SCHEDULE M *1500010018* Form 740 42A740M Department of Revenue Attach to Form 740 Revenue Ky

What is the SCHEDULE M *1500010018* Form 740 42A740M Department Of Revenue Attach To Form 740 Revenue Ky

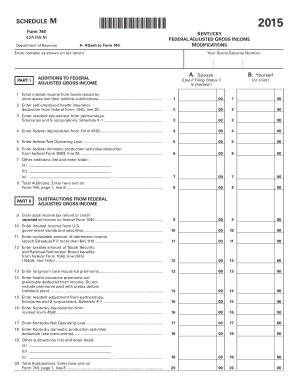

The SCHEDULE M *1500010018* Form 740 42A740M is a tax form used in Kentucky to report specific adjustments to income for state tax purposes. This form is attached to Form 740, which is the standard individual income tax return for residents of Kentucky. It allows taxpayers to account for various income modifications, ensuring accurate tax calculations. Understanding the purpose of this form is essential for compliance with state tax regulations.

Steps to complete the SCHEDULE M *1500010018* Form 740 42A740M Department Of Revenue Attach To Form 740 Revenue Ky

Completing the SCHEDULE M *1500010018* Form 740 42A740M involves several key steps:

- Gather all necessary financial documents, including W-2s and 1099s.

- Review the instructions provided with the form to understand the specific adjustments applicable to your situation.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check your calculations to avoid errors that could lead to penalties.

- Attach the completed SCHEDULE M to your Form 740 before submission.

How to use the SCHEDULE M *1500010018* Form 740 42A740M Department Of Revenue Attach To Form 740 Revenue Ky

To use the SCHEDULE M *1500010018* Form 740 42A740M effectively, start by determining which income adjustments apply to your tax situation. Complete the form by following the provided instructions carefully. Ensure that you provide accurate information, as any discrepancies may lead to delays in processing or issues with your tax return. Once completed, attach it to your Form 740 and submit it through the appropriate channels.

Legal use of the SCHEDULE M *1500010018* Form 740 42A740M Department Of Revenue Attach To Form 740 Revenue Ky

The legal use of the SCHEDULE M *1500010018* Form 740 42A740M is governed by Kentucky tax laws. To ensure that the form is legally binding, it must be filled out completely and accurately. The form must be signed and submitted according to state regulations. Compliance with eSignature laws, such as the ESIGN Act, is crucial if the form is submitted digitally. This ensures that the submission is recognized as valid by the Kentucky Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the SCHEDULE M *1500010018* Form 740 42A740M align with the general deadlines for Form 740. Typically, individual income tax returns in Kentucky are due on April 15. If you require additional time, you may file for an extension, but it is essential to ensure that any payments due are made by the original deadline to avoid penalties and interest.

State-specific rules for the SCHEDULE M *1500010018* Form 740 42A740M Department Of Revenue Attach To Form 740 Revenue Ky

Each state has specific rules regarding the completion and submission of tax forms. In Kentucky, the SCHEDULE M *1500010018* Form 740 42A740M must adhere to the guidelines set forth by the Kentucky Department of Revenue. This includes understanding the types of income adjustments that can be reported and ensuring compliance with state tax laws. Familiarizing yourself with these rules is crucial for accurate reporting and to avoid potential issues with your tax return.

Quick guide on how to complete schedule m 1500010018 form 740 42a740m department of revenue attach to form 740 revenue ky

Effortlessly prepare SCHEDULE M *1500010018* Form 740 42A740M Department Of Revenue Attach To Form 740 Revenue Ky on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct forms and securely save them online. airSlate SignNow equips you with all the tools you require to create, edit, and electronically sign your documents promptly without delays. Handle SCHEDULE M *1500010018* Form 740 42A740M Department Of Revenue Attach To Form 740 Revenue Ky on any platform via airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to edit and electronically sign SCHEDULE M *1500010018* Form 740 42A740M Department Of Revenue Attach To Form 740 Revenue Ky with ease

- Obtain SCHEDULE M *1500010018* Form 740 42A740M Department Of Revenue Attach To Form 740 Revenue Ky and click Get Form to commence.

