South Dakota Certificate of Exemption 2015-2026

What is the South Dakota Certificate of Exemption

The South Dakota Certificate of Exemption is a crucial document that allows businesses to claim exemption from sales tax on certain purchases. This form is primarily used by contractors who are involved in construction projects. By submitting this certificate, contractors can avoid paying sales tax on materials and supplies that will be used in the performance of their contracts. The exemption is designed to support the construction industry and facilitate economic growth within the state.

How to Use the South Dakota Certificate of Exemption

To effectively use the South Dakota Certificate of Exemption, businesses must first ensure they qualify for the exemption. Once eligibility is confirmed, the contractor must complete the form accurately, providing necessary details such as the purchaser's name, address, and the nature of the project. After filling out the certificate, it should be presented to the supplier at the time of purchase. This allows the supplier to exempt the sales tax from the transaction, thereby reducing costs for the contractor.

Steps to Complete the South Dakota Certificate of Exemption

Completing the South Dakota Certificate of Exemption involves several straightforward steps:

- Obtain the form from a reliable source, ensuring it is the most current version.

- Fill in the required fields, including the name and address of the purchaser and the type of exemption being claimed.

- Specify the project details, including the location and nature of the work.

- Sign and date the form to validate it.

- Provide the completed certificate to the supplier at the time of purchase.

Eligibility Criteria

Eligibility for the South Dakota Certificate of Exemption is generally limited to contractors engaged in construction activities. To qualify, the contractor must be registered with the state and must be purchasing materials that will be incorporated into a construction project. It is essential for contractors to understand the specific criteria outlined by the South Dakota Department of Revenue to avoid any compliance issues.

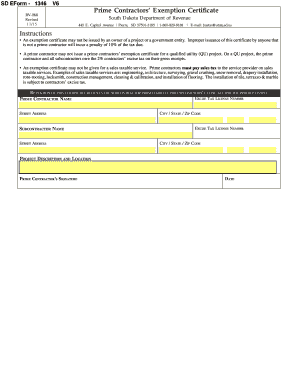

Key Elements of the South Dakota Certificate of Exemption

The South Dakota Certificate of Exemption includes several key elements that are vital for its validity:

- Purchaser Information: The name and address of the contractor or business claiming the exemption.

- Project Details: Information about the construction project for which the exemption is being claimed.

- Signature: The signature of the purchaser or an authorized representative is required to authenticate the form.

- Date: The date of completion of the form is essential for record-keeping and compliance purposes.

Form Submission Methods

The South Dakota Certificate of Exemption can be submitted in various ways, depending on the supplier's preferences. Typically, the completed form is presented directly to the supplier at the time of purchase. Some suppliers may also accept the form via email or fax, but it is crucial to confirm the acceptable submission methods with the supplier beforehand. Maintaining a copy of the submitted certificate is advisable for the contractor's records.

Quick guide on how to complete south dakota exemption certificate 2015 2019 form

Your assistance manual on how to prepare your South Dakota Certificate Of Exemption

If you’re curious about how to generate and submit your South Dakota Certificate Of Exemption, here are a few straightforward instructions to ease your tax filing process.

To start, simply register your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an extremely user-friendly and robust document platform that allows you to modify, draft, and finalize your tax papers seamlessly. Utilizing its editing features, you can toggle between text, checkboxes, and eSignatures, and return to modify responses as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing capabilities.

Follow these steps to complete your South Dakota Certificate Of Exemption in just a few minutes:

- Create your account and begin editing PDFs in minutes.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Select Get form to access your South Dakota Certificate Of Exemption in our editor.

- Input the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to apply your legally-recognized eSignature (if needed).

- Examine your document and rectify any errors.

- Save changes, print your version, submit it to your recipient, and download it to your device.

Refer to this guide for electronically filing your taxes with airSlate SignNow. Be aware that paper submissions may lead to errors in returns and prolong reimbursement processes. Moreover, before e-filing your taxes, verify the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct south dakota exemption certificate 2015 2019 form

FAQs

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

How long does a landlord in South Dakota have to return a damage deposit after I have been flooded out? I have not stayed in my apt since Mar 14, 2019.

I’m not sure about the legal requirement, but as a tenant, I would make sure that the landlord has no excuses. You should send (with delivery confirmation) a written request to the landlord which includes the following:Request for return of security/damage depositReason request is being made (My apartment is uninhabitable due to flood, therefore I have permanently moved out as of (date) and I am no longer in possession of the keys which I have returned to you, etc.)$ amountMake check payable to (your name)Send check to (mailing address)Once the landlord is in possession of this letter, he/she cannot claim ignorance. You can start counting the days from when the letter was delivered (you have confirmation from the postal service). When you find out the legal requirement for return of your money, follow up with legal action on the appropriate date (probably small claims court).

Create this form in 5 minutes!

How to create an eSignature for the south dakota exemption certificate 2015 2019 form

How to generate an electronic signature for your South Dakota Exemption Certificate 2015 2019 Form online

How to generate an eSignature for your South Dakota Exemption Certificate 2015 2019 Form in Chrome

How to generate an eSignature for signing the South Dakota Exemption Certificate 2015 2019 Form in Gmail

How to make an electronic signature for the South Dakota Exemption Certificate 2015 2019 Form straight from your smartphone

How to make an eSignature for the South Dakota Exemption Certificate 2015 2019 Form on iOS devices

How to make an eSignature for the South Dakota Exemption Certificate 2015 2019 Form on Android OS

People also ask

-

What is a prime contractors exemption certificate and why do I need it?

A prime contractors exemption certificate is a document that allows contractors to be exempt from certain taxes during the course of their work. This certificate is crucial for businesses to ensure compliance with tax regulations and to avoid unnecessary expenditures. Having a prime contractors exemption certificate can streamline your budgeting process and improve your financial management.

-

How does airSlate SignNow support the management of prime contractors exemption certificates?

airSlate SignNow provides a user-friendly platform that simplifies the process of sending and signing documents, including prime contractors exemption certificates. With customizable templates and easy-to-navigate features, managing these essential documents becomes hassle-free. Businesses can ensure that all necessary documentation is completed quickly and securely.

-

What are the pricing options for using airSlate SignNow for managing prime contractors exemption certificates?

airSlate SignNow offers competitive pricing plans that cater to a variety of business needs. You can choose from monthly or annual subscriptions, which include all features necessary for managing prime contractors exemption certificates. Additionally, a free trial may be available, allowing you to explore the platform before making a commitment.

-

Can I integrate airSlate SignNow with other software to manage prime contractors exemption certificates?

Yes, airSlate SignNow offers integrations with various business applications, including CRM and project management tools. This capability allows for seamless workflows and efficient management of prime contractors exemption certificates alongside other important documents. Integrating these tools can enhance operational efficiency and document accessibility.

-

What are the main benefits of using airSlate SignNow for prime contractors exemption certificates?

The primary benefits of using airSlate SignNow for managing prime contractors exemption certificates include enhanced document security, faster turnaround times, and improved compliance with tax regulations. The platform also offers real-time tracking and notifications, ensuring you never miss a deadline or signature. Overall, it's a cost-effective solution that streamlines workflows.

-

Is it safe to use airSlate SignNow for sensitive documents like prime contractors exemption certificates?

Absolutely, airSlate SignNow prioritizes security and compliance, employing industry-standard encryption and authentication measures. This ensures that sensitive documents, such as prime contractors exemption certificates, are protected from unauthorized access. You can confidently manage your documents with peace of mind.

-

How can I get support if I have questions about prime contractors exemption certificates?

airSlate SignNow provides comprehensive support options, including a robust help center, FAQs, and customer service representatives. If you have specific questions regarding prime contractors exemption certificates, the dedicated support team is available via chat, email, or phone to assist you. This ensures that you have the resources you need to navigate your documentation seamlessly.

Get more for South Dakota Certificate Of Exemption

- Va nurse 3 proficiency examples 55543617 form

- Form cn 1055 tennessee 138667

- Priority health provider change form

- Buffalo state eop income verification form form fill online

- Fl 610 answer to complaint or supplemental complaint regarding parental obligations governmental judicial council forms

- Inappropriate sample identification release form

- To apply for coverage download and complete the application form

- Instructionsresponse to family claim form f4 use

Find out other South Dakota Certificate Of Exemption

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form