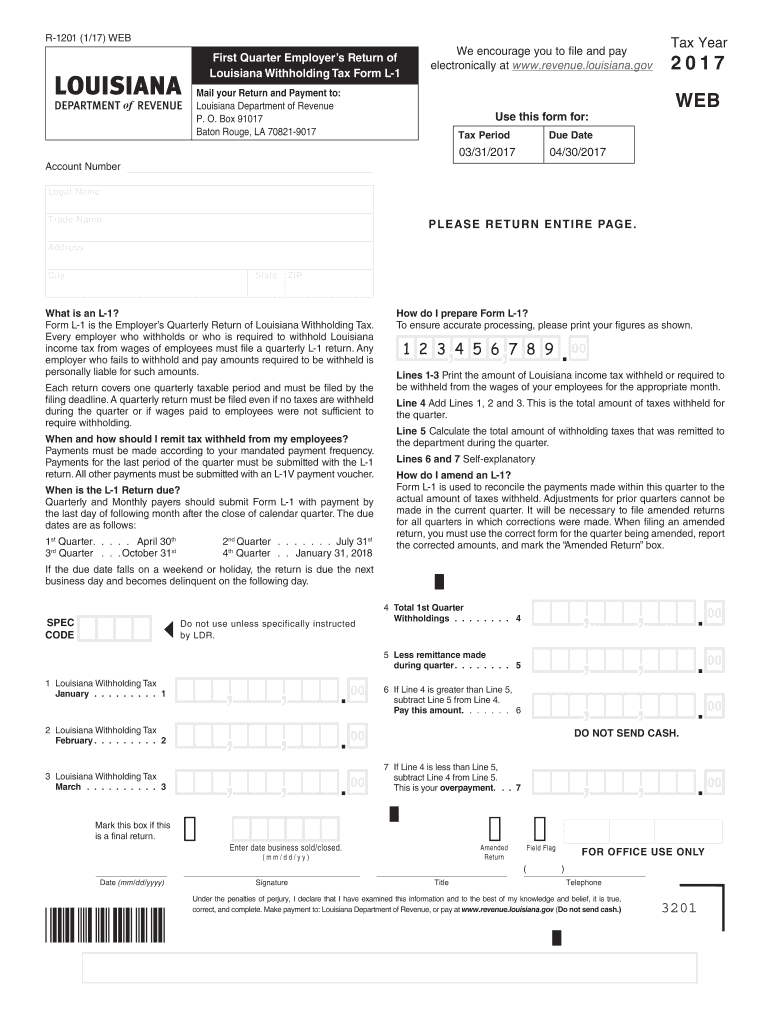

L 1 Tax Form 2017

What is the L-1 Tax Form

The L-1 Tax Form is a specific document used by individuals and businesses in the United States to report certain types of income, particularly for those involved in international business operations. This form is crucial for compliance with federal tax regulations, especially for foreign nationals working in the U.S. under an L-1 visa. The form helps the Internal Revenue Service (IRS) track income earned by these individuals and ensure appropriate tax obligations are met.

How to use the L-1 Tax Form

Using the L-1 Tax Form involves several key steps to ensure accurate reporting of income and compliance with IRS regulations. First, gather all necessary financial documents, including income statements and any relevant tax documents. Next, fill out the form with accurate information, including your personal details, income sources, and deductions. Once completed, review the form for any errors before submitting it. It is advisable to consult a tax professional if you have questions about specific entries or tax implications.

Steps to complete the L-1 Tax Form

Completing the L-1 Tax Form requires careful attention to detail. Follow these steps:

- Gather all required documents, such as W-2s, 1099s, and any other income records.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income accurately, ensuring that all sources are included.

- Claim any deductions or credits you are eligible for to reduce your taxable income.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the L-1 Tax Form

The L-1 Tax Form must be used in accordance with IRS guidelines to ensure its legal validity. It is essential to provide truthful and accurate information, as any discrepancies can lead to penalties or legal issues. The form is designed for specific taxpayer scenarios, including those holding an L-1 visa. Adhering to the legal requirements not only protects the taxpayer but also ensures compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the L-1 Tax Form are critical for compliance. Generally, the form must be submitted by April fifteenth of the following tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes in tax laws or deadlines, as these can affect your filing requirements. Additionally, if you need more time, you can file for an extension, but this does not extend the time to pay any taxes owed.

Required Documents

To complete the L-1 Tax Form, you will need several key documents, including:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as investments or rental properties.

- Documentation for any deductions or credits you plan to claim.

Having these documents ready will streamline the process and help ensure accuracy in your tax reporting.

Quick guide on how to complete l 1 tax 2017 form

Your assistance manual on how to prepare your L 1 Tax Form

If you’re looking to learn how to create and submit your L 1 Tax Form, here are a few concise instructions to simplify tax processing.

To start, you only need to set up your airSlate SignNow account to modify how you handle documents online. airSlate SignNow is a very intuitive and powerful document tool that enables you to edit, draft, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, returning to modify details as necessary. Optimize your tax handling with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your L 1 Tax Form quickly:

- Create your account and start working on PDFs within moments.

- Utilize our directory to search for any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your L 1 Tax Form in our editor.

- Complete the necessary fillable sections with your information (text, numbers, checkmarks).

- Employ the Signature Tool to add your legally-recognized eSignature (if required).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper can amplify return mistakes and delay refunds. Naturally, before e-filing your taxes, consult the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct l 1 tax 2017 form

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

Create this form in 5 minutes!

How to create an eSignature for the l 1 tax 2017 form

How to make an electronic signature for your L 1 Tax 2017 Form in the online mode

How to create an electronic signature for your L 1 Tax 2017 Form in Google Chrome

How to generate an eSignature for putting it on the L 1 Tax 2017 Form in Gmail

How to generate an electronic signature for the L 1 Tax 2017 Form right from your smart phone

How to generate an eSignature for the L 1 Tax 2017 Form on iOS devices

How to generate an electronic signature for the L 1 Tax 2017 Form on Android OS

People also ask

-

What is the L 1 Tax Form used for?

The L 1 Tax Form is primarily used to report income and tax obligations for specific businesses. Understanding its requirements is crucial for compliance and can help businesses avoid penalties. airSlate SignNow streamlines the signing and submission of the L 1 Tax Form, ensuring timely and accurate filing.

-

How does airSlate SignNow simplify the L 1 Tax Form process?

airSlate SignNow simplifies the L 1 Tax Form process by providing an intuitive platform for e-signature and document management. Users can easily send, sign, and track the completion of the L 1 Tax Form online. This not only saves time but also reduces the chances of errors in the filing process.

-

Are there any associated costs for using airSlate SignNow for the L 1 Tax Form?

While airSlate SignNow offers various pricing plans, the cost for using their service for the L 1 Tax Form depends on the selected plan. Each plan includes features tailored for efficient document management, ensuring that businesses can choose an option that best fits their needs. It's advisable to check the pricing page for detailed information on specific plans and features.

-

What features does airSlate SignNow offer for managing the L 1 Tax Form?

AirSlate SignNow offers several features for managing the L 1 Tax Form, including customizable templates, automated reminders, and real-time tracking of document statuses. These features allow users to oversee the signing process efficiently and enhance document security. Additionally, audit trails ensure compliance and accountability throughout the transaction.

-

Can I integrate airSlate SignNow with other software for L 1 Tax Form management?

Yes, airSlate SignNow can be integrated with various third-party applications, enhancing the management of the L 1 Tax Form. This integration allows for seamless workflows, enabling users to easily pull data from other systems and attach relevant documents. It's designed to enhance productivity and streamline tax-related processes.

-

How secure is the data when using airSlate SignNow for the L 1 Tax Form?

Security is a top priority at airSlate SignNow, especially when handling sensitive data like the L 1 Tax Form. The platform employs advanced encryption and compliance measures to protect user information. This ensures that all documents and personal data remain confidential and secure throughout the signing process.

-

What benefits does eSigning the L 1 Tax Form provide?

eSigning the L 1 Tax Form through airSlate SignNow offers numerous benefits, such as faster processing times and enhanced accessibility. This means you can avoid the delays associated with traditional paper-based signing and complete your form from anywhere. Additionally, the electronic format helps in maintaining organized records for future reference.

Get more for L 1 Tax Form

- Preventative health care examination form ky

- Raksha tpa claim form 57337746

- Application to change a child39s name ontario ca forms ssb gov on

- Lowes accounts receivable application form

- External training request form

- Management fee contract template form

- Management dashboard contract template form

- Management database contract template form

Find out other L 1 Tax Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document