DO NOT MAIL BMarylandb Tax BFormsb and Instructions

What is the DO NOT MAIL Maryland Tax Forms and Instructions

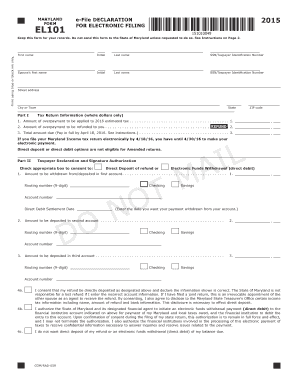

The DO NOT MAIL Maryland Tax Forms and Instructions are essential documents that guide taxpayers in the state of Maryland on how to properly complete and submit their tax forms. These instructions provide detailed information about the specific forms required for various tax situations, ensuring compliance with state tax laws. Understanding these forms is crucial for individuals and businesses alike, as they outline the necessary steps to accurately report income, deductions, and credits.

Steps to complete the DO NOT MAIL Maryland Tax Forms and Instructions

Completing the DO NOT MAIL Maryland Tax Forms requires careful attention to detail. Here are the key steps to follow:

- Gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements.

- Review the specific instructions associated with the form you are completing to ensure you understand the requirements.

- Fill out the form accurately, entering all required information as specified in the instructions.

- Double-check your entries for accuracy, ensuring that all calculations are correct.

- Sign and date the form, if required, to validate your submission.

Legal use of the DO NOT MAIL Maryland Tax Forms and Instructions

The legal use of the DO NOT MAIL Maryland Tax Forms and Instructions is governed by Maryland tax laws. These documents must be completed accurately to avoid penalties and ensure compliance with state regulations. The forms are designed to be legally binding when filled out correctly, and electronic submissions are accepted as long as they meet the state's legal requirements for e-signatures and document integrity.

Filing Deadlines / Important Dates

Filing deadlines for the DO NOT MAIL Maryland Tax Forms are crucial for compliance. Typically, individual income tax returns are due on April fifteenth of each year. However, taxpayers should check for any changes or extensions that may apply. It's important to stay informed about these dates to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Maryland have several options for submitting the DO NOT MAIL Maryland Tax Forms. These methods include:

- Online Submission: Many taxpayers choose to file electronically through the Maryland Comptroller's website or approved e-filing software.

- Mail: Completed forms can be printed and mailed to the appropriate address as indicated in the instructions.

- In-Person: Taxpayers may also deliver their forms in person at designated tax offices.

Key elements of the DO NOT MAIL Maryland Tax Forms and Instructions

Understanding the key elements of the DO NOT MAIL Maryland Tax Forms is essential for accurate completion. These elements typically include:

- Personal Information: Name, address, and Social Security number.

- Income Details: All sources of income must be reported.

- Deductions and Credits: Information about eligible deductions and credits that can reduce tax liability.

- Signature: A signature is often required to validate the form.

Quick guide on how to complete do not mail bmarylandb tax bformsb and instructions

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced files, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to DO NOT MAIL BMarylandb Tax BFormsb And Instructions

Create this form in 5 minutes!

How to create an eSignature for the do not mail bmarylandb tax bformsb and instructions

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the importance of not mailing Maryland Tax Forms?

The 'DO NOT MAIL Maryland Tax Forms and Instructions' directive is crucial for ensuring your tax documents are submitted electronically, streamlining the process. By utilizing airSlate SignNow, you can securely eSign and send these forms without the delays associated with traditional mailing. This improves efficiency and ensures compliance with the latest state regulations.

-

How can airSlate SignNow help with Maryland Tax Forms?

airSlate SignNow provides an efficient platform for managing the 'DO NOT MAIL Maryland Tax Forms and Instructions.' You can easily create, eSign, and send your tax forms without the hassles of mailing, ensuring quick submissions and better tracking of your documents. This service simplifies your tax processes signNowly.

-

What features does airSlate SignNow offer for tax document management?

Key features of airSlate SignNow include seamless eSigning, customizable templates for 'DO NOT MAIL Maryland Tax Forms and Instructions,' and automated workflows. These tools allow you to manage your tax documentation more effectively, reducing the time spent on paperwork and helping to maintain compliance with state requirements.

-

Is airSlate SignNow cost-effective for businesses needing to manage Maryland Tax Forms?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for managing 'DO NOT MAIL Maryland Tax Forms and Instructions.' Our pricing plans are flexible, allowing businesses of all sizes to find an option that fits their budget while enjoying the benefits of eSigning and document management.

-

Can I integrate airSlate SignNow with other tools for my tax management?

Yes, airSlate SignNow offers numerous integrations with popular platforms to enhance your document management processes, including accounting and tax software that are essential for managing 'DO NOT MAIL Maryland Tax Forms and Instructions.' These integrations enable data syncing and streamline your overall workflow, making tax season smoother.

-

How secure is the eSigning process with airSlate SignNow for tax documents?

Your security is our priority. The eSigning process for 'DO NOT MAIL Maryland Tax Forms and Instructions' on airSlate SignNow uses bank-level encryption and complies with all regulatory requirements to protect sensitive information. You can trust that your tax documents are secure and handled with the utmost care.

-

What support is available for users of airSlate SignNow?

airSlate SignNow offers comprehensive customer support for all users managing 'DO NOT MAIL Maryland Tax Forms and Instructions.' Whether you have questions about features, integrations, or troubleshooting, our dedicated support team is available to assist you through various channels including chat, email, and phone.

Get more for DO NOT MAIL BMarylandb Tax BFormsb And Instructions

- Guidelines survey procedures for tourism economic impact assessments of ungated events and festivals form

- Hort 335 sociohorticulture howdy texas aampm university form

- Official transcript request form registraramp39s office texas state registrar txstate

- San marcos tx cisd background check form

- Dripping springs isd background check form education txstate

- Petition for readmission pdf texas state university txstate form

- Lead apron checklist form

- Texas tech ferpa form

Find out other DO NOT MAIL BMarylandb Tax BFormsb And Instructions

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document