We Will Waive the Late Payment Penalty for Underpayment of Estimated Tax If You Timely Paid the Lesser of 100 Form

Understanding the Penalty for Underpayment of Estimated Tax

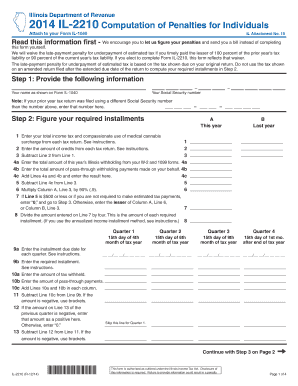

The penalty for underpayment of estimated tax is a financial consequence imposed by the IRS when taxpayers do not pay enough tax throughout the year. This can occur if individuals or businesses fail to make the required estimated tax payments, which are typically due quarterly. The IRS expects taxpayers to pay at least 90% of the current year’s tax liability or 100% of the previous year's tax liability, whichever is less, to avoid penalties.

How to Calculate the Penalty for Underpayment

To determine the penalty for underpayment of estimated tax, taxpayers can use IRS Form 2210. This form helps calculate the penalty based on the amount of tax owed and the payments made throughout the year. The penalty is calculated for each quarter that the estimated tax payment was underpaid. Taxpayers can avoid the penalty by ensuring that they meet the required payment thresholds, either through withholding or estimated payments.

IRS Guidelines on Estimated Tax Payments

The IRS provides specific guidelines regarding estimated tax payments. Taxpayers should review these guidelines to understand their obligations. Generally, individuals who expect to owe at least one thousand dollars in taxes after subtracting withholding and refundable credits must make estimated payments. The IRS outlines the payment schedule, which typically includes four quarterly payments due in April, June, September, and January of the following year.

Filing Deadlines for Estimated Tax Payments

Filing deadlines for estimated tax payments are crucial for avoiding penalties. The due dates for estimated tax payments are as follows:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Taxpayers should ensure that payments are made on or before these dates to avoid incurring penalties for underpayment.

Eligibility for Waiving the Penalty

Taxpayers may be eligible to have the penalty for underpayment of estimated tax waived if they meet certain criteria. This includes situations where the taxpayer can demonstrate that the underpayment was due to reasonable cause and not willful neglect. Additionally, if the taxpayer paid at least 90% of their current year's tax liability or 100% of their previous year's tax liability, they may qualify for a waiver. It is essential to document any claims for waiver properly.

Steps to Avoid the Penalty for Underpayment

To avoid the penalty for underpayment of estimated tax, taxpayers can take several proactive steps:

- Estimate your tax liability accurately based on current income.

- Make timely estimated tax payments according to IRS guidelines.

- Monitor your income throughout the year to adjust payments as necessary.

- Keep records of all payments made to ensure compliance.

By following these steps, taxpayers can minimize the risk of incurring penalties for underpayment.

Quick guide on how to complete penalty for underpayment of estimated tax

Prepare penalty for underpayment of estimated tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle penalty for underpayment of estimated tax on any platform with airSlate SignNow's Android or iOS applications and simplify any document-centric operation today.

The easiest way to edit and eSign penalty for underpayment of estimated tax without effort

- Find penalty for underpayment of estimated tax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you would like to send your form, either via email, text message (SMS), invite link, or download it to your computer.

Eliminate the problems of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign penalty for underpayment of estimated tax and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to penalty for underpayment of estimated tax

Create this form in 5 minutes!

How to create an eSignature for the penalty for underpayment of estimated tax

The way to generate an e-signature for your PDF document in the online mode

The way to generate an e-signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask penalty for underpayment of estimated tax

-

What is the penalty for underpayment of estimated tax?

The penalty for underpayment of estimated tax occurs when taxpayers fail to pay enough tax throughout the year, leading to underpayment penalties calculated by the IRS. To avoid this penalty, individuals should ensure they meet at least 90% of their current year tax liability or 100% of the previous year’s tax. Consulting with a tax professional could help clarify your obligations.

-

How can airSlate SignNow help with tax documents related to underpayment penalties?

AirSlate SignNow simplifies the process of sending and eSigning tax documents, making it easier to handle correspondence related to the penalty for underpayment of estimated tax. Our platform provides secure and trackable document management, ensuring you maintain compliance while addressing tax-related obligations. Sign documents easily and avoid potential delays in your tax submissions.

-

What features does airSlate SignNow offer to aid in tax compliance?

AirSlate SignNow offers features such as customizable templates, real-time tracking, and integrated workflows designed for efficient document handling. These features can assist users in managing the necessary documentation required to address any issues surrounding the penalty for underpayment of estimated tax, streamlining your compliance process. Simplifying the tax filing process can help mitigate potential penalties.

-

Is airSlate SignNow pricing competitive for small businesses?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to suit small businesses. By benefiting from these affordable solutions, small business owners can effectively manage their documentation needs and minimize the risk of incurring a penalty for underpayment of estimated tax. Investing in our platform gives you access to vital tools for maintaining compliance and efficiency.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! AirSlate SignNow easily integrates with various accounting software to help manage all aspects of your tax-related documents. This integration is crucial for tracking any potential issues related to the penalty for underpayment of estimated tax, as it allows for seamless document sharing and collaboration. Maximizing your technology can enhance your efficiency and compliance.

-

How does airSlate SignNow ensure document security for sensitive tax information?

AirSlate SignNow prioritizes document security through advanced encryption and compliance with data protection regulations. This ensures your sensitive tax documents, especially those related to the penalty for underpayment of estimated tax, are protected from unauthorized access. Our platform provides peace of mind that your information is safe and secure.

-

What support does airSlate SignNow provide for new users?

AirSlate SignNow offers comprehensive support for new users, including tutorials, FAQs, and customer service assistance. Our team is dedicated to helping you navigate any issues related to sending important documents, including those dealing with the penalty for underpayment of estimated tax. We aim to ensure you have the resources you need to effectively use our platform.

Get more for penalty for underpayment of estimated tax

- 1099 correctionduplicate request form ohio shared services

- Master report ohio board of embalmers and funeral directors funeral ohio form

- Ohleg gateway form

- Recordsohiosecretaryofstategov form

- Form 03en001e csed 1 okdhs

- 04af010e form

- Form 04af008e oklahoma department of human services okdhs

- 07lc002t form

Find out other penalty for underpayment of estimated tax

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile