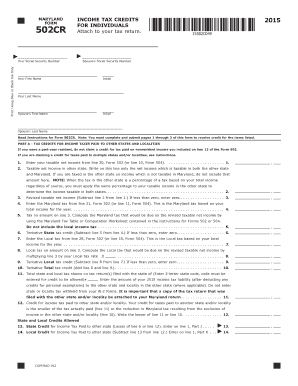

INCOME TAX CREDITS for INDIVIDUALS Attach to Your Tax Breturnb Form

What is the income tax credits for individuals attach to your tax return?

The income tax credits for individuals attach to your tax return form are financial incentives provided by the federal government to reduce the overall tax burden. These credits can directly lower the amount of tax owed, and in some cases, may even result in a refund. Common credits include the Earned Income Tax Credit (EITC), Child Tax Credit, and the American Opportunity Tax Credit for education expenses. Understanding these credits is essential for maximizing your tax benefits and ensuring compliance with tax regulations.

How to use the income tax credits for individuals attach to your tax return

To effectively use the income tax credits for individuals, you must first determine your eligibility for each credit. This often involves reviewing your income level, filing status, and specific circumstances, such as dependents. Once you identify applicable credits, you can complete the relevant sections on your tax return form. Accurate documentation and calculations are crucial, as errors may lead to delays or audits. Utilizing tax preparation software can simplify this process by guiding you through the necessary steps.

Steps to complete the income tax credits for individuals attach to your tax return

Completing the income tax credits for individuals involves several key steps:

- Gather necessary documentation, including income statements, Social Security numbers, and information about dependents.

- Review eligibility criteria for each credit you plan to claim.

- Fill out the appropriate sections of your tax return form, ensuring that all calculations are accurate.

- Attach any required schedules or forms that provide additional details about your credits.

- Double-check your return for errors before submitting, whether electronically or by mail.

Legal use of the income tax credits for individuals attach to your tax return

The legal use of the income tax credits for individuals requires adherence to IRS guidelines. Each credit has specific eligibility requirements and documentation standards. It is important to maintain accurate records and provide truthful information on your tax return. Misrepresentation or failure to comply with tax laws can result in penalties, including fines or audits. Utilizing a trusted eSignature solution can help ensure that your documents are securely signed and stored, maintaining compliance with legal standards.

Eligibility criteria for the income tax credits for individuals

Eligibility criteria for income tax credits vary depending on the specific credit. Generally, factors such as income level, filing status, and the number of dependents play a significant role. For example, the Earned Income Tax Credit is primarily aimed at low to moderate-income earners, while the Child Tax Credit is available to those with qualifying children. It is essential to review the IRS guidelines for each credit to ensure that you meet the necessary requirements before claiming them on your tax return.

Filing deadlines for the income tax credits for individuals

Filing deadlines for claiming income tax credits align with the overall tax return submission dates. Typically, individual taxpayers must file their returns by April 15 of each year, unless an extension is granted. It is crucial to be aware of these deadlines to avoid penalties and ensure that you receive any credits for which you qualify. Keeping track of important dates, such as when to file and when to make payments, can help you stay compliant with tax obligations.

Required documents for the income tax credits for individuals

To claim income tax credits, you will need to provide specific documentation. This may include:

- W-2 forms from employers to report income.

- Form 1099 for other income sources, such as freelance work.

- Proof of dependent status, such as Social Security numbers and birth certificates.

- Receipts or records for qualifying expenses, like education costs for the American Opportunity Tax Credit.

Having these documents organized and readily available can streamline the process of claiming your credits and ensure accuracy in your tax return.

Quick guide on how to complete income tax credits for individuals attach to your tax breturnb

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to alter and eSign [SKS] with ease

- Find [SKS] and click Get Form to initiate the process.

- Use the tools provided to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Breturnb

Create this form in 5 minutes!

How to create an eSignature for the income tax credits for individuals attach to your tax breturnb

How to create an e-signature for your PDF document in the online mode

How to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The best way to generate an e-signature for a PDF file on Android devices

People also ask

-

What are INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Breturnb?

INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Breturnb are tax benefits that reduce the amount of tax you owe to the government. These credits can signNowly lower your tax liability and may even result in a refund. Understanding how to properly attach these credits to your tax return is crucial for maximizing your tax savings.

-

How do I know if I qualify for INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Breturnb?

Qualification for INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Breturnb depends on various factors such as your income level, filing status, and specific circumstances like dependents. It's essential to review the eligibility criteria set by the IRS. You may also consult with a tax professional for personalized advice on your situation.

-

Can airSlate SignNow help with claiming INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Breturnb?

Yes, airSlate SignNow provides an easy-to-use platform for managing documents related to your tax filing. You can securely eSign and send necessary tax forms and supporting documents, helping ensure that your INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Breturnb are accurately filed. This simplifies the entire process and helps prevent delays.

-

Are there any fees for using airSlate SignNow to manage my tax documents?

airSlate SignNow offers various pricing plans to suit different needs, including features for managing documents related to INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Breturnb. Each plan is designed to be cost-effective, providing value through its user-friendly interface and functionalities. Check our website for the latest pricing details.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features like document templates, eSigning, and real-time tracking. These tools help streamline your tax document management process, making it easier to prepare your INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Breturnb efficiently. Enhanced collaboration features allow you to work with tax professionals seamlessly.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security, employing encryption and compliance measures to protect your data. When managing sensitive tax documents, including those related to INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Breturnb, you can trust that your information is safeguarded. Regular security audits further ensure our platform's reliability.

-

Can I integrate airSlate SignNow with other tools for tax preparation?

Yes, airSlate SignNow can integrate with various software solutions, enhancing your tax preparation experience. This includes compatibility with popular accounting software that may help in managing INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Breturnb. These integrations allow for more efficient document flow and collaboration.

Get more for INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Breturnb

Find out other INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax Breturnb

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter