Part?Year Resident Computation Of Illinois Tax Nonresident And Part?Year Resident Computation Of Il with minimal effort

- Obtain Schedule NR, Nonresident And Part?Year Resident Computation Of Illinois Tax Nonresident And Part?Year Resident Computation Of Il and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your eSignature with the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Schedule NR, Nonresident And Part?Year Resident Computation Of Illinois Tax Nonresident And Part?Year Resident Computation Of Il and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2013 schedule nr nonresident and partyear resident computation of illinois tax nonresident and partyear resident computation of

The way to generate an e-signature for a PDF file in the online mode

The way to generate an e-signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an e-signature from your smartphone

The way to create an e-signature for a PDF file on iOS devices

How to generate an e-signature for a PDF file on Android

People also ask

-

What is the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax?

The Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax is a form used by individuals who earn income in Illinois but do not reside there full-time. This schedule helps calculate the tax owed to Illinois for the income generated during the time spent in the state. Understanding this computation is essential for compliance and can help optimize your tax obligations.

-

How can airSlate SignNow assist with filling out the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax?

airSlate SignNow provides users with tools to easily fill out, manage, and eSign documents, including the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax. Its user-friendly interface and document management features streamline the administrative tasks related to tax filing, ensuring accuracy and efficiency in completing your tax obligations.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, such as the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax, offers numerous benefits. It enhances the document workflow process, reduces errors through electronic input, and ensures secure, legally binding signatures. Additionally, it provides tracking features, allowing you to monitor the progress of your submissions.

-

Are there any costs associated with using airSlate SignNow for Illinois tax computations?

Yes, airSlate SignNow operates on a subscription model with various pricing tiers, suitable for different business needs. The costs are competitive, especially considering the value provided in terms of speed and efficiency for managing documents like the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax. Potential users can review the pricing structure on our website to find the option that fits their budget.

-

Can I integrate airSlate SignNow with other business tools?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, including CRM and project management tools. This allows you to efficiently manage your documentation processes, including the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax, alongside your other workflows. Integration enhances productivity and ensures all your tools work together effectively.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that sensitive tax documents, including the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax, are protected. We implement strong encryption protocols and adhere to best practices in data protection to safeguard your information. You can trust that your documents are managed securely.

-

What kind of support does airSlate SignNow provide for users with tax filing questions?

airSlate SignNow offers robust customer support, including resources like FAQs, tutorials, and live support, to assist users with any questions related to tax filing, including using the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax. Our dedicated support team is available to guide you through any challenges you may encounter, ensuring a smooth user experience.

Get more for Schedule NR, Nonresident And Part?Year Resident Computation Of Illinois Tax Nonresident And Part?Year Resident Computation Of Il

- Declaration trust agreement form

- North carolina trust form

- Deed trust form nc

- Condominium lease agreement with option to purchase and rent payments to apply to purchase price rent to own condo rental north form

- Money deed trust purchase form

- Quitclaim deed two individuals to one individual north carolina form

- General warranty deed 497316836 form

- Quitclaim deed individual to a trust north carolina form

Find out other Schedule NR, Nonresident And Part?Year Resident Computation Of Illinois Tax Nonresident And Part?Year Resident Computation Of Il

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free