IL 2210 Computation of Penalties for Individuals Form

What is the IL 2210 Computation Of Penalties For Individuals

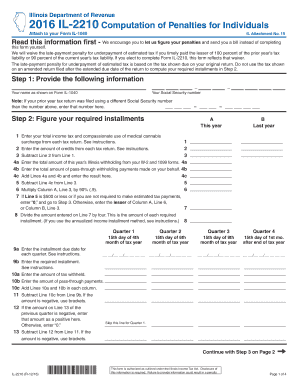

The IL 2210 Computation Of Penalties For Individuals is a tax form used by residents of Illinois to calculate penalties for underpayment of state income tax. This form is essential for individuals who did not pay enough tax throughout the year, either through withholding or estimated tax payments. By using this form, taxpayers can determine if they owe any penalties and how much they should pay to remain compliant with state tax laws.

How to use the IL 2210 Computation Of Penalties For Individuals

Using the IL 2210 Computation Of Penalties For Individuals involves several steps. First, gather your financial documents, including your income statements and any records of tax payments made throughout the year. Next, fill out the form by entering your total tax liability and the amount you have already paid. The form will guide you through the calculations needed to determine if you owe any penalties. Ensure that all entries are accurate to avoid additional complications.

Steps to complete the IL 2210 Computation Of Penalties For Individuals

Completing the IL 2210 Computation Of Penalties For Individuals requires careful attention to detail. Follow these steps:

- Gather all necessary documents, including W-2s and 1099s.

- Calculate your total income for the year.

- Determine your total tax liability based on your income.

- Review your payments made throughout the year, including withholding and estimated payments.

- Complete the form by entering the required information in each section.

- Calculate any penalties based on the provided guidelines.

- Double-check your entries for accuracy before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the IL 2210 Computation Of Penalties For Individuals. Typically, the form must be submitted along with your annual state tax return. For most individuals, this means filing by April 15 of the following year. If you require an extension, be sure to check the specific dates for extended filing to ensure compliance and avoid penalties.

Penalties for Non-Compliance

Failing to file the IL 2210 Computation Of Penalties For Individuals or underpaying your taxes can result in significant penalties. The state of Illinois imposes interest on unpaid taxes and may charge a penalty for underpayment. It is essential to understand these potential consequences to avoid unexpected financial burdens. Regularly reviewing your tax payments and ensuring compliance can help mitigate these risks.

Digital vs. Paper Version

The IL 2210 Computation Of Penalties For Individuals can be completed in both digital and paper formats. Using a digital platform can streamline the process, allowing for easier calculations and faster submission. Digital forms often include built-in checks for errors, enhancing accuracy. However, some individuals may prefer the traditional paper method. Regardless of the format chosen, ensure that all information is accurate and submitted by the deadline.

Quick guide on how to complete 2016 il 2210 computation of penalties for individuals

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow furnishes you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage [SKS] on any device with the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to adjust and eSign [SKS] seamlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to submit your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 2210 Computation Of Penalties For Individuals

Create this form in 5 minutes!

How to create an eSignature for the 2016 il 2210 computation of penalties for individuals

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

The way to generate an e-signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is the IL 2210 Computation Of Penalties For Individuals?

The IL 2210 Computation Of Penalties For Individuals refers to the process of calculating penalties for underpayment of estimated tax by individual taxpayers in Illinois. This computation is essential for ensuring compliance with state tax regulations and avoiding unnecessary penalties. Understanding this process can help individuals manage their tax liabilities effectively.

-

How does airSlate SignNow assist with IL 2210 Computation Of Penalties For Individuals?

airSlate SignNow provides tools that facilitate the electronic signing of important tax documents, including those related to the IL 2210 Computation Of Penalties For Individuals. By using our platform, users can efficiently manage their tax filings and communications, ensuring they stay informed and compliant with state requirements.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, making it a cost-effective solution for managing documents. Each plan includes features to help with processes like the IL 2210 Computation Of Penalties For Individuals. Be sure to compare plans to find the best fit for your requirements.

-

What features does airSlate SignNow offer for tax professionals dealing with penalties?

The platform includes features like customizable templates, tracking capabilities, and compliance tools that are useful for tax professionals handling IL 2210 Computation Of Penalties For Individuals. These tools help streamline workflows and ensure that all documents are signed and stored securely, enhancing productivity.

-

Can airSlate SignNow integrate with accounting software?

Yes, airSlate SignNow can seamlessly integrate with various accounting software platforms, enhancing your ability to work on documents related to the IL 2210 Computation Of Penalties For Individuals. This integration helps eliminate manual entry and reduces the risk of errors, ensuring your documents are always up to date.

-

What are the benefits of using airSlate SignNow for e-signatures?

Using airSlate SignNow for e-signatures simplifies the process of signing and managing documents, including those pertaining to the IL 2210 Computation Of Penalties For Individuals. It enhances efficiency, security, and convenience, allowing you to focus more on your business rather than paperwork.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow employs advanced security measures to ensure that your sensitive tax documents, such as those related to the IL 2210 Computation Of Penalties For Individuals, are protected. Our platform utilizes encryption and secure storage solutions to keep your information safe throughout the signing process.

Get more for IL 2210 Computation Of Penalties For Individuals

- Form 06cb035e dds 35 oklahoma department of human okdhs

- Form 13mp003e h 2 request for review of decision on appeal by the director of department of human services okdhs

- Forms 21 526

- Odaff 2 form

- Rose college transcript request form

- Form civil service 2012 2019

- Application for authorization to perform radiological procedures portal state pa

- Form 2011 036 1

Find out other IL 2210 Computation Of Penalties For Individuals

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document