40A102 11 13 Commonwealth of Kentucky DEPARTMENT of REVENUE *1300010028* Revenue Ky Form

What is the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky

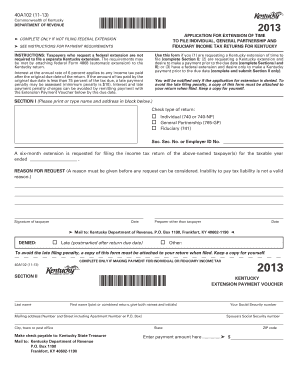

The 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky form is a crucial document used for tax purposes within the state of Kentucky. This form is primarily utilized by individuals and businesses to report various types of income, deductions, and credits to the state revenue department. It is essential for ensuring compliance with state tax regulations and for determining the accurate amount of tax owed or refunded. Understanding this form is vital for taxpayers to fulfill their legal obligations and to take advantage of available tax benefits.

Steps to complete the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky

Completing the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky form involves several key steps:

- Gather necessary documents, including income statements, previous tax returns, and any relevant deductions.

- Carefully fill out the form, ensuring all sections are completed accurately. Pay attention to income categories and applicable deductions.

- Review the form for any errors or omissions before finalizing it.

- Sign and date the form, as electronic signatures may be required if submitting online.

- Submit the completed form through the appropriate channels, either electronically or via mail.

How to use the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky

Using the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky form is straightforward. Taxpayers can fill it out digitally, which allows for easy editing and submission. It is advisable to utilize a reliable electronic signature solution to ensure that the submission is secure and compliant with state regulations. This form can be used by both individuals and businesses to report income and claim deductions, making it versatile for various tax situations.

Legal use of the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky

The legal use of the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky form is governed by state tax laws. Proper completion and submission of this form are essential for compliance with Kentucky's tax regulations. Failure to file this form accurately can lead to penalties, including fines and interest on unpaid taxes. Therefore, it is crucial for taxpayers to understand the legal implications and ensure that they follow all guidelines when using this form.

Required Documents for the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky

To successfully complete the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky form, several documents are typically required:

- W-2 forms from employers, if applicable.

- 1099 forms for any freelance or contract income.

- Documentation for deductions, such as receipts for business expenses or educational credits.

- Previous tax returns for reference and accuracy.

Form Submission Methods (Online / Mail / In-Person)

The 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky form can be submitted through various methods:

- Online: Taxpayers can fill out and submit the form electronically through the Kentucky Department of Revenue's website.

- Mail: Completed forms can be printed and sent to the appropriate address specified by the Kentucky Department of Revenue.

- In-Person: Some taxpayers may choose to submit their forms in person at designated tax offices, where assistance may also be available.

Quick guide on how to complete 40a102 11 13 commonwealth of kentucky department of revenue 1300010028 revenue ky

Effortlessly complete [SKS] on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct version and securely store it online. airSlate SignNow gives you all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your updates.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your document control needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky

Create this form in 5 minutes!

How to create an eSignature for the 40a102 11 13 commonwealth of kentucky department of revenue 1300010028 revenue ky

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

The way to generate an e-signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky. form?

The 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky. form is a document required for specific tax processes within the Commonwealth of Kentucky. This form facilitates proper communication with the Department of Revenue regarding tax obligations. Utilizing airSlate SignNow can streamline the submission and signing process for this essential form.

-

How much does using airSlate SignNow for the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky. cost?

Pricing for airSlate SignNow varies depending on the plan you choose, but it is designed to be cost-effective. Each plan offers various features that can aid in managing documents like the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky. form. You can explore our pricing options to find the best fit for your needs.

-

What features does airSlate SignNow offer for handling the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky.?

airSlate SignNow offers features such as eSignatures, document sharing, and templates specifically designed to handle forms like the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky. You can easily customize your documents and send them for quick signing, improving workflow efficiency and compliance.

-

What benefits does airSlate SignNow provide for managing the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky.?

Using airSlate SignNow for the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky. offers signNow benefits, such as reducing paper usage and speeding up the signing process. The platform ensures that all documents are secure and accessible from anywhere, making tax compliance easier and more efficient for businesses.

-

Can airSlate SignNow integrate with other software when handling the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky.?

Yes, airSlate SignNow offers integrations with various software platforms, allowing seamless handling of the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky. form. This feature ensures that your document management processes are streamlined alongside your existing tools, enhancing productivity across different departments.

-

Is it easy to eSign the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky. form with airSlate SignNow?

Absolutely! airSlate SignNow provides an intuitive user interface that makes eSigning the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky. form straightforward. Users can sign documents in just a few clicks, which reduces time spent on manual tasks and accelerates overall workflow.

-

How can airSlate SignNow improve compliance when dealing with the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky.?

airSlate SignNow helps improve compliance when managing the 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky. form by providing secure eSignature options and an audit trail. This means you can track who signed and when, which is crucial for meeting regulatory requirements.

Get more for 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky

- Decent safe and sanitary housing inspection dot nd form

- Sharps injury log form

- 1099 correctionduplicate request form ohio shared services

- Master report ohio board of embalmers and funeral directors funeral ohio form

- Ohleg gateway form

- Recordsohiosecretaryofstategov form

- Form 03en001e csed 1 okdhs

- 04af010e form

Find out other 40A102 11 13 Commonwealth Of Kentucky DEPARTMENT OF REVENUE *1300010028* Revenue Ky

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract