L1 Form Louisiana 2018

What is the L1 Form Louisiana

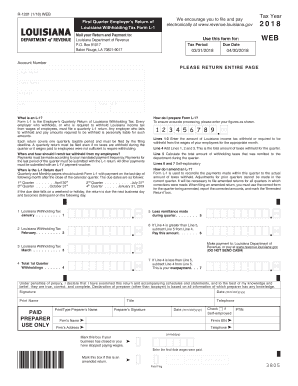

The L1 Form Louisiana is a tax document used by employers to report withholding taxes for employees. Specifically, it is utilized to report the amount of state income tax withheld from employee wages during a given quarter. The form is essential for compliance with Louisiana state tax laws and helps ensure that employers fulfill their tax obligations accurately. The L1 Form is particularly important for the fourth quarter of 2018, as it reflects the final withholding amounts for that tax year.

How to use the L1 Form Louisiana

To use the L1 Form Louisiana, employers must first gather all relevant payroll information for the quarter. This includes total wages paid to employees and the amount of state income tax withheld. Employers can fill out the form online or print it for manual completion. After entering the required information, the form must be submitted to the Louisiana Department of Revenue by the designated deadline. Proper completion of the form ensures that the employer remains compliant with state tax regulations.

Steps to complete the L1 Form Louisiana

Completing the L1 Form Louisiana involves several key steps:

- Gather all payroll records for the quarter, including total wages and withholding amounts.

- Access the L1 Form, either online or in printed format.

- Fill in the required fields accurately, ensuring that all figures reflect the actual amounts withheld.

- Review the completed form for accuracy to prevent any errors that could lead to penalties.

- Submit the form to the Louisiana Department of Revenue by the specified deadline.

Filing Deadlines / Important Dates

For the L1 Form Louisiana, employers must adhere to specific filing deadlines. The fourth quarter form is typically due by January 31 of the following year. It is crucial for employers to be aware of these dates to avoid late penalties. Additionally, any changes in state tax regulations may affect submission timelines, so staying informed is essential for compliance.

Required Documents

When completing the L1 Form Louisiana, employers should have the following documents on hand:

- Employee payroll records for the quarter.

- Documentation of state income tax withheld from employee wages.

- Previous L1 Forms, if applicable, for reference.

Having these documents readily available will streamline the completion process and ensure accuracy in reporting.

Penalties for Non-Compliance

Failure to file the L1 Form Louisiana by the deadline can result in significant penalties. Employers may face fines based on the amount of tax owed or a flat fee for late submissions. Additionally, non-compliance can lead to increased scrutiny from the Louisiana Department of Revenue, which may result in further audits or legal action. It is essential for employers to file on time to avoid these potential consequences.

Quick guide on how to complete l 1 tax 2018 2019 form

Your assistance manual on how to prepare your L1 Form Louisiana

If you’re interested in understanding how to finalize and submit your L1 Form Louisiana, here are some brief guidelines on how to make tax filing easier.

To begin, you simply need to set up your airSlate SignNow profile to change the way you handle documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to edit, draft, and complete your income tax forms effortlessly. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures, and return to modify information as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your L1 Form Louisiana in no time:

- Create your account and begin working on PDFs quickly.

- Use our directory to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to access your L1 Form Louisiana in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-binding eSignature (if required).

- Examine your document and fix any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes digitally with airSlate SignNow. Please be aware that filing on paper can increase return errors and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct l 1 tax 2018 2019 form

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

I am filling income tax return for AY 2018–19. How do I download ITR-1 form?

You can fill it online ate-Filing Home Page, Income Tax Department, Government of IndiaCreate a user id and file all your returns from here only. No need to do offline

-

How do I file tax exempted interest from PPF in the ITR 1 form for AY 2018-2019?

In form no 1 exempted income up to Rs.5,000/, can be filed. If the ecempted income is above Rs. 5,000/- then form no. 2 should be used. In case your exempted PPF interest is Rs. 5,000/- or below then there is a col in form no.1 where exempted income can be filled. This col is very small there for, please see very minutaly.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

Create this form in 5 minutes!

How to create an eSignature for the l 1 tax 2018 2019 form

How to make an eSignature for the L 1 Tax 2018 2019 Form in the online mode

How to create an eSignature for your L 1 Tax 2018 2019 Form in Chrome

How to make an electronic signature for putting it on the L 1 Tax 2018 2019 Form in Gmail

How to generate an electronic signature for the L 1 Tax 2018 2019 Form right from your smartphone

How to make an electronic signature for the L 1 Tax 2018 2019 Form on iOS

How to generate an electronic signature for the L 1 Tax 2018 2019 Form on Android devices

People also ask

-

What is the significance of the louisiana l 1 2018 4th quarter document for businesses?

The louisiana l 1 2018 4th quarter document is essential for businesses operating in Louisiana as it outlines quarterly earnings and impacts tax obligations. Understanding this document can help businesses effectively manage their financial reporting and ensure compliance with state regulations.

-

How does airSlate SignNow streamline handling the louisiana l 1 2018 4th quarter document?

airSlate SignNow offers an intuitive platform that simplifies the preparation, signing, and sharing of the louisiana l 1 2018 4th quarter document. With its user-friendly interface, businesses can quickly collect electronic signatures, ensuring timely submission and preventing any delays.

-

What are the pricing options for airSlate SignNow services related to the louisiana l 1 2018 4th quarter?

airSlate SignNow offers various pricing plans tailored to meet different business needs, including options for handling specific documents like the louisiana l 1 2018 4th quarter. Businesses can choose from monthly or annual subscriptions, with the potential for signNow cost savings on larger plans.

-

Are there any integrations available for managing the louisiana l 1 2018 4th quarter document with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with a range of popular applications, allowing users to manage the louisiana l 1 2018 4th quarter document alongside their existing workflow tools. Integrations include cloud storage options, CRM systems, and project management software for enhanced productivity.

-

What are the key features of airSlate SignNow that benefit the louisiana l 1 2018 4th quarter process?

Key features of airSlate SignNow include customizable templates for the louisiana l 1 2018 4th quarter document, real-time tracking of document status, and secure cloud storage. These features ensure that users can efficiently manage their documents while maintaining compliance and security.

-

How can airSlate SignNow help ensure compliance when submitting the louisiana l 1 2018 4th quarter?

By using airSlate SignNow, businesses can ensure compliance when submitting the louisiana l 1 2018 4th quarter document through legally binding electronic signatures and audit trails. This not only streamlines the submission process but also provides complete visibility and accountability.

-

What makes airSlate SignNow a cost-effective solution for the louisiana l 1 2018 4th quarter management?

airSlate SignNow is considered a cost-effective solution for the louisiana l 1 2018 4th quarter management due to its competitive pricing and the reduction in costs associated with paper documents and physical signatures. By digitizing the process, businesses can save time and resources.

Get more for L1 Form Louisiana

- Oregon notice of filing of lien claim individual form

- Aodsud intake and assessment alameda county behavioral health form

- Download the application form london criminal courts solicitors lccsa org

- Song of ice and fire character sheet blank form

- Drainage manual county of santa clara sccgov form

- Commercial minor repair spec list form

- Management consultant contract template form

- Management contract template form

Find out other L1 Form Louisiana

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF