Tx Tax Exemption Form 2017

What is the Texas Tax Exemption Form?

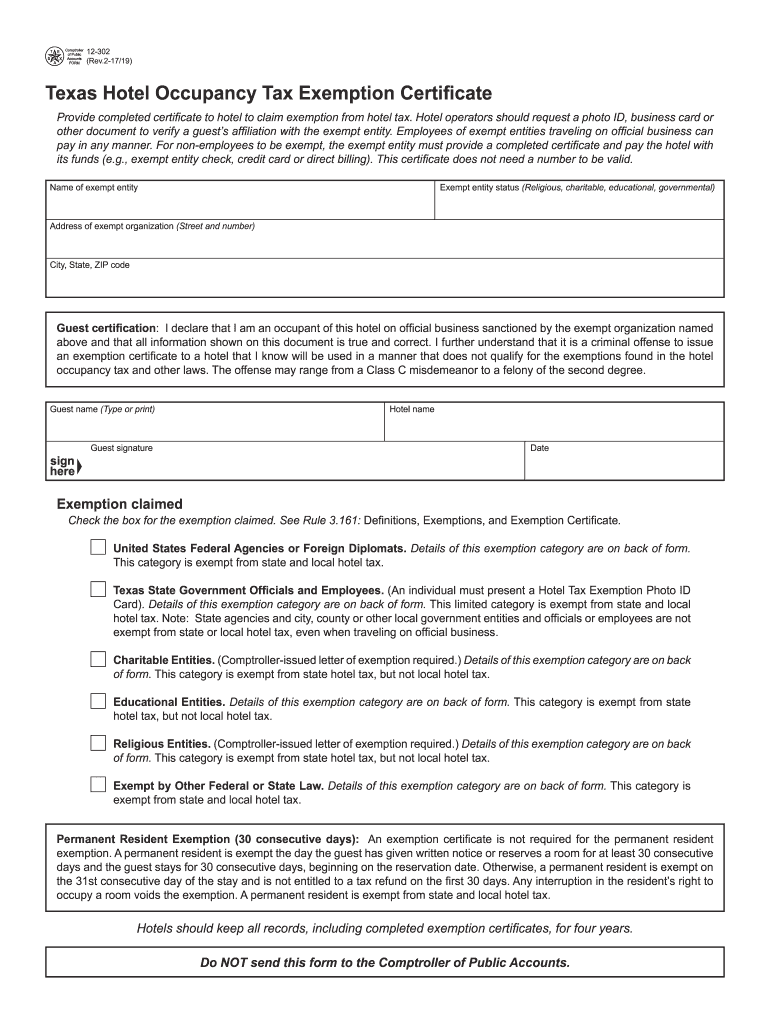

The Texas Tax Exemption Form, commonly referred to as the 12 302 form, is a document used by businesses and individuals to claim exemption from the hotel occupancy tax in Texas. This form is essential for those who qualify for exemption under specific circumstances, such as government entities, certain non-profit organizations, or individuals staying for specific purposes like medical treatment. Understanding the purpose of this form is crucial for ensuring compliance with Texas tax regulations and for avoiding unnecessary tax liabilities.

Steps to Complete the Texas Tax Exemption Form

Completing the Texas Tax Exemption Form involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including the name and address of the entity claiming the exemption, the reason for the exemption, and any relevant identification numbers. Next, fill out the form carefully, ensuring that all fields are completed accurately. After filling out the form, review it for any errors or omissions before signing and dating it. Finally, submit the completed form to the hotel or lodging provider to validate your tax-exempt status.

Eligibility Criteria for the Texas Tax Exemption Form

To qualify for the Texas Tax Exemption Form, certain eligibility criteria must be met. Generally, exemptions are available for government entities, non-profit organizations, and individuals who are traveling for specific purposes, such as medical care or educational activities. Each category has distinct requirements, such as providing proof of status or purpose for the stay. It is essential to review these criteria thoroughly to ensure that the exemption claim is valid and supported by the necessary documentation.

Legal Use of the Texas Tax Exemption Form

The legal use of the Texas Tax Exemption Form is defined by state law and tax regulations. This form must be used in accordance with the Texas Tax Code, which outlines the specific situations in which exemptions are permissible. Misuse of the form, such as claiming an exemption without meeting the legal criteria, can result in penalties, including fines or back taxes owed. Therefore, it is important to understand the legal implications and ensure that the form is used appropriately to avoid any compliance issues.

Form Submission Methods

The Texas Tax Exemption Form can be submitted through various methods, depending on the preferences of the lodging provider. Common submission methods include presenting the form in person at the hotel, sending it via email, or mailing a physical copy. Each method has its own advantages, such as immediate validation when submitted in person or the convenience of electronic submission. It is advisable to confirm the preferred method with the hotel to ensure that the exemption is processed correctly.

Required Documents for the Texas Tax Exemption Form

When submitting the Texas Tax Exemption Form, certain documents may be required to support the exemption claim. These documents can include proof of the entity's status, such as a government ID or non-profit certification, as well as any relevant identification numbers. Additionally, if the exemption is based on the purpose of the stay, documentation supporting that purpose, such as a medical referral or educational enrollment, may also be necessary. Ensuring that all required documents are included can facilitate a smoother approval process.

Quick guide on how to complete texas hotel tax exempt form 2017 2019

Your instructional manual on preparing your Tx Tax Exemption Form

If you're interested in learning how to create and submit your Tx Tax Exemption Form, here are some concise instructions on how to make tax filing simpler.

To commence, you just need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, draft, and finalize your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and revisit to adjust information as necessary. Streamline your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Tx Tax Exemption Form swiftly:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Obtain form to open your Tx Tax Exemption Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Use the Signature Tool to apply your legally-binding eSignature (if needed).

- Examine your document and rectify any inaccuracies.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Please be aware that paper submissions can lead to increased return inaccuracies and delays in reimbursements. Naturally, before electronically filing your taxes, verify the IRS website for declaring guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct texas hotel tax exempt form 2017 2019

FAQs

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

Create this form in 5 minutes!

How to create an eSignature for the texas hotel tax exempt form 2017 2019

How to generate an electronic signature for the Texas Hotel Tax Exempt Form 2017 2019 online

How to make an electronic signature for your Texas Hotel Tax Exempt Form 2017 2019 in Chrome

How to generate an electronic signature for signing the Texas Hotel Tax Exempt Form 2017 2019 in Gmail

How to generate an eSignature for the Texas Hotel Tax Exempt Form 2017 2019 straight from your smart phone

How to generate an eSignature for the Texas Hotel Tax Exempt Form 2017 2019 on iOS

How to create an electronic signature for the Texas Hotel Tax Exempt Form 2017 2019 on Android

People also ask

-

What is airSlate SignNow and how does it relate to 12 302?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents quickly and securely. The term '12 302' is frequently associated with enhancing document workflows, and airSlate SignNow plays a crucial role in simplifying these processes.

-

What features does airSlate SignNow offer for 12 302 compliance?

airSlate SignNow includes features such as secure document storage, customizable templates, and audit trails that help ensure compliance with 12 302 standards. These features are designed to streamline the eSigning process while maintaining the highest level of security.

-

How much does airSlate SignNow cost in relation to 12 302 services?

Pricing for airSlate SignNow varies based on the plan chosen, but it is known to be a cost-effective solution for businesses seeking compliance with 12 302. Organizations can choose from various plans that suit their budget and requirements, ensuring accessibility for all.

-

Can airSlate SignNow integrate with other tools to support 12 302 workflows?

Yes, airSlate SignNow offers various integrations with popular business applications that can help streamline 12 302 workflows. This allows users to automate processes and improve efficiency by connecting SignNow with their existing systems and tools.

-

What are the benefits of using airSlate SignNow for 12 302 eSigning?

Using airSlate SignNow for 12 302 eSigning provides numerous benefits, including enhanced speed, improved accuracy, and secure storage of documents. The platform’s user-friendly interface ensures that all users can easily navigate the eSigning process, leading to better productivity.

-

Is airSlate SignNow suitable for small businesses focusing on 12 302?

Absolutely! airSlate SignNow is designed to be a flexible solution for businesses of all sizes, including small businesses focused on 12 302 compliance. Its affordability and ease of use make it ideal for companies just starting with eSignature solutions.

-

How does airSlate SignNow ensure the security of documents related to 12 302?

airSlate SignNow utilizes advanced encryption and secure storage to protect documents, ensuring compliance with 12 302. With features like user authentication and detailed audit logs, businesses can confidently manage their sensitive information.

Get more for Tx Tax Exemption Form

- Golf tournament rules sheet template form

- Maricopa county superior court probate forms

- N95 voluntary respirator use form

- The document you are trying to load requires adobe 628151313 form

- Maintenance work order wo windfield co op windfieldcoop form

- Recognition of previous experience covenant health recognizes previous experience for the purposes of determining employees form

- Eligibility for funding form

- Donation form please fill out your personal inform

Find out other Tx Tax Exemption Form

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document