- Make use of the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiring form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign SCHEDULE M *1500010018* Form 740 42A740M Department Of Revenue Attach To Form 740 Revenue Ky to ensure effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule m 1500010018 form 740 42a740m department of revenue attach to form 740 revenue ky

The way to make an e-signature for a PDF in the online mode

The way to make an e-signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

How to make an e-signature straight from your smart phone

The way to make an e-signature for a PDF on iOS devices

How to make an e-signature for a PDF document on Android OS

People also ask

-

What is the SCHEDULE M *1500010018* Form 740 42A740M Department Of Revenue Attach To Form 740 Revenue Ky?

The SCHEDULE M *1500010018* Form 740 42A740M is a tax form required by the Kentucky Department of Revenue to report certain adjustments. This form must be attached to your Form 740 to ensure compliance with state tax regulations. Completing this form accurately is essential for proper reporting and to avoid potential issues with the Department of Revenue.

-

How can airSlate SignNow help me with the SCHEDULE M *1500010018* Form 740 42A740M?

airSlate SignNow simplifies the process of filling out and eSigning the SCHEDULE M *1500010018* Form 740 42A740M. Our easy-to-use platform allows you to complete this form online, ensuring accuracy and compliance. Plus, you can securely share and store your documents for easy access.

-

Is there a cost associated with using airSlate SignNow for the SCHEDULE M *1500010018* Form 740 42A740M?

Yes, airSlate SignNow offers competitive pricing plans to fit various business needs. Depending on the features you require for handling the SCHEDULE M *1500010018* Form 740 42A740M, you can choose a plan that best suits your budget. A free trial is often available so you can explore the features before committing.

-

Can I integrate airSlate SignNow with other applications for managing the SCHEDULE M *1500010018* Form 740 42A740M?

Absolutely! airSlate SignNow offers various integrations with popular software applications, enhancing your workflow. You can connect it with tools you already use for accounting or document management to streamline the process of completing the SCHEDULE M *1500010018* Form 740 42A740M.

-

What features does airSlate SignNow offer for the SCHEDULE M *1500010018* Form 740 42A740M?

airSlate SignNow includes features such as eSignature capability, document templates, and secure storage specifically designed for managing forms like the SCHEDULE M *1500010018* Form 740 42A740M. These features ensure you can fill out, sign, and save your documents efficiently.

-

Are there benefits to using airSlate SignNow for tax forms like SCHEDULE M *1500010018* Form 740 42A740M?

Using airSlate SignNow for tax forms like the SCHEDULE M *1500010018* Form 740 42A740M saves time and enhances accuracy. It eliminates the need for printing, scanning, and mailing, allowing you to complete and file documents quickly. Plus, the secure platform helps ensure your sensitive information is protected.

-

What support options are available if I have questions about the SCHEDULE M *1500010018* Form 740 42A740M?

airSlate SignNow offers several support options, including live chat, email support, and an extensive knowledge base. If you have specific questions about the SCHEDULE M *1500010018* Form 740 42A740M, our support team is ready to assist you. You can also find helpful guides and tutorials on our website.

Get more for SCHEDULE M *1500010018* Form 740 42A740M Department Of Revenue Attach To Form 740 Revenue Ky

- North carolina option 497317028 form

- North carolina divorce sample form

- Verification north carolina form

- Assignment of lease and rent from borrower to lender north carolina form

- Assignment of lease from lessor with notice of assignment north carolina form

- Letter from landlord to tenant as notice of abandoned personal property north carolina form

- Guaranty or guarantee of payment of rent north carolina form

- Letter from landlord to tenant as notice of default on commercial lease north carolina form

Find out other SCHEDULE M *1500010018* Form 740 42A740M Department Of Revenue Attach To Form 740 Revenue Ky

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors