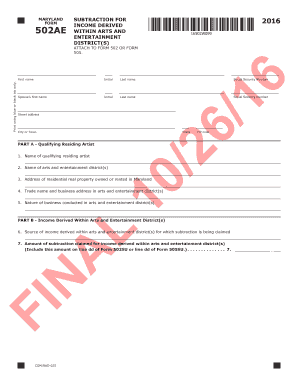

Subtraction for Income Derived within Arts and Entertainment Districts Form

What is the Subtraction For Income Derived Within Arts And Entertainment Districts

The subtraction for income derived within arts and entertainment districts is a tax provision that allows eligible businesses and individuals to reduce their taxable income based on specific earnings generated in designated areas. These districts are typically established to promote cultural and artistic activities, and the subtraction aims to incentivize growth and development within these regions. By providing this tax benefit, the government encourages investment and participation in the arts and entertainment sectors, contributing to local economies.

How to use the Subtraction For Income Derived Within Arts And Entertainment Districts

To utilize the subtraction for income derived within arts and entertainment districts, taxpayers must first determine their eligibility based on income generated within these designated areas. This involves accurately tracking income sources and ensuring they align with the criteria established by local regulations. Once eligibility is confirmed, taxpayers can complete the necessary forms to claim the subtraction on their tax returns. It is essential to maintain thorough records of all relevant income and expenses to support the claim if required by tax authorities.

Steps to complete the Subtraction For Income Derived Within Arts And Entertainment Districts

Completing the subtraction for income derived within arts and entertainment districts involves several key steps:

- Identify the income generated from activities within the arts and entertainment district.

- Gather all necessary documentation, including financial records and proof of location.

- Complete the required tax forms, ensuring accurate reporting of income and deductions.

- Submit the forms by the designated filing deadline, either electronically or via mail.

- Retain copies of submitted forms and supporting documents for future reference.

Legal use of the Subtraction For Income Derived Within Arts And Entertainment Districts

The legal use of the subtraction for income derived within arts and entertainment districts is governed by specific regulations that outline eligibility criteria and acceptable income sources. Taxpayers must adhere to these guidelines to ensure compliance and avoid penalties. It is crucial to consult local tax authorities or a tax professional to understand the legal implications and requirements associated with claiming this subtraction. Proper documentation and reporting are essential to validate the claim during audits or reviews.

Eligibility Criteria

Eligibility for the subtraction for income derived within arts and entertainment districts typically includes several factors:

- Income must be generated from activities directly related to arts and entertainment within the designated district.

- Taxpayers may need to demonstrate their business operations are primarily located within the district.

- Compliance with local regulations and any additional requirements set forth by state or municipal authorities.

Filing Deadlines / Important Dates

Filing deadlines for the subtraction for income derived within arts and entertainment districts align with standard tax return due dates. Taxpayers should be aware of the following important dates:

- Individual tax returns are typically due on April 15 each year.

- Extensions may be available, but any taxes owed must be paid by the original deadline to avoid penalties.

- Local jurisdictions may have additional deadlines for specific forms related to the subtraction.

Quick guide on how to complete subtraction for income derived within arts and entertainment districts

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the functionalities you require to create, modify, and eSign your documents quickly and without hold-ups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and improve any document-related procedure today.

The easiest method to alter and eSign [SKS] with minimal effort

- Find [SKS] and then click Get Form to begin.

- Use the tools available to complete your form.

- Select important sections of the documents or conceal sensitive data with features that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then press the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] while ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the subtraction for income derived within arts and entertainment districts

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Subtraction For Income Derived Within Arts And Entertainment Districts?

Subtraction For Income Derived Within Arts And Entertainment Districts refers to the tax incentive that allows qualifying businesses in specific districts to reduce their taxable income. This benefit is designed to promote artistic and entertainment endeavors, stimulating economic growth in the region. By leveraging this subtraction, businesses can retain more revenue to reinvest in creative projects.

-

How can airSlate SignNow assist with documents related to Subtraction For Income Derived Within Arts And Entertainment Districts?

airSlate SignNow simplifies the process of managing documentation necessary for claiming Subtraction For Income Derived Within Arts And Entertainment Districts. Our eSignature platform enables you to sign and share important forms securely, streamlining compliance with local regulations. This ensures you can efficiently prepare the necessary paperwork to benefit from this tax subtraction.

-

What features does airSlate SignNow offer to support businesses claiming the subtraction?

airSlate SignNow offers features like customizable templates, bulk sending, and secure cloud storage to support businesses claiming Subtraction For Income Derived Within Arts And Entertainment Districts. Our platform allows for easy onboarding of the essential paperwork and collaboration with team members. This ensures that you stay organized and compliant while focusing on your creative initiatives.

-

Are there any costs associated with using airSlate SignNow for this tax subtraction process?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different business needs when handling Subtraction For Income Derived Within Arts And Entertainment Districts. Each plan is designed to provide the necessary features tailored to your requirements, ensuring cost-effectiveness. Our platform is competitively priced, allowing businesses to enhance their documentation processes without overspending.

-

Can I integrate airSlate SignNow with other software to manage tax documents?

Absolutely! airSlate SignNow seamlessly integrates with a variety of software solutions, enabling you to manage documents related to Subtraction For Income Derived Within Arts And Entertainment Districts more efficiently. Whether you use CRM systems, accounting software, or project management tools, these integrations can help streamline your workflow. This ensures that all necessary documents are easily accessible in one secure location.

-

What benefits does claiming the subtraction offer for arts and entertainment businesses?

Claiming Subtraction For Income Derived Within Arts And Entertainment Districts can provide substantial financial relief for arts and entertainment businesses. It allows these entities to decrease their income tax burden, enabling them to allocate more resources towards growth and innovation. This incentive fosters a more vibrant cultural landscape while promoting economic development in the area.

-

How does airSlate SignNow ensure security for sensitive tax documents?

AirSlate SignNow employs state-of-the-art security measures, ensuring that documents related to Subtraction For Income Derived Within Arts And Entertainment Districts remain protected. Our platform uses encryption, secure access controls, and compliance with industry standards to safeguard sensitive information. This means you can confidently manage and sign your tax-related documents without worrying about unauthorized access.

Get more for Subtraction For Income Derived Within Arts And Entertainment Districts

Find out other Subtraction For Income Derived Within Arts And Entertainment Districts

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